Authors/ Yi-Jyun Shih, Senior Assistant Researcher, RSPRC.

Han Wang, Senior Assistant Researcher, RSPRC.

Hui-Tsen Hsiao, Assistant Researcher, RSPRC.

Shu-Jung Hsu, Project Specialist, RSPRC.

Reviewer/ Chien-Ming Hsu, Postdoctoral Fellow, RSPRC.

At this year's COP28, the Global Stocktake emphasized the need for all countries to triple their installed capacity for renewable energy by 2030. Therefore, Taiwan must adopt more forward-looking strategies and actions to maximize emission reduction efficiencies. However, relying solely on solar and wind power is insufficient to achieve this goal. Therefore, it is imperative to promptly introduce other emerging sources of renewable energy.

Taiwan is not only surrounded by sea and has abundant ocean energy resources in the surrounding maritime area,but is also situated in the Pacific Ring of Fire,which has a high potential for geothermal power generation. These are sources that must be addressed in promoting renewable energy. In addition, Taiwan is an island country that lacks its energy sources. Thus, biomass energy, with its "carbon neutral" benefits, is expected to be one of the alternative fuel sources to fossil fuels. Given this, Taiwan has proposed the "Key Strategies for Forward-Looking Energy Action Plan" since April 2022, which listed geothermal, bioenergy, and ocean energy as the three major fields for development.

In this issue of Open Energy, we will explore global trends in the development of geothermal, bioenergy, and ocean energy and discuss the development status quo and challenges of forward-looking energy in Taiwan from the perspectives of readiness through "governance," "resources," "technology," and "environment and society".

Global trends in forward-looking energy

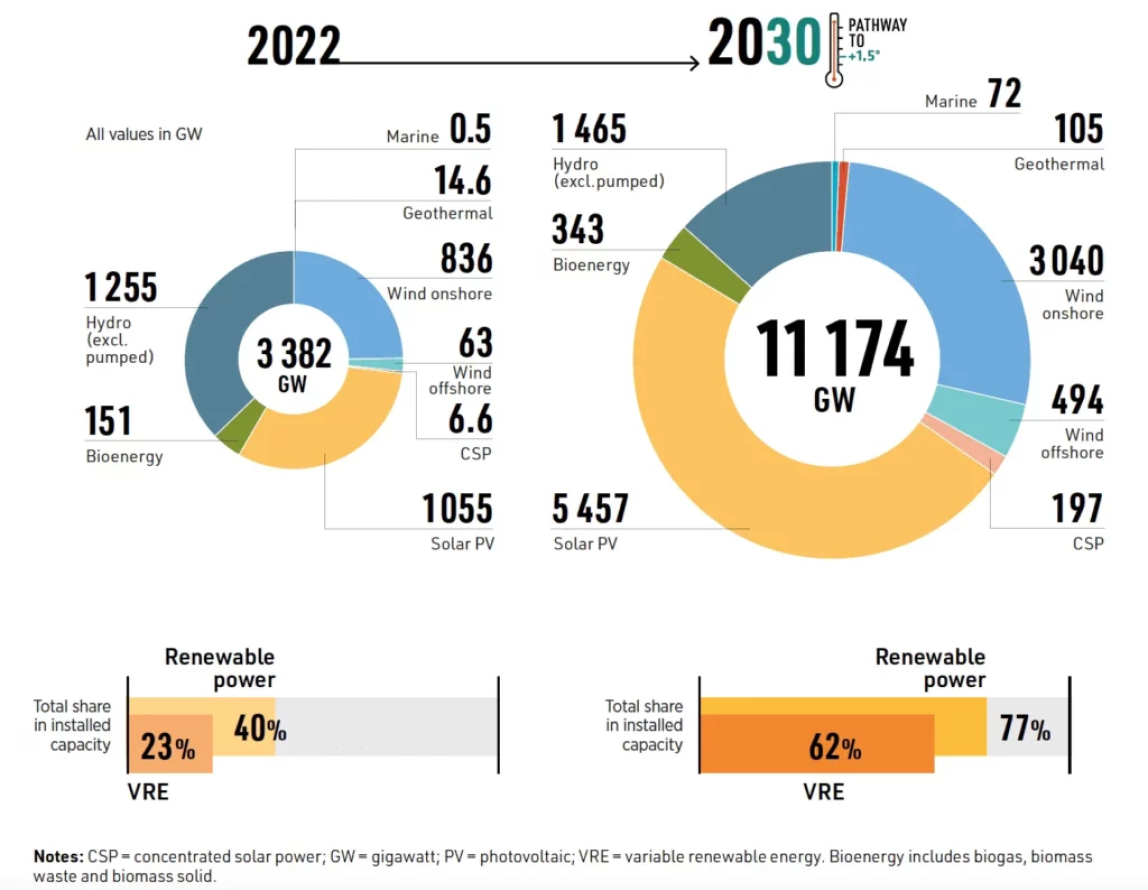

- According to the 1.5°C scenario defined by the International Renewable Energy Agency (IREA), the total global installed capacity for renewable energy needs to be increased by more than three-fold in 2030, that is, from 3,382 GW in 2022 to 11,174 GW (see Figure 1). Solar power, land-based wind power, and hydrogen energy will serve as the main drivers of growth, supplemented by geothermal (increase by 7.2-fold vs. 2022), bioenergy (increase by 2.3-fold vs. 2022), and ocean energy(increase by 144-fold vs. 2022).

Figure 1. Global installed renewable electricity generation capacity in the 1.5°C Scenario, 2022 and 2030

Source: COP28 et al.(2023: 23).

- Geothermal energy: According to estimates under the 1.5°C scenario, the installed capacity of geothermal energy needs to be reached to 105 GW by 2030 (COP28 et al., 2023). As of the end of 2022, the total global installed capacity for geothermal power generation was 16,127 MW, with the top five countries being the United States, Indonesia, Philippines, Turkey, and New Zealand (Richter, 2023).

- Bioenergy: According to estimates under the 1.5°C scenario, bioenergy must account for 22% of global primary energy supply by 2050. In the same year, the share of modern biomass energy use in the global total final energy consumption (TFEC) will increase to 15%. The majority will be used in the industrial sector (52%), followed by transportation (23%), construction (18%) and other categories (8%). Under the 1.5°C scenario, bioenergy will account for approximately 4.5% of total power generation, i.e., 6.5 EJ in 2030 and 14.9 EJ in 2050.

- Ocean energy: According to estimates under the 1.5°C scenario, the installed capacity of ocean energy must reach 72 GW by 2030 (COP28 et al., 2023). Currently, the global cumulative installed capacity for ocean energy is 535 MW, of which tidal power accounts for 98% of the total global installed capacity. France's Rance Tidal Power Station and South Korea's Sihwa Lake Tidal Power Plant are currently two of the world's largest tidal power stations (IRENA, 2020).

- Geothermal Energy

- BioEnergy

- Ocean energy

- Comprehensive analysis

Policy goal

- Geothermal targets: According to "Taiwan's 2050 Net-Zero Transition: Key Strategies for 'Forward-Looking Energy' Action Plan", the cumulative geothermal installed capacity is expected to reach 20 MW by 2025, 56–192 MW by 2030, followed by a significant leap to 3–6.2 GW by 2050 (MOEA, 2023b).

- To Prioritize shallow geothermal energy: The Academia Sinica recommends that the short-term goal should involve expanding the installed capacity of shallow geothermal energy, whereas the long-term goal should involve the active development of deep geothermal energy, which would eventually serve as the main force of geothermal power generation (Academia Sinica, 2022). Currently, the government's pathway to renewable energy is predominantly based on solar photovoltaics and offshore wind power, in conjunction with the development of forward-looking energy, such as geothermal energy. This strategy is to "accelerate traditional geothermal development and expand geothermal resource exploration."(Executive Yuan, 2023)

- Implementing geothermal resource surveys and adjusting regulations: The National Science and Technology Council, Academia Sinica, and various ministries have jointly formulated the "Net-Zero Technology Plan (2023–2026)". This plan was approved in March 2023(Office of Energy and Carbon Reduction, EY, 2023), and the average annual budget from 2023 to 2026 will be about NT$ 15 billion. Its expected benefits include the implementation of geothermal resource surveys and regulation adjustments. However, it should be noted that in addition to terrestrial geothermal energy, the plan also mentions the layouts of "marine geothermal geological exploration."(NSTC et al., 2023)

Trend analysis

- Connection of multiple geothermal power plants to the grid for power generation in 2023. After years of administrative procedures and technological breakthroughs this year, several geothermal power plants will be officially connected to the grid and activate power generation. Examples include the Sihuangziping Pilot Geothermal Power Plant in Datun Mountain, New Taipei; a geothermal power plant in Jinlun, Taitung, developed by the LCY Group subsidiary, Quan Yang Geothermal; and the Renze Geothermal Power Plant in Yilan. The Renze Geothermal Power Plant applies domestically manufactured generator units and will officially commence operations at the end of 2023. The nearby CPC geothermal plant in Yilan Tuchang is also expected to be connected to the grid in 2024(MOEA, 2023a).

- Gradual investment by enterprises and banks: Geothermal energy has attracted the investment interests of several enterprises, and banks have also begun investing in geothermal financing. For example, Bank SinoPac will provide Taiyi and Honglun Power with electric power financing in 2022 to construct a geothermal power plant in Jinlun, Taitung.(Bank SinoPac, 2022)

- Active geothermal development in Taitung County: Taitung County has abundant geothermal resources, and the county government strongly supports geothermal energy development. To establish good communication channels between companies and indigenous peoples, the Finance and Economics Department of the Taitung County Government is currently drafting a "Company Statement of Commitment," including a mechanism for developers to compensate the indigenous peoples(Huang, 2023).

- Special provisions and sub-laws for geothermal energy: On May 29, 2023, the revised draft of the "Renewable Energy Development Act" was passed through the third reading. The new amendments introduced special provisions for geothermal energy, which mainly involved changing the review system to a joint review between the central and local governments and extending water rights to 20 years. In addition, developers who wish to develop in hot spring and indigenous areas must submit an impact assessment on the hot spring industry and undergo consultation and consent procedures with the indigenous peoples (MOEA, 2023c). The public sector has held several meetings to discuss the contents of the sub-laws with stakeholders. Although the contents of the regulations have not yet been finalized, the geothermal exploration, drilling, plant construction, grid connection, and other work have already been launched. After the sub-laws are enacted in the future, there may be issues regarding the transition between the old and new systems. Currently, the "Licensing and Administrative Measures for Geothermal Energy Exploration and Development (Draft)" formulated by the Energy Administration also includes a linkage mechanism for the planning stage.

Current status and challenges

Governance

- Geothermal regulations: Geothermal energy is an emerging energy source and has raised many legal issues that the public sector has never dealt with. Therefore, implementing geothermal regulations will necessitate substantial time and effort, entailing gradual discussions with relevant departments and stakeholders on the proposed provisions. For example, the "Licensing and Administrative Measures for Geothermal Exploration and Development (Draft)" addresses concerns surrounding the necessity of obtaining consent from all landowners for underground inclined shafts, the requirement for compensation, the manner in which compensation should be provided, and potential land ownership challenges that may arise during the enforcement of these regulations. Since the depth of current geothermal drilling far exceeds the scale of previous projects, it is difficult to fully apply existing regulations, which has sparked discussions from multiple parties.

- Regarding the acquisition of geothermal exploration data, regulations for data access have been specified in the "Geothermal Exploration System (GeoTEX)" platform, which divides data into three tiers, each with different access methods.

- Geothermal incentives: To boost private investment in the geothermal industry, the Ministry of Economic Affairs announced the "Measures for Geothermal Power Generation Demonstration Incentives" in 2022, which incentivizes local governments to propose geothermal tenders and supplement developers. Although in the latter case, each project can receive up to NT$ 100 million in subsidies, Article 8 of these measures stipulates that "the incentive per watt shall not exceed the actual expenditure of the total exploration expenses per watt, minus the difference from the sum of the exploration and drilling cost parameters per watt of capacity used in the electricity Feed-in Tariff (FiT) rate for geothermal power generation equipment announced in the year of application." If the policy goal is to increase the installed geothermal energy capacity maximally. Dr. Wang Shou-Cheng of the Geothermal Association, in this case suggests that these measures must be amended such that operators can receive incentives once they reach a specified installed capacity target. Based on the practical operations of the current incentive system, some industry players do not consider the incentive fund beneficial(Lee, 2022). In contrast, others are concerned that the application process for the incentive funds will require cumbersome procedures and data submission processes, and hence have chosen not to apply.

Resources

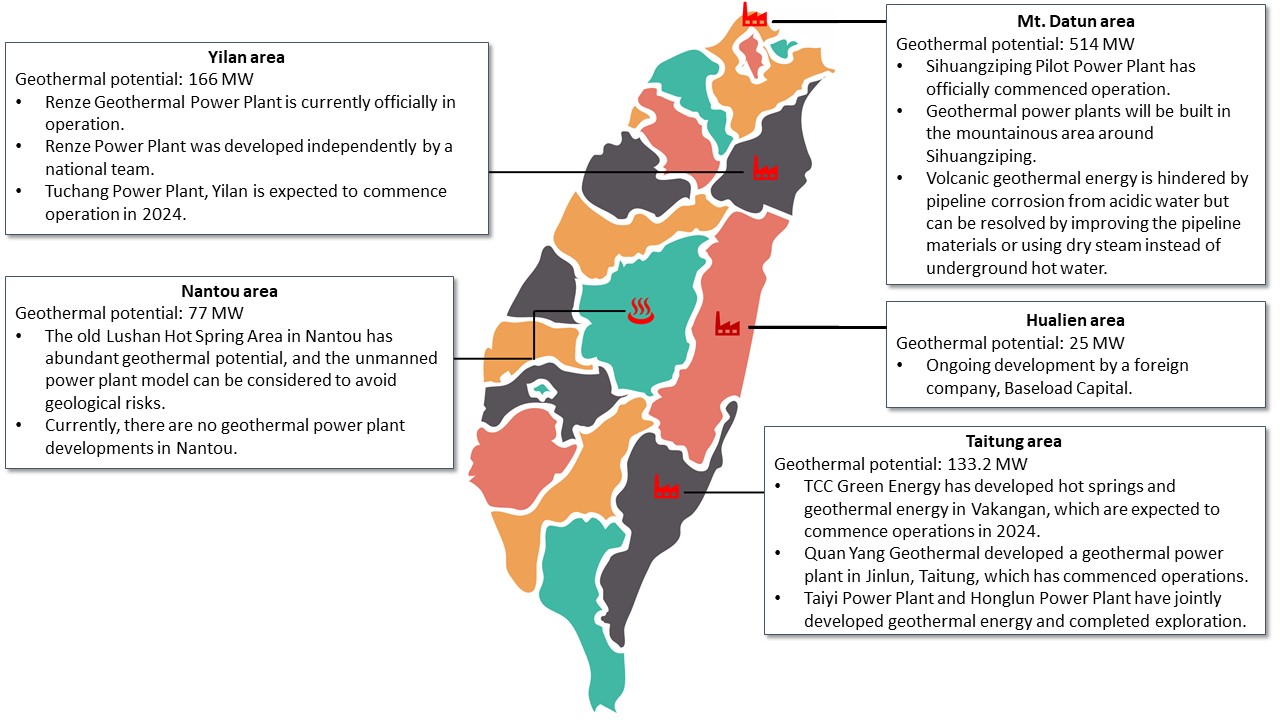

- Taiwan's geothermal potential is approximately 40 GW, of which shallow geothermal potential accounts for approximately 990 MW. The top five potential areas for shallow geothermal energy are Datun Mountain (514 MW); Qingshui, Yilan (61 MW); Jinlun, Taitung (48 MW); Lushan, Nantou (41 MW); Zhiben, Taitung (25 MW); and Tuchang, Yilan (25 MW). There are already geothermal power plants commercialized in Datun Mountain, Qingshui, Yilan, and Jinlun, Taitung. The geothermal power plant developed by Taiwan Cement Corporation (TCC) Green Energy in Zhiben, Taitung, is expected to be completed in 2024. The geothermal project developed by CPC in Tuchang, Yilan, is also expected to be connected to the grid in 2024. According to a press release from the Ministry of Economic Affairs in October 2023, the current volume of geothermal development in Taiwan has reached 61.75 MW(MOEA, 2023a).

- Special attention should be paid to Lushan, Nantou. Lushan has the fourth-largest shallow geothermal potential but no ongoing geothermal projects. Due to Typhoon Sinlaku in 2008 and Typhoon Morakot in 2009, the slopes of Lushan are at risk of deep-seated landslides. Hence, the Nantou County government abandoned this hot spring area and selected Fuxing Farm in Puli to house Lushan's original hot spring operators [1] (The Control Yuan, 2022a). To address this risk, Dr. Wang Shou-Cheng of the Taiwan Geothermal Association once explained in a BCC program that the construction of unmanned geothermal power plants can be attempted in the local area to utilize its abundant geothermal resources(BCC , 2023).

- In addition to terrestrial geothermal energy, Taiwan has enriched submarine geothermal resources in its waters, such as the Xinlai submarine volcano of the Waimushan maritime area in northern Taiwan(Lee et al., 2021; Action Group on Wai-Mu Mountain Protection, 2022 ).

Figure 2. Taiwan's geothermal potential areas and the current status of geothermal development

Source: Compiled by the RSPRC research team. Graphics by Ng Kai Wen.

Technology

- Geothermal development technology: Taiwan's geothermal systems are divided into volcanic and metamorphic geothermal resources. In volcanic geothermal energy, the low pH value of the fluid can corrode pipeline materials, whereas metamorphic geothermal energy is prone to scaling. In other countries, chemicals are usually injected into pipelines or reservoirs to neutralize acidic water or dissolve scaling. However, these methods are not employed in Taiwan to avoid environmental impact. Currently, pipeline materials that can resist acid corrosion (e.g., titanium alloys) have been developed for volcanic geothermal energy. Taiwan has opted to address this issue by using corrosion-resistant pipelines. As for scaling, this can be scraped off using drills or prevented through pressure control to minimize scaling in stratigraphic fissures that are difficult to access(Han, 2023; Chung, 2023; Economic Development Department, NTPC, 2023). The Sihuangziping Pilot Geothermal Power Plant in Datun Mountain mainly uses dry steam rather than underground hot water to generate electricity, which can reduce acid corrosion(Chen et al., 2023; Liu, 2023).

- The Renze Geothermal Power Plant applies domestically manufactured generator units and will commence operations at the end of 2023. Fabulous Power Co., Ltd., based in Datun Mountain, has successfully introduced foreign technology, which enabled the commercialization of the Sihuangziping Pilot Geothermal Power Plant in 2023.

Figure 3. President of Fabulous Power, Lin Bo-Hsiu, explaining to visitors at the Sihuangziping Pilot Geothermal Power Plant

Image source: Provided by the National Taiwan University Risk Society and Policy Research Center.

Environment and Society

- Residents' rights and social communication: Owing to the limited land area in Taiwan, current geothermal development sites in Hualien and Taitung are located close to settlements. Therefore, it is necessary to coordinate and communicate with residents regarding issues such as noise and vibrations during the development process. Geothermal development within or around a settlement must compensate the local community appropriately. The timing and content of compensation should be decided based on joint discussions between the developers and affected residents.

- Cooperation and competition between geothermal energy and hot springs: After a landslide buried the Hongye Hot Springs in Taitung during Typhoon Morakot in 2009, the Yanping Township Office cooperated with TCC Green Energy to restore the Hongye Hot Spring area via a build-operate-transfer (BOT) project. In addition, TCC Green Energy has also begun developing geothermal energy in the Hongye Hot Spring area, which is expected to be completed in 2024(TCC Ltd., 2022 ). However, residents of the Hongye Tribe are doubtful that the Hongye Hot Springs will still be unable to attract young people to return to their hometowns(PNN, 2023 ). Similar to the Vakangan Hot Springs, the Jinlun Hot Springs in Taitung were also severely damaged by Typhoon Morakot in 2009, and it took several years to restore its tourism industry. The hot spring industry is booming, but residents are concerned that geothermal developments could have a negative impact on hot spring resources.

Policy goal

Taiwan's cumulative installed capacity for bioenergy reached 724 MW as of August 2022, mainly including 92 MW of biomass power generation (including biogas) and 632 MW of waste-to-energy power generation. Biomass power generation (agricultural and forestry materials and biogas) mainly involves electricity generation and thermal energy applications. The total power generated in 2021 was 170 million kWh. Waste-to-energy power generation is mainly based on the thermal power generated from waste in large incineration plants, and the total power generated in 2021 was 3.6 billion kWh. The government recognizes that bioenergy generated 3.77 billion kWh of power in 2021, which accounted for approximately 1.3% of the total domestic power generation(MOEA, 2023b). Taiwan's power generation target for bioenergy 2030 ranges from 805 to 1,329 MW. If we take the lower limit of 805 MW, the room for growth will be very limited. Furthermore, the government is reluctant to promote relevant policies if we exclude the expected power generation from waste incineration. Therefore, this raises the question of whether there are difficulties facing bioenergy development in Taiwan.

Figure 4. Installed capacity of bioenergy in 2022

Source:Ministry of Economic Affairs(2023).

Types and applications of bioenergy

Bioenergy resources are the most abundant natural resources in the world and can be divided into three major categories:

- Solid biomass fuel application: small and medium-sized steam boilers using wood pellets and waste wood as a low-carbon fuel.

- Liquid biomass fuel application: steam boilers using biomass oil as low-carbon fuel; paper industry using black liquor as low-carbon fuel for cogeneration boilers.

- Gaseous biomass fuel application: biogas power generation [2].

Trend analysis

- Taiwan's main fuels for stationary biomass power generation include urban organic waste (waste-to-energy power generation), agricultural and forestry materials, and biogas(The Renewable Energy Website, MOEA, 2018).

- By examining bioenergy development from the perspective of FiT rates, we will see that in addition to adding new categories, adjustments have also been made to the rates themselves. In 2023, the "agricultural and forestry plants" FiT category was added, with a FiT rate of NT$ 3.1187 per kWh; the FiT rate for bioenergy from anaerobic digestion equipment is NT$ 7.0089 (higher than 2022), whereas that from non-anaerobic digestion will remain at NT$ 2.8066.

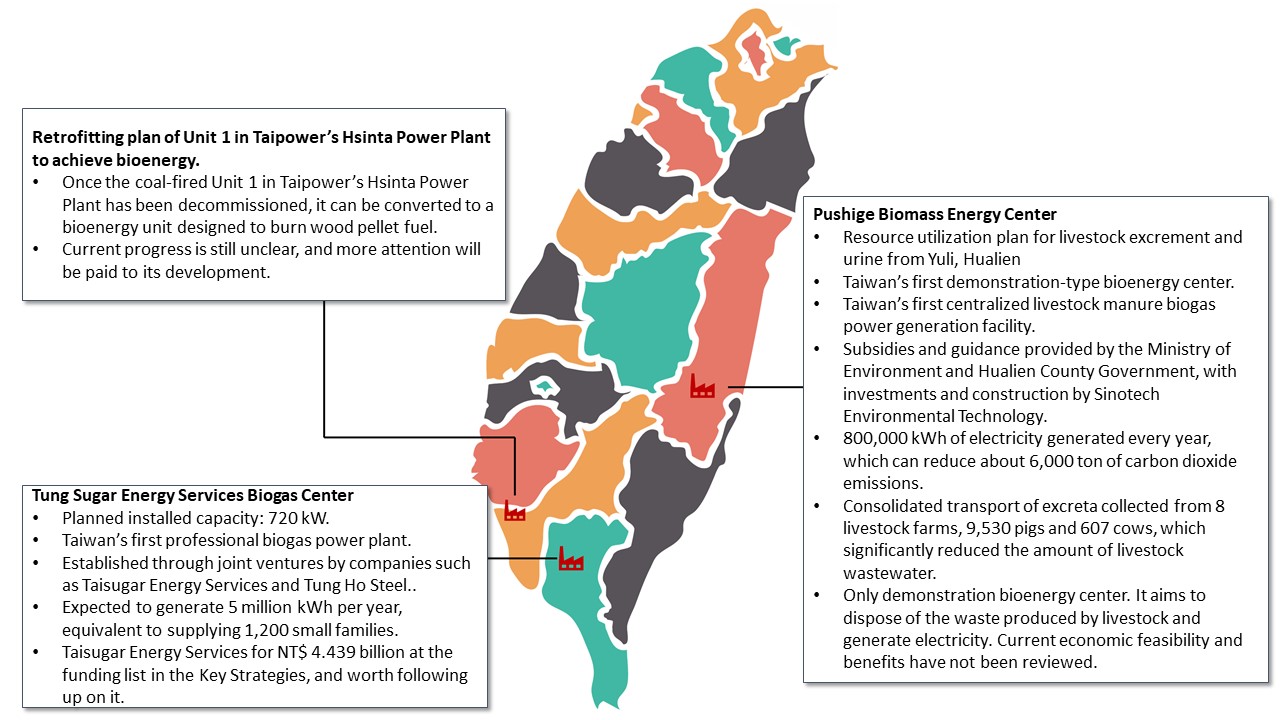

- Whether it is the adjustment of FiT rates or the development trend of the government's policies on demonstration plans, the development of bioenergy is dominated by the promotion of biogas (gaseous biomass fuel applications) and demonstration projects for converting coal-fired plants to wood pellets (biomass solid fuels applications). With regard to liquid biomass fuels, Taiwan has previously promoted the "B2 biodiesel policy", which stipulated that 2% biodiesel must be added to diesel fuel, and was even the first country in Asia to promote biodiesel. However, due to quality control issues, the policy was suspended in 2014. Despite the advances in manufacturing technology, biodiesel has not continued to develop in Taiwan (foodNEXT, 2022).

- In addition, major corporate carbon emitters are keen to invest in bioenergy. Formosa Plastics, China Steel Corporation, Taiwan Semiconductor Manufacturing Company, and significant paper manufacturers relevant to bioenergy aim to increase their self-produced green energy, reduce corporate carbon emissions, and even invest in bioenergy development to achieve a circular economy. In contrast, Taiwan's policies for developing bioenergy are in dire need of reinforcement. Even though the Forward-Looking Energy policy states that the total power generated from bioenergy in 2021 was 3.77 billion kWh, accounting for 1.3% of total domestic power generation, no clear development policies have been proposed. Moreover, the current installed capacity for biomass energy includes waste-to-energy power generation, which implies that the Taiwanese government has not taken a proactive stance concerning biomass energy development.

- Based on interviews with experts from the Taiwan Bio-energy Technology Development Association, we learned that although bioenergy has been listed as a forward-looking energy in the "Twelve Key Strategies for Net-Zero Emissions," development and promotion of this energy type has been relatively slow. One of the issues involves regulatory restrictions. Despite the gradual adjustments, incentives such as FiT rates and related incentive measures are still inadequate, which has failed to attract company investments. The government's main goal for 2030 is to maintain and stabilize growth.

Current status and challenges

Governance

- First, at the topmost level of governance, it is necessary to clarify the role of bioenergy as a forward-looking energy and clearly define the main policy goals for bioenergy. Is bioenergy intended to resolve the problem of waste and resource recycling? Or is it to convert coal-fired power plants to wood pellets?

- The provision of reasonable economic incentives is necessary. The current rates only serve as basic subsidies, which do not give companies sufficient incentive to invest. Therefore, FiT rates need to be continuously adjusted. In addition, increasing the carbon fees will provide major carbon emitters with greater incentives to develop, but these rates need to rise further to be effective.

- According to the Regulations on the Administrative Measures for the Installation of Renewable Energy Power Generation Equipment, Paragraph 5 of Article 7 states that when installing biomass power generation equipment, a separate affidavit must be attached, pledging that the source of fuel used by the power generation equipment shall be 100% agricultural and forestry plants, biogas, or processed domestic organic waste. Furthermore, Paragraph 6 of Article 7 also states that when installing waste-to-energy power generation equipment, a separate affidavit must be attached, pledging that the fuel source used in the power generation equipment shall be 100% general domestic waste or general industrial waste. However, since power generation from waste incineration is currently listed as a type of forward-looking bioenergy, the feasibility of diverting bioenergy from waste-based energy in the future or expanding the recognition of biomass co-firing and the relevant regulations will impact subsequent development.

- As a continuation to the issues above, if the relevant regulations are not stipulated, this may lead to the burgeoning of solid recovered fuel (SRF) plants. Chang Chia-Chi, a senior researcher at the Taiwan Bio-energy Technology Development Association, believes that "Power generation from plastic-containing SRF can apply for renewable energy certificates according to the law in Taiwan, but there is a risk that this may not be recognized in the international community."(Liu, 2022)

- It is also time to revive the formulation and development of the policies on biodiesel, which have stagnated for many years. In 2021, the government specified that high electricity users with more than 5,000 kW capacity should install 10% of renewable energy within 5 years. One solution could be introducing biodiesel power generation for the emergency backup generators of the factory (Chen, 2022).

- If Taiwan aspires to align itself with global advancements in bioenergy development, it is imperative that the government addresses these issues directly. In addition to learning from the practices of the international community and neighboring countries in East Asia (e.g., Japan and South Korea), the government should offer reasonable economic incentives, ensure a stable supply of relevant raw materials, and increase investments in resources, professional expertise, and technological advancements to achieve this goal.

Technology

- Bioenergy development can be divided into liquefaction and gasification technology, biogas utilization technology, and biodiesel technology. The main issue at present is not the technology.

- Technological planning and financial feasibility need to be considered in pilot projects. Additionally, it is imperative to establish regulations regarding various incentives for the adoption of different carbon reduction technologies in the future.

- Once the relevant development policies have been clarified, we recommend referring to mature developmental pathways from the international community in the early stages of Taiwan's development and using and introducing mature equipment and technologies.

- A lack of investment in professional talents also results in unclear policy formulation and current relevant development status. If co-firing is permitted, professional talents will also be needed for policy formulation, equipment standards, power generation efficiency, among others.

Resources

- One of the key directions in bioenergy development is the demonstration projects for converting coal-fired power plants to wood pellets. We hope that the demonstration project for retrofitting Taipower's Hsinta Power Plant will serve as an opportunity to convert coal-fired power plants to biomass power generation. However, we also believe that it is necessary to confirm whether Taiwan has sufficient sources of raw materials for wood pellets.

Figure 5. Current status of bioenergy development in Taiwan

Source: Tseng(2022); Hsu(2022); Sinotech Ltd.(2023). Graphics by Ng Kai Wen.

Environment and Society

- Since biogas equipment, except for incinerators, can achieve a circular economy once installed, there have not been any major public protests to date.

Policy goal

- Installed capacity targets: Phased development shall occur according to the technological maturation plan. The installation of 100 kW–MW-scale demonstration generator units will be completed in 2030; 1–10 MW commercially operated generator units will be installed in 2035; and the target installed capacity of 1.3–7.5 GW will be further achieved in 2050, depending on the maturity of technological development (MOEA, 2022).

Trend analysis

- There are numerous wave energy generation technologies. Foreign companies are gradually investing.: The Industrial Technology Research Institute (ITRI) has developed the "Floating Point Absorber(FPA)" system; the National Academy of Marine Research (NAMR), in collaboration with the National Taiwan Ocean University(NTOU), has developed the "oscillating-water-column(OWC)" system. There have been successive investments from foreign enterprises in partnership with Taiwanese companies. The cooperative projects with Singapore are expected to provide sufficient electricity for consumption by approximately 1,500 households (Huang, 2022; Weng, 2023a).

- Kuroshio Current offers the greatest potential for Taiwan's development of ocean current energy: The Kuroshio Current passes near Taiwan's main island, Green Island and Orchid Island, at a distance of only approximately 20 km from the main island. Hence, it is expected to have greater advantages in transmitting power to the user end. Under the leadership of the Ocean Affairs Council, the NAMR, National Taiwan University, and National Sun Yat-Sen University have jointly developed the "floating ocean current turbine generator unit" and completed the 20 KW anchored system and real sea testing. The 200 KW demonstration power plant project is expected to be completed between 2024 and 2027 (National Academy of Marine Research, 2023). Taiwanese companies such as Foxconn and TCC have also invested in developing ocean current energy (Hung, 2022; Guo, 2023).

- Bright prospects for ocean thermal energy conversion (OTEC) in Taiwan: Taiwan's eastern maritime area is characterized by a steep seabed topography, with water depths of up to 700 m near the shore and water temperatures of approximately 6°C, whereas the temperature at the geothermal wellheads at the Coastal Mountain Range can be as high as 80–120°C. Thus, the topographic and water temperature conditions are both optimal(Chen, year unknown). In a joint effort by TCC Green Energy and Ho-Ping Power Company, Taiwan's first large-scale hybrid OTEC and thermal power generation system is currently under construction at the Ho-Ping Power Plant in Hualien and is scheduled for parallel connection in 2026 (Weng, 2023b).

Ocean energy

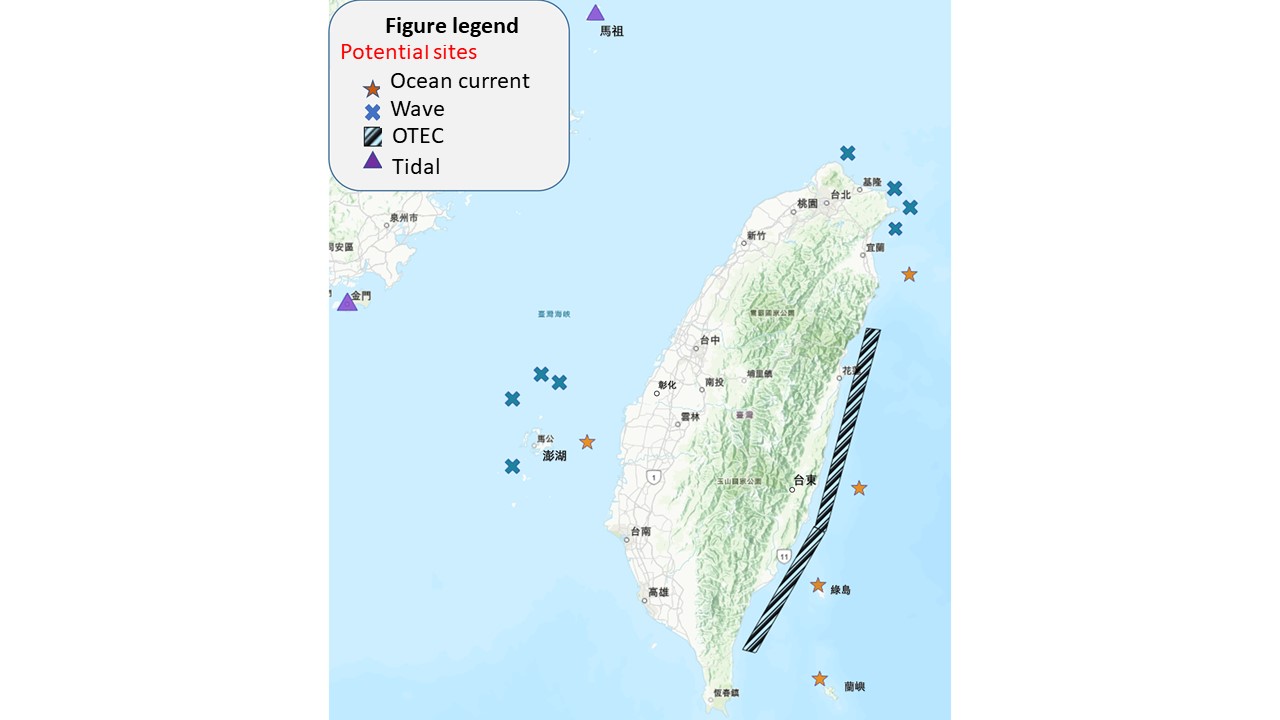

The international community focuses on five technologies: tidal energy, wave energy, ocean current energy, ocean thermal energy conversion (OTEC), and salinity gradient energy. Among these, Taiwan has the greatest potential for developing wave energy, ocean current energy, and OTEC.

- Tidal energy: Highly regular, uses the changes in high and low tides to generate electricity, such as the principle of hydroelectric power generation.

- Wave energy: Less regular, most unstable of all ocean energies. Numerous wave energy technologies are available, with more than 1,000 patents globally. The basic principle involves using the movements of the water caused by the undulations of the waves; this includes using the potential energy difference, reciprocating motion, or buoyancy of wave movements to generate electricity.

- Ocean current energy: Relatively stable. Its power generation principle involves driving turbines using the density and pressure gradient caused by the earth’s rotation and the uneven distribution of water temperature and salinity or wind-driven ocean currents.

- Ocean thermal energy conversion (OTEC): Relatively stable, providing a continuous power supply suitable for baseload power. It involves using the temperature difference between ocean surface waters and deep ocean waters caused by the differences in heat absorption of solar radiation and ocean heat transport. This temperature difference vaporizes the working fluid, which drives the turbines to generate electricity.

- Salinity gradient energy: Its principle is based on the difference in chemical potential energy between two ocean water bodies with different salt concentrations. However, this technology is not as advanced as other ocean energy technologies on a global scale, with only reverse electrodialysis showing relatively mature development.

Data source: Compiled by the authors.

Current status and challenges

Governance

- Reasonable policy goal setting: The government and the academic community jointly lead Taiwan's research and development (R&D) in ocean energy. The government has specified a phased installation target of 0.1–1 MV by 2030. Based on exclusive interviews with ocean energy experts at the RSPRC, Taiwan's phased installed capacity target for 2030 is considered reasonable.

- Cross-sector integration and establishment of one-stop shops: Taiwan currently has the "Ocean Basic Act," "2020 National Ocean Policy White Paper," and "Marine Industry Development Act" to serve as a basis for the promotion of marine affairs by various ministries and local governments. It is hoped that this legal basis will strengthen policy integration and coordination. However, from a practical point of view, let us consider the cable license application in the administrative procedures for the anchoring of ocean current generator units as an example; this involves several regulations related to the maritime environment, environmental assessment, coastal management, underwater cultural heritage, among others. Furthermore, the corresponding organizations include the Ministry of the Environment, the Fisheries Agency of the Ministry of Agriculture, the National Land Management Agency of the Ministry of the Interior, the Ministry of Culture, among others. Therefore, we recommend that the government research the application mechanism for ocean energies with different installed capacities, relevant fee collection principles, and their corresponding provisions to establish a one-stop shop and simplify the application process.

- Implementation of comprehensive maritime survey and spatial planning: In 2021, the European Commission recommended that all coastal European Union (EU) countries establish maritime spatial plans. The purpose of this is to first assess the impact of maritime activities on economic activities, society, and environmental protection during the planning stage of development sites, thereby achieving adequate communication with all stakeholders, reducing conflicts between different activities, strengthening cross-border cooperation within the EU, protecting the ecological environment, and encouraging investment (European Commision, 2023). In Taiwan, the "Maritime Management Act" concerning maritime spatial planning was originally supposed to be enacted in 2021 per the "Ocean Basic Act," but its legislation is still ongoing.

- Policies to incentivize investments from companies: In 2022, the Ministry of Economic Affairs proposed the FiT rate for ocean energy power generation at NT$ 7.32 per kWh for the first time, which will subsequently be adjusted on a rolling basis and will remain at NT$ 7.32 per kWh in 2023. Mr. Miin-Chieh Chuang, Chairman of the Taiwan Ocean Energy Development Association, stated that the current FiT rate is insufficient as an incentive for development investors (Chen, 2022). Furthermore, banks are also unable to provide financing. According to our interviews with ocean energy experts, the costs of machinery, cables, and various equipment for the different types of ocean energy technologies are high, and it is difficult to estimate the returns from the initial investment costs. Hence, there is limited incentive for small- and medium-sized enterprises.

- Furthermore, although the "Ministry of Economic Affairs Energy Bureau (now the Energy Administration) Industrial Energy Technology Program" has lifted the upper limit for subsidies since 2018, the subsidy ratio still cannot exceed 50%. It may be reduced to lower than 50% after review; this is also inadequate to incentivize industrial investment and development. Therefore, the government should proactively clarify industry needs and match large enterprises with small- and medium-sized enterprises.

Resources

- According to the ITRI's inventory, Taiwan has the greatest potential for developing three types of ocean energies: (1) wave energy, with potential development sites located in the waters off the northeastern corner of Taiwan, Fugui Cape, Penghu and Yunchang Ridge, giving a developable potential of up to 2.4 GW; (2) ocean current energy, with potential development sites located in Fugui Cape, Penghu Channel and the Kuroshio Current to the east, giving a developable potential of up to 4 GW; and (3) OTEC, with potential development sites located off the coasts of Hualien and Taitung, giving a developable potential of up to 2.8 GW. Tidal energy is distributed at Kinmen and Matsu Islands but only gives a developable potential of 0.2 GW due to the limited area (Lin, 2023).

Figure 6. Potential sites for ocean energy in Taiwan

Source: Lin(2023). Graphics by Ng Kai Wen.

Technology

- Improvements needed in resistance of generator units to typhoons and marine organisms: Given the highly variable nature of underwater environments and the statistics by the Ministry of Interior showing that Taiwan experiences an average of 4.7 typhoons per year (National Fire Agency, Ministry of Interior, 2019), the key to developing domestic ocean energy still lies with optimizing the resistance of the generator units to typhoons, waves, seawater corrosion, and organic matter adhesion. In conjunction with the ocean resource inventory and maritime spatial planning above, gradual adjustments are needed to achieve the stable development of ocean energy. Internationally, there is a greater emphasis on wave energy and tidal energy for power generation, and hence, international technology may not be suitable for Taiwan's maritime space.

- Ocean energy technologies in Taiwan are not ready for commercialization: According to our interviews with ocean energy experts, in general terms, the technology readiness levels (TRL) of different ocean energies in Taiwan is about TRL 4–6 for wave energy, TRL 6–7 for ocean current energy (the Kuroshio Current), and TRL 7–8 for OTEC.

Technology Readiness Level (TRL) Evaluation Mechanism

TRL is currently employed internationally to manage the progress and results of important R&D projects. It is a systematic metric/indicator that is a consistent standard for measuring different types of technologies. It describes the entire process of a technology from its inception to its successful application in a product. The technology R&D process covered by TRL roughly includes four parts:

- (1) Conceptual development (TRL 1–3): Basic research on a new technology or concept.

- (2) Prototype validation (TRL 4–5): Material/ component/ prototype validation, i.e., the transition from the laboratory to the real world.

- (3) System development (TRL 6–7): Continuous prototype testing and validation until it is nearly ready for production.

- (4) System launched and operational (TRL 8–9): Ready for production trial or mass production.

Data source: Wang(2017). Compiled by the authors.

- Integration of ocean energy with other technologies or facilities: Using cables as an example, considerable capital investment is needed to manufacture, install, and maintain these cables, and hence, the setup cost is high. Based on our interviews with ocean energy experts, it may be possible to consider integrating ocean energy with other renewable energy technologies. For example, the cables already installed for offshore wind power can also be used for wave energy, reducing ocean energy installation costs.

Environment and Society

- Involvement of traditional indigenous maritime areas: There is currently no comprehensive inventory of traditional indigenous areas that may be affected by ocean energy development. Furthermore, there is no legal basis for managing traditional maritime areas. However, the "Regional Planning Act" and "Regulations for Non-Urban Land Utilization Control" still declare traditional indigenous maritime areas. Hence, the Council of Indigenous Peoples must still approve development and utilization within these maritime areas. For example, the Kuroshio Current, which passes through many areas that overlap with traditional indigenous maritime areas.

- Environmental protection issues and communication with other stakeholders: After the "Marine Industry Development Act" was passed in 2023, discussions about the "Three Ocean Acts" have begun heating up again, whereas environmental groups continue to focus on the progress of the "Marine Conservation Act." In addition, ocean energy development involves communication and coordination with different stakeholders, such as the tourism industry, fishery industry, and residents. Based on our interviews with ocean energy experts, ocean energy development and offshore wind power sites tend to encounter similar problems. Individual developers coordinate offshore wind power separately, which is prone to disputes over compensation amounts. Therefore, it is necessary to reconsider and improve the current compensation mechanism.

By examining the status and challenges of geothermal energy, bioenergy, and ocean energy from the perspectives of "governance," "resources," "technology," and "environment and society" (Table 1), our team found that the readiness of all four aspects was insufficient. Hence, it is necessary to improve supporting policies, regulations, and infrastructure, create sufficient financial and economic incentives, and reduce financing and risk uncertainty while developing a deeper understanding and consideration of a fair energy transition. Given this, we propose the following policy recommendations:

(1) Propose supporting policies and regulations, improve infrastructure, and create a robust environment for industrial development

The policy goals, regulations, and infrastructure proposed by the government all play a critical role in creating the development environment for the forward-looking energy industry. In terms of governance, although geothermal energy already has a one-stop-shop, there is still room for improvement in its data inventory and readability; the inventory for ocean energy still needs to be coordinated by the central government; bioenergy requires greater clarity in its policy goals to guide its market and technology development trends. In particular, the field of forward-looking energy involves many regulations and authorities. For example, most potential sites in geothermal and ocean energy development are located in remote areas, far away from existing power grids and high-power consumption areas. Therefore, owing to the complex spatial characteristics, issues such as the expansion of power grid deployment, resolution of grid connection difficulties, and setting up port infrastructure all involve discussions among multiple sectors and stakeholders, urgently requiring government coordination and resolution. Furthermore, many geothermal potential areas are located within national parks. If the Marine Conservation Act is passed in the future, further considerations must be given to the compatibility of ocean energy facilities and marine sanctuaries. We recommend that the government not only propose specific supporting policies and regulations but also simplify cumbersome administrative procedures, establish a more flexible regulatory environment, and continue to emphasize cooperation across ministries and with local governments to ensure the continued promotion and consistency of policies for forward-looking energy.

(2) Create sufficient economic incentives, reduce uncertainties in financing and risk, and build a favorable investment environment

Although the Ministry of Economic Affairs has proposed changes to the FiT rate, the industry and academic circles continue to stress that more comprehensive and powerful economic incentives are needed to rapidly deploy forward-looking energy and sustainable business models. First, tax incentives are an important means whereby corresponding tax exemptions or deductions can be set up to encourage enterprises to invest in renewable energy (IRENA and IGA, 2023). Second, a differentiated FiT system should reflect the maturity and development needs of different renewable energy technologies, providing a more flexible incentive structure.

Third, direct grants, R&D subsidies, soft loans, and other fiscal support measures can reduce the investment burden of enterprises in the early stages of development, as well as promote technological innovation and R&D. Fourth, given the particularity and technological maturity of different renewable energy technologies, they are faced with differences in technical risks, policy dependence of renewable energy investment, and other risks. For example, changes in the government's regulatory framework or negative environmental and social impacts unfavorable to the project site may adversely affect investments in forward-looking energy. Thus, implementing risk assessment and mitigation, guarantees, and insurance plans can help to allay investors' concerns about technology and market risks, thereby enhancing the feasibility of project financing.

(3) Establish a benefit-sharing mechanism and implement a pathway to a fair energy transition

Establishing a benefit-sharing mechanism is also one of the keys to achieving a fair energy transition. Large energy developers often dominate the traditional "centralized energy" model, and such a structure tends to power and benefits to fall into the hands of a few. Recently, benefit sharing has also been implemented in the development of renewable energy. In addition to emphasizing community involvement, it also considers how a benefit-sharing mechanism can be constructed with stakeholders in the community. Forms of benefit sharing include sharing part of the revenues with residents, providing residents with preferential electricity prices, developers paying taxes to local governments, establishing local development funds, and providing residents with employment and skill development opportunities (UNEP, 2007). For example, the Yorke Biomass Energy Project in South Australia (Yorke Biomass Energy Project)[3] introduced new job opportunities to the local area; the EU-funded Crowdthermal Project enables the public to develop geothermal projects through social participation tools and alternative financing options, such as crowdfunding (Crowdthermal, 2023). The current impact of forward-looking energy on local communities and the environment can vary depending on the technological characteristics and deployment conditions. However, based on the experience accumulated from the development of solar photovoltaics and wind power in the past and our environmental and social inventory, we can see various issues related to resources, land, noise, and traditional indigenous areas. Therefore, individual and community involvement in developing and managing renewable energy is a serious issue that the government should emphasize when formulating policies for a fair energy transition.

Table 1. Current development status and challenges of geothermal energy, biomass energy, and ocean energy

Interview data

- Chien-Ming Hsu, Han Wang, Yi-Jyun Shih, and Shu-Jung Hsu (2023, December 7). Online Interview with Ocean Energy Expert A1.

- Chien-Ming Hsu, Han Wang, Yi-Jyun Shih, and Shu-Jung Hsu (2023, December 7). In-Person Interview with Bioenergy Expert A1, Taipei.

- Yi-Jyun Shih and Shu-Jung Hsu (2023, December 13). Online Interview with Ocean Energy Expert A2.

Reference

- 工業技術研究院(ITRI)(2023)。〈地熱案場分布現況〉。

- 中央研究院(Academia Sinica)(2022)。〈臺灣淨零科技研發政策建議書〉。

- 中廣流行網(BCC)(2023)。〈【地熱發電 綠能新希望】專訪 臺灣地熱資源發展協會秘書長 王守誠|媒事來哈啦 2023.05.10〉。

- 內政部消防署(National Fire Agency, Ministry of Interior)(2019)。〈平均每年4.7次颱風侵臺 遠離災害要注意這10點〉。

- 公視新聞網(PNN)(2023)。〈臺東紅葉地熱預計明年商轉 年發電876萬度盈餘回饋鄉鎮〉。

- 王珮華(Wang, Pei-Hua)(2017)。〈技術成熟度機制 助技術產業化行穩致遠"。《工業技術與資訊月刊》(312):14-15。

- 台灣水泥(TCC Ltd.)(2022)。〈台泥綠能與雲品國際攜手打造永續旅遊基地,紅葉谷綠能溫泉園區試營運,落實產業與部落共好〉。

- 永豐銀行(Bank SinoPac)(2022)。〈正夯!永豐首度跨足地熱發電融資〉。

- 守護外木山行動小組(Action Group on Waimushan Protection)(2022)。〈【護海公民學堂】 第19場次 陳雪梨老師、李昭興老師|基隆地熱發電行不行?〉。

- 行政院(Executive Yuan)(2023)。〈加速推動再生能源—極大化綠電發展,逐步達成能源轉型〉。

- 行政院能源及減碳辦公室(Office of Energy and Carbon Reduction, EY)(2023)。〈推動成果〉。

- 地熱發電單一服務窗口(The Single Service Window for Taiwan Geothermal Power)(2023)。〈2023臺灣國際地熱論壇(中文口譯版)〉。

- 李昭興、陳愷、許心瑀(Lee, Chao-Shing et al.)(2021)。〈臺灣北部外海新瀨海底火山的地熱能源〉,《海洋及水下科技季刊》31(4):38-44。

- 李蘇竣(Lee, Su-Jiun)(2022)。〈能源局推地熱發展 探勘費用最高補助1億 獎勵效果民間不買單〉。

- 林晏平(Lin, Yen-Ping)(2023)。〈海洋能發電技術簡介及發展趨勢〉。

- 洪定宏(Hung, Ding-Hung)(2022)。〈 鴻海子公司加入洋流能發電聯盟 電力調節系統成商轉關鍵 〉。

- 食力編輯部(foodNEXT editorial board)(2022)。〈 廢食用油變柴油,能減少90%溫室氣體排放量...法國為什麼踩煞車? 〉。

- 徐榛蔚(Shiu, Jen-Wei)(2021)。〈 花蓮首創生質能源中心!畜牧業排泄物轉為沼氣發電,黃金變綠金 〉。

- 翁永全(Weng, Yung-Chiuan)(2023a)。〈 聯達行攜手Eco Wave Power打造首座波浪能電廠 〉。

- 翁永全(Weng, Yung-Chiuan)(2023b)。〈 臺泥MW海洋溫差發電 預定2026併聯 〉。

- 國科會等(NSTC et al.)(2023)。〈 淨零科技方案(2023-2026年) 〉。

- 國家海洋研究院(National Academy of Marine Research)(2023)。〈 洋流能發電專區 〉。

- 郭逸(Guo, Yi)(2023)。〈 臺灣發「海洋財」有潛力?北歐新創攜手臺泥來插旗 〉。

- 陳佳利、陳添寶(Chen, Jia-Li and Chen, Tian-Bau)(2023)。〈 大屯山地熱發電資源豐富 將成能源重要布局 〉。

- 陳孟炬(Chen, Meng-Jiu)(年份不詳)。〈 東臺灣地域深層海水與溫泉水整合溫差發電可行性探討 〉。

- 陳逸格(Chen, Yi-Ko)(2022)。〈 海洋能躉購費率座談會 海洋能發展協會提四大主張 〉。

- 陳碧珠(Chen, Pi-Chu)(2023)。〈 【產業尖兵】廢食用油暗藏綠金 承德油脂揚威歐洲生質柴油市場 〉。

- 曾智怡(Tzeng, Chih-I)(2022)。〈 綠能新活水 臺糖攜手東鋼砸2.7億蓋首座沼氣發電廠 〉。

- 黃志偉(Huang, Chih-Wei)(2022)。〈 發電新選擇 臺灣海洋波浪發電新里程 〉。

- 黃明堂(Huang, Ming-Tang)(2023)。〈 東縣推地熱發電 居民憂金崙溫泉水脈枯竭 〉。

- 新北市政府經濟發展局(Economic Development Department, NTPC)(2023)。〈 新北首座地熱發電廠預計於10月份完工 年發電量達640萬度電 地熱開發重要里程碑 〉。

- 業興環境科技股份有限公司(Sinotech Environmental Technology Ltd.)(2023)。〈花蓮縣璞石閣畜牧生質能源中心網站〉。

- 經濟部(MOEA, R.O.C.)(2023a)。〈地熱發電國家隊成果首發 臺電宜蘭仁澤地熱啟用 年發近500萬度綠電〉。

- 經濟部(MOEA, R.O.C.)(2023b)。〈臺灣2050淨零轉型「前瞻能源」關鍵戰略行動計畫〉。

- 經濟部(MOEA, R.O.C.)(2023c)。〈建物設置太陽光電、地熱專章 再生能源發展條例部分條文修正草案三讀通過〉。

- 經濟部再生能源資訊網(The Renewable Energy Website, MOEA)(2018)。〈生質能發電概況與趨勢〉。

- 監察院(The Control Yuan)(2022a)。〈廬山溫泉區遷建埔里福興農場案〉。

- 劉光榮(Liu, Kuang-Jung)(2023)。〈臺灣第一座火山地熱電廠,在大屯山誕生 為何比全世界晚了一百年?〉。

- 劉光瑩(Liu, Kuang-Ying)(2022)。〈燒垃圾年賺6億!臺灣要用廢棄物發綠電,為何恐被歐盟打槍?〉。

- 韓吟龍(Han, Yin-Long)(2023)。〈綠金藍圖ep6: 臺灣地熱,又熱又綠 ft. 工研院綠能所副組長韓吟龍〉。

- 鐘佩蓉(Chung, Pei-Jung)(2023)。〈從國際推動方式探索我國酸性地熱的機遇與挑戰,《臺灣經濟研究月刊》46(3):41-51〉。

- COP28, IRENA and GRA (2023). Tripling renewable power and doubling energy efficiency by 2030: Crucial steps towards 1.5°C, International Renewable Energy Agency, Abu Dhabi.

- Crowdthermal(2023). "About Crowdthermal."

- European Commission(2023). "Maritime spatial planning."

- International Renewable Energy Agency (IRENA) (2020). "Webinar: Oceans powering the energy transition."

- IRENA and IGA (2023). Global geothermal market and technology assessment, International Renewable Energy Agency, Abu Dhabi; International Geothermal Association, The Hague.

- Lane, T. and J. Hicks (2017). Community Engagement and Benefit Sharing in Renewable Energy Development: A Guide for Applicants to the Victorian Renewable Energy Target Auction. Department of Environment, Land, Water and Planning, Victorian Government, Melbourne.

- Richter (2023). "ThinkGeoEnergy’s Top 10 Geothermal Countries 2022 – Power Generation Capacity (MW)."

- United Nations Environment Programme (2007). A Compendium of Relevant Practices for Improved Decision-making on Dams and Their Alternatives. Nairobi: UNEP.

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

※The aforementioned may not be copied for commercial use without the center's consent, thank you.※

Note:

[1] Lushan Hot Spring Area: According to the Control Yuan's "Case of Relocating the Lushan Hot Spring Area to Puxing Farm, Puli", after Typhoon Sinlaku in 2008 and Typhoon Morakot in 2009, Mu'an Mountain on the northern slope of Lushan ran the risk of deep-seated landslides, which may bury the Lushan Hot Spring Area during heavy rain. In 2011, the Lushan Hot Spring Area was declared a protected area and river area, where construction is prohibited, and the original buildings are not allowed to be used for the original purpose. The Nantou County government selected Fuxing Farm, located in Puli Township, as a base for relocating and reconstructing the Lushan Hot Springs.

[2] Taipower Green Net (year unknown), Understanding biomass energy.

[3] Farmers within 50 km of the Yorke Biomass Power Plant established a “farmers cooperative" and supplied the biomass power plant with more than 90,000 tons of straw. The quality of these straws is inadequate for other agricultural uses, and the ash produced during straw burning is returned proportionally to the farmers for nutrient recycling; this has improved the current practice of straw burning, creating 40 job opportunities and 120 indirect job opportunities. Source: Lane, T. and J. Hicks (2017). Community Engagement and Benefit Sharing in Renewable Energy Development: A Guide for Applicants to the Victorian Renewable Energy Target Auction. Department of Environment, Land, Water and Planning, Victorian Government, Melbourne.