Author /Ya-Ting Kuo, Assistant Professor, Department of Marketing & Distribution Management, Asia Eastern University of Science and Technology

Kuei-Tien Chou, Director of RSPRC

Yi-Meng Chao, Senior Assistant Researcher, RSPRC

In recent years, the assessment of climate risks has had a profound effect on the sustainability of business operations. To address this challenge, the Financial Stability Board (FSB) established the Task Force on Climate-related Financial Disclosures (TCFD) in 2015, which issued relevant guidelines in 2017. However, as climate risk issues have become more complex, the TCFD announced its dissolution in 2023, transferring its oversight responsibilities to the International Financial Reporting Standards (IFRS) Foundation. As IFRS standards begin to regulate climate-related financial disclosures, the transparency of climate risk information in corporate financial reports will become an increasingly important factor for investors and other stakeholders when evaluating a company's sustainability. This shift has led companies to improve the accuracy and comprehensiveness of their climate risk disclosures. A number of disclosure frameworks and policies have been developed by Taiwan's Financial Supervisory Commission (FSC) for reporting greenhouse gases since 2020, which reflects a broader shift from voluntary to mandatory disclosures in response to climate risks. These changes highlight the importance of climate risk management in sustainable business practices. As the environment evolves, companies must not only comply with relevant policies and regulatory requirements but also incorporate climate risks into their business strategies to maintain a competitive advantage and achieve sustainable development.

Taiwan's corporate sustainability transition differs significantly in the context of global efforts to address climate change. Some large enterprises in Taiwan are actively adopting international standards for climate-related financial disclosures, demonstrating greater transparency and responsibility. However, many small and medium-sized businesses (SMEs) are having difficulty adapting to these new regulations, with most failing to disclose climate-related financial information. Taiwanese companies have varying resources and capabilities, resulting in this disparity, which underscores the need and urgency for Taiwan's industries to undertake a comprehensive sustainability transition. For Taiwan to achieve net-zero carbon emissions by 2050, balancing the disclosure gap between companies is imperative.

The Third Corporate Climate-Related Financial Disclosure Survey

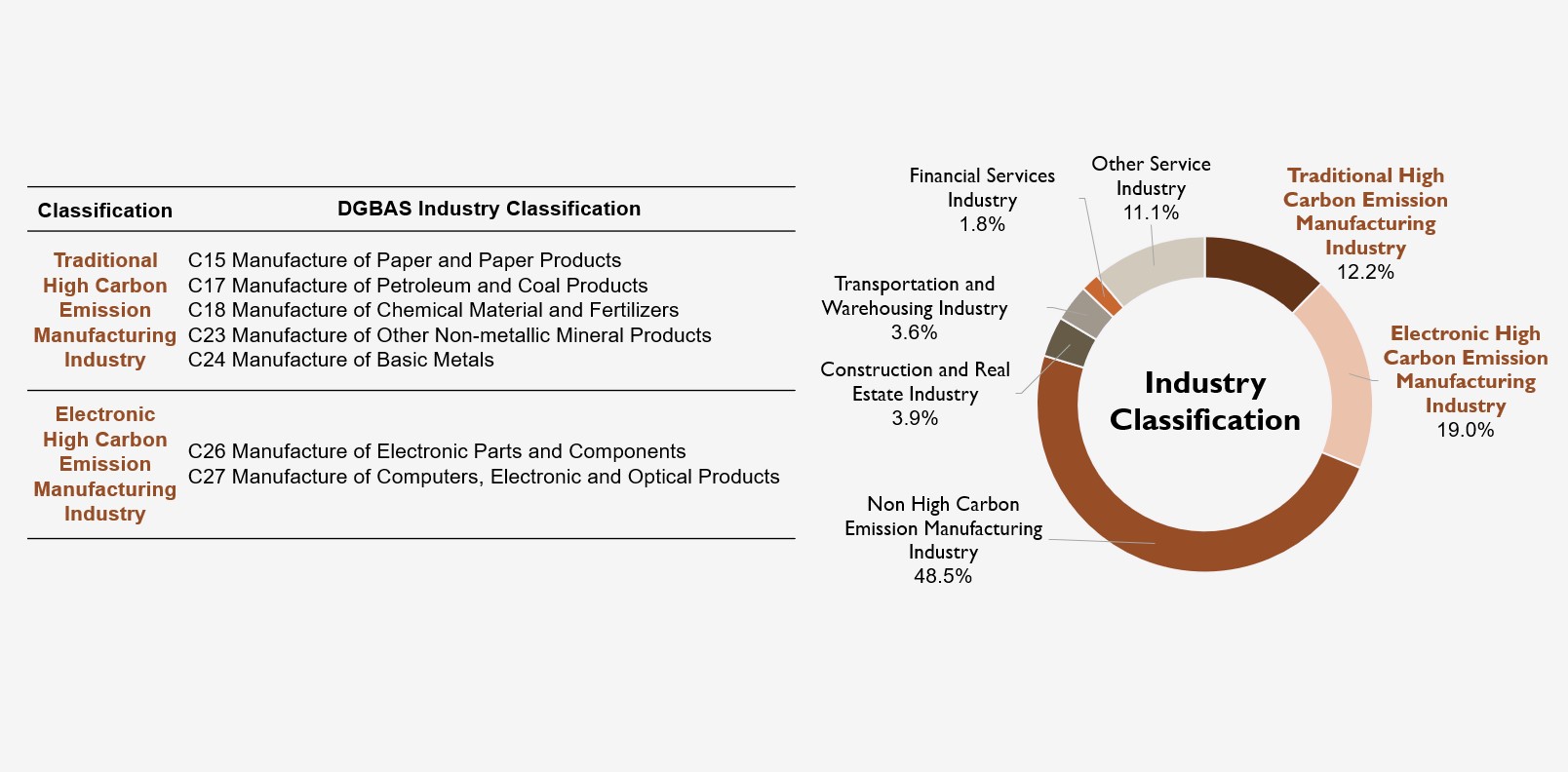

A systematic survey of climate-related financial disclosures among Taiwanese companies has been conducted by the NTU Risk Society and Policy Research Center since 2022. The third edition of this survey was conducted in 2024, which focused on assessing the corporate implementation of the four key areas outlined by the TCFD—governance, strategy, risk management, and metrics and targets. The survey also examines how corporations are implementing low-carbon transition strategies and carbon pricing. Conducted between April and May 2024, the survey employed proportionate stratified random sampling to target companies in Taiwan with annual revenues exceeding NT$100 million, covering a total of 901 companies. Nearly 80% (79.7%) of the samples comprised non-high-carbon manufacturing, traditional high-carbon manufacturing, and electronic high-carbon manufacturing industries. The remaining 20% included service industries, financial services, transportation and warehousing, construction, and real estate.

Figure 1: Industry Categories in the Third Survey Assessing Areas Outlined by the Task Force on Climate-related Financial Disclosure

Key Focus Areas of the Survey

1. Disclosure of the Four Core Elements of the Third Task Force on Climate-related Financial Disclosure Survey by Taiwanese Companies:

(a) Governance: Governance refers to how companies adjust their organizational structure to manage climate-related risks and opportunities.

(b) Strategy: Strategy refers to how companies incorporate climate change factors into their short-, medium-, and long-term strategic planning.

(c) Risk Management: Risk management refers to how companies identify and manage physical risks and transition risks related to climate change.

(d) Metrics and Targets: Metrics and targets refer to metrics and targets used by companies to measure and manage risks and opportunities related to climate change.

2. Carbon Pricing and Low-Carbon Transition Strategies:

(a) Carbon Pricing Strategy: Carbon pricing strategy evaluates how companies assess the financial impact of future carbon pricing, their internal carbon pricing mechanisms, and their response to the EU's Carbon Border Adjustment Mechanism (CBAM).

(b) Low-Carbon Transition: Low-carbon transition refers to specific actions companies are taking to promote sustainable transitions, including low-carbon product innovation, process innovation, organizational innovation, and marketing innovation.

Analysis of Sample Characteristics

The surveyed sample included a diverse range of companies, reflecting the differences and commonalities among various types of businesses in Taiwan regarding climate-related financial disclosures and carbon pricing strategies. The detailed characteristics of the sample are as follows:

1. Distribution of Company Types:

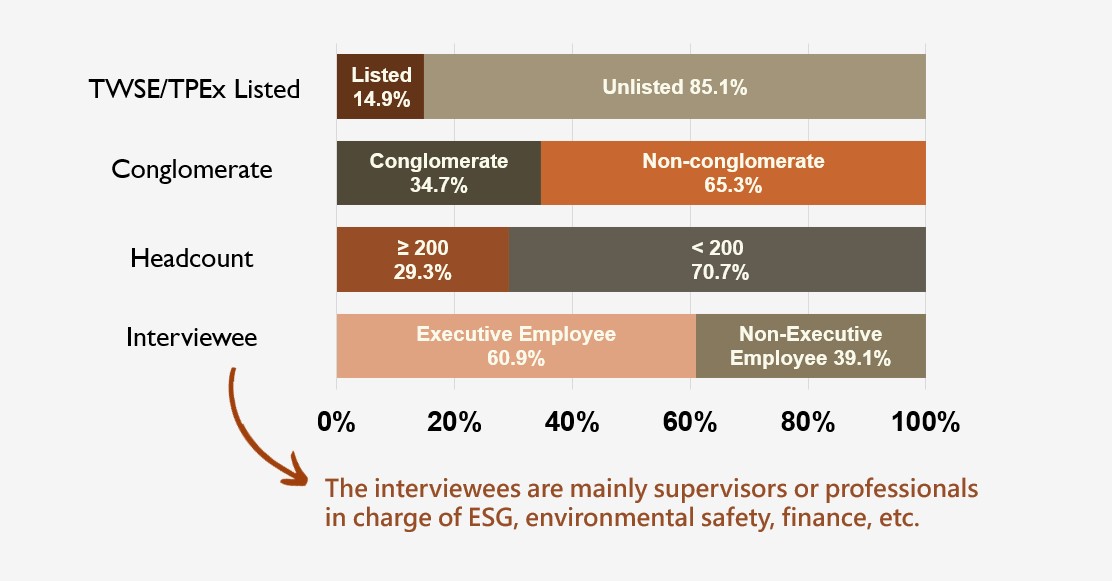

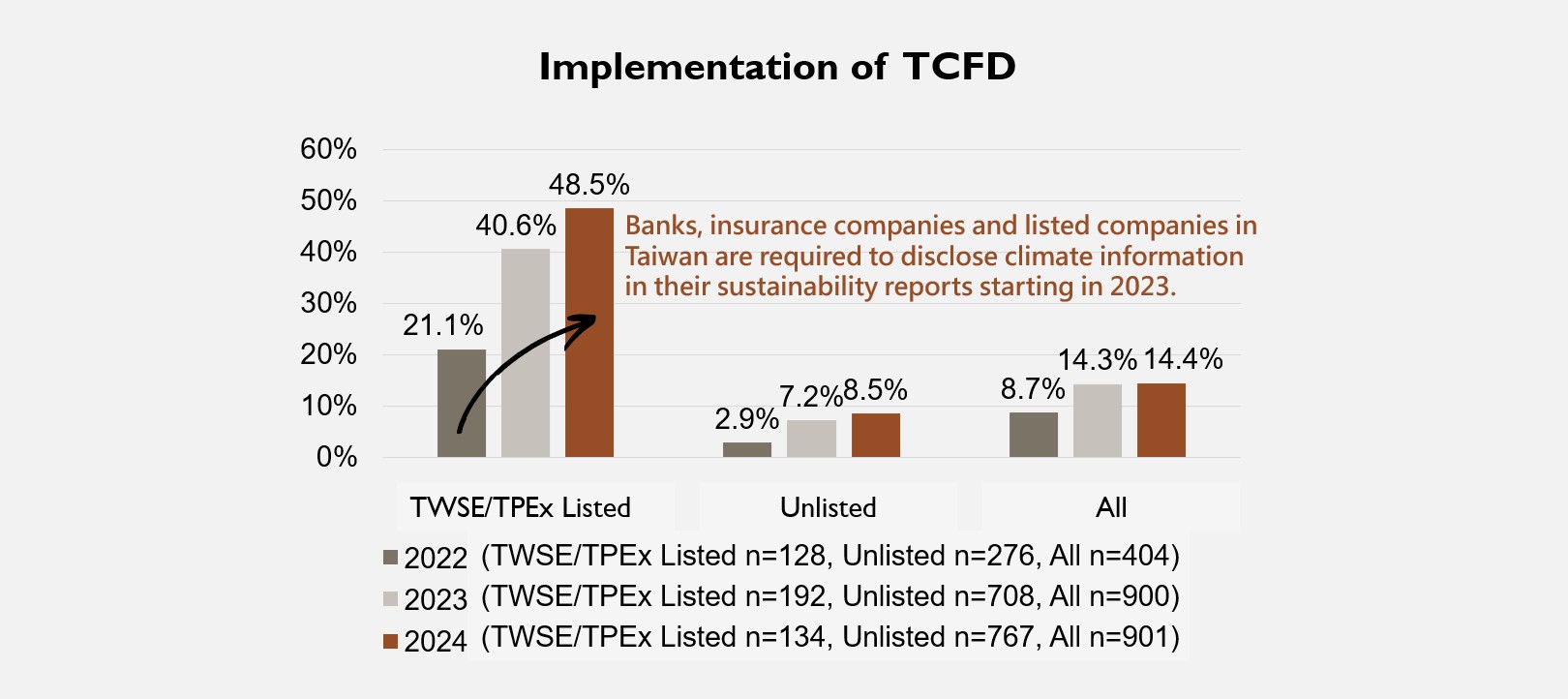

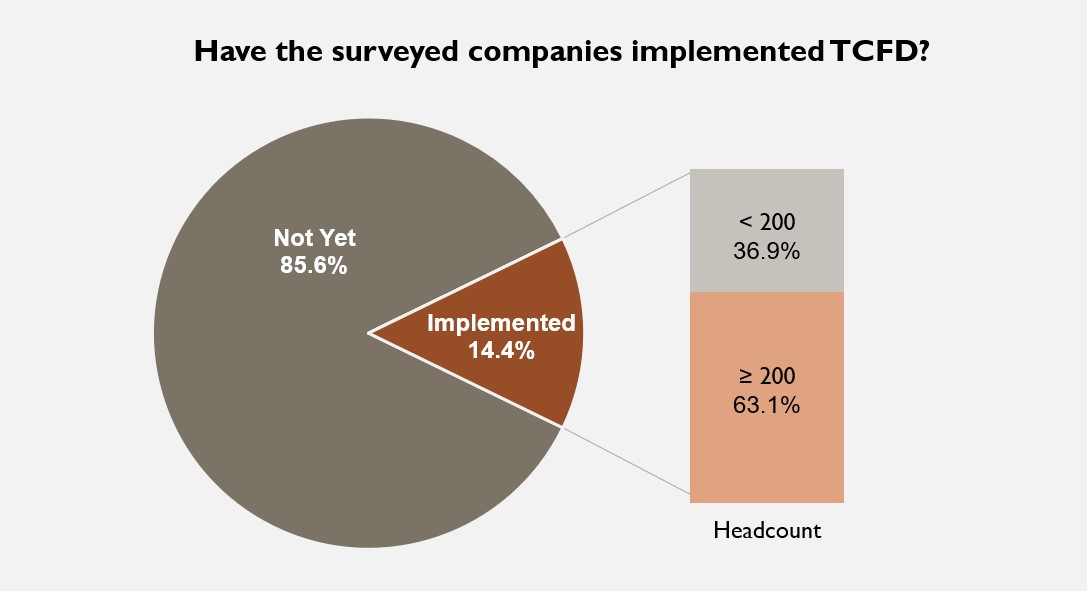

As shown in Figure 2, more than 80% of the companies surveyed are non-listed (85.1%), and over 60% are non-group companies (65.3%). Moreover, Figure 3 reveals that, compared to the previous two surveys, the share of Taiwanese companies providing climate-related financial disclosures increased from 8.7% in 2022 to 14.3% in 2023, with only a slight increase to 14.4% (130 companies) in 2024. Furthermore, Figure 4 shows that 63.1% of the 130 companies reporting climate-related financial information are large enterprises with more than 200 employees. Small and medium-sized enterprises (SMEs) face significant challenges in their ability and willingness to comply with climate-related financial disclosure requirements due to their lack of resources and governance structures compared to listed and group companies, which hampers their efforts in carbon reduction and transparency.

Figure 2: Basic Information about the Surveyed Companies (n=901)

Figure 3: Proportion of Companies Conducting the Task Force on Climate-related Financial Disclosure (TCFD) over the Years

Figure 4: Breakdown of Large Enterprises and SMEs Conducting the TCFD in the Third Survey

2. Company Size:

Approximately 30% (29.3%) of the surveyed companies have more than 200 employees, thus qualifying as large enterprises (see Figure 2). In general, large businesses have a greater resource base and organizational capability, which enables them to address the complex demands of climate risk management more effectively. The remaining 70.7% of the surveyed companies are small and medium-sized enterprises (SMEs), which may face more limitations in terms of resources and capabilities, leading to greater challenges and difficulties in climate risk management and disclosure.

3. Revenue and Market Focus:

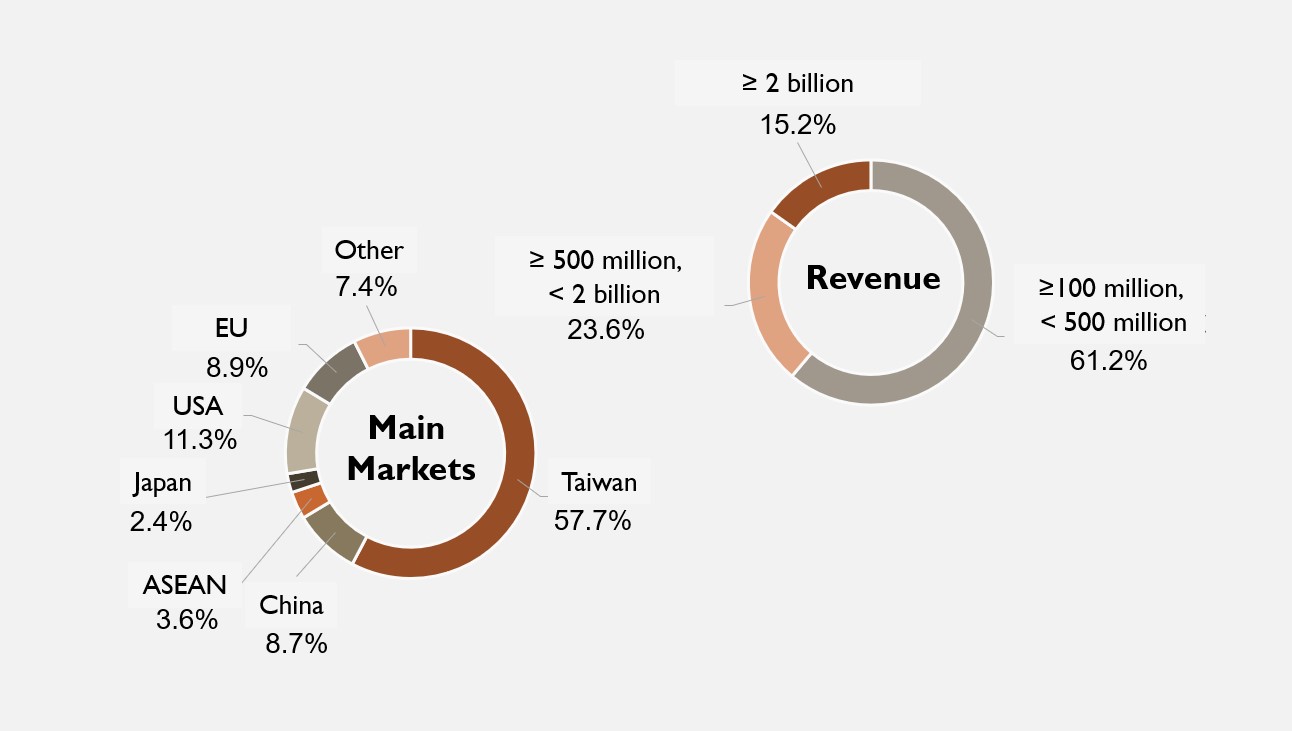

A majority (61.2%) of the surveyed companies have annual revenue in the range of NT$100 million to NT$500 million, indicating that most have a moderate business scale in an expansion phase, although not yet at the level of large enterprises (see Figure 5). Approximately 60% of the companies surveyed (57.7%) focus primarily on the Taiwanese market, suggesting they face challenges in the global marketplace. In particular, when it comes to adhering to international climate disclosure standards and responding to global climate-related policies, these companies must enhance their understanding of and capacity to comply with international standards to enhance their global competitiveness and meet international regulatory requirements.

Figure 5: Overview of the Revenue and Primary Market of the Surveyed Companies

Differences in Climate-Related Financial Disclosures Among Taiwanese Companies

There are notable differences between large enterprises in Taiwan and small and medium-sized enterprises in addressing climate change and enhancing the transparency of climate-related financial disclosures. The main differences between these enterprises are primarily due to the adoption of international standards and the level of transparency in their disclosures.

1. Proactive Approach of Large Enterprises: Many large enterprises, particularly those with international operations or listed companies, are more proactive in adopting international standards, such as the disclosure framework recommended by the TCFD. Due to their sufficient resources and more advanced governance structures, these companies are able to effectively comply with these new regulations. Specifically, large enterprises tend to exhibit the following characteristics:

(a) Responsibility and Transparency: Large enterprises are more likely to publicly and comprehensively disclose their climate risk management strategies and performance data, demonstrating a strong sense of responsibility and transparency in addressing climate change.

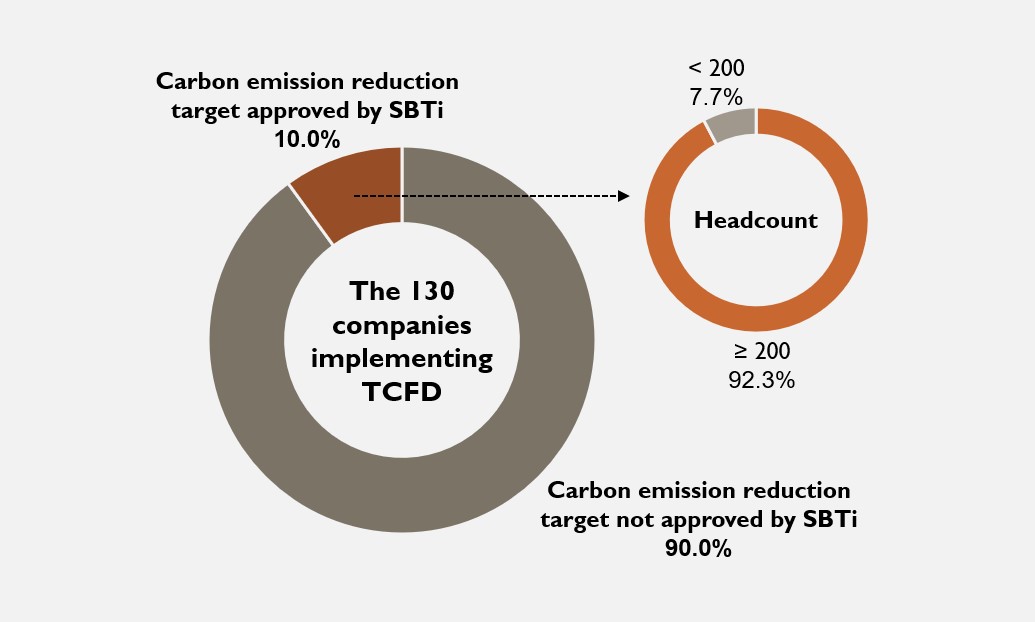

(b) Strict Adherence to International Standards: Compared to small and medium-sized enterprises, large enterprises are more likely to fully adopt international standards for disclosing climate risks and mitigation measures, which results in a higher proportion of climate-related financial disclosures. The survey data indicate that among the companies disclosing climate-related information, those with emissions reduction targets verified by the Science Based Targets initiative (SBTi) are predominantly large enterprises (92.3%; 12 companies). It is important for large enterprises to adhere strictly to international standards to maintain their credibility and competitiveness in the global market.

Figure 6: Status of the Task Force on Climate-related Financial Disclosure (TCFD)-reporting Companies with Emissions Reduction Targets Verified by the Science Based Targets initiative (SBTi)

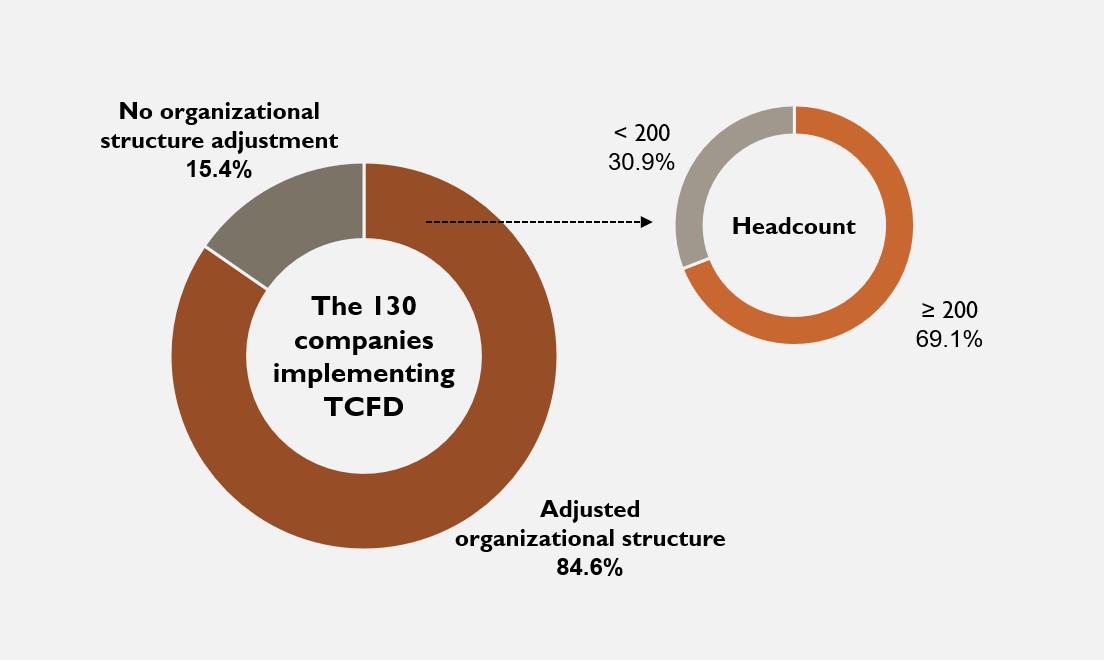

(3) Proactively Adjusting Organizational Structures: Large organizations not only comply with regulations but also account for climate change risks when formulating long-term strategies. Its corporate governance structures are designed to have dedicated climate-related roles, and its organizational frameworks can be adjusted to address potential sustainability risks posed by climate change (as shown in Figure 7).

Figure 7: Organizational Structure Adjustments of the Companies Conducting the Task Force on Climate-related Financial Disclosure (TCFD)

2. Challenges in Adaptation for Small and Medium-Sized Enterprises: In contrast, Taiwan's small and medium-sized enterprises face greater difficulties in adapting to these new climate-related financial disclosure regulations. The resources, scale, and operational capabilities of these companies often limit the progress they can make in climate disclosures and management. Specific challenges include the following:

(a) Insufficient Resources: Small and medium-sized enterprises typically lack the financial and human resources to establish and maintain detailed assessments of climate risks and opportunities. Consequently, they often lack the organizational structures and personnel necessary to comply with international standards for financial disclosures related to climate change.

(b) Lack of Transparency: Small and medium-sized enterprise disclosures of climate-related information are often incomplete or lack depth, hindering the level of transparency required by international standards.

(c) Different Priorities: Small and medium-sized enterprises tend to focus on short-term operational and survival pressures, while climate-related financial disclosures are considered a secondary, long-term issue.

Impacts of the Gap between Sustainability Transitions and Recommended Countermeasures

A sustainability gap remains in terms of climate-related financial disclosures between small and medium-sized enterprises and large enterprises, which has profound implications for market transparency and risk management. Specific support measures should be provided to small and medium-sized enterprises to narrow this gap. These measures include the following:

Policy Guidance: Governments and relevant institutions should provide small and medium-sized enterprises with more policy guidance and resources to help them gradually improve their climate disclosure capabilities. Assisting small and medium-sized enterprises in preparing for the low-carbon economy by auditing their greenhouse gas emissions and product carbon footprints, collaborating with upstream and downstream supply chains to establish greenhouse gas reduction targets, and developing sustainable energy and low-carbon innovation strategies is recommended. Through this approach, Taiwan's industries will be able to increase their international sustainability competitiveness.

Training Programs and Human Resources: Training programs related to carbon reduction certification and human resource support must be provided to small and medium-sized enterprises to assist them in understanding and implementing climate-related financial disclosure standards. This will improve their carbon reduction capabilities and ensure they meet international disclosure standards.

Collaboration and Knowledge Sharing: There is a need for collaboration between large enterprises, which have a multitude of resources and technical advantages, and small and medium-sized enterprises, which are usually more innovative and agile in their approach so that they can more effectively and efficiently address climate risks. Through this collaboration, low-carbon technologies can be promoted and the best sustainability practices can be provided. Partnerships of this kind could involve co-developing low-carbon technologies, exchanging climate data to improve climate forecasting models, or collaborating on low-carbon innovation projects, integrating processes in the upstream and downstream of low-carbon products. Taking part in this cooperation will enable Taiwan's industries to address climate change challenges more quickly and efficiently, achieve long-term sustainability goals, and work toward net-zero carbon emissions by 2050.

Conclusion

The results of this survey aim to provide Taiwanese companies with a practical understanding of climate-related financial disclosures, carbon pricing, and low-carbon transition, enabling them to operate more sustainably and effectively address climate challenges in the context of global climate change. The characteristics of the sampled companies illustrate the complex challenges Taiwanese businesses face concerning the disclosure requirements related to climate change, carbon pricing strategies, and the transition to a low-carbon economy. There are significant differences between the approaches and actions taken by large enterprises and small businesses when responding to climate risks and opportunities owing to significant differences in resources, capabilities, and market positioning. Therefore, when formulating and promoting relevant policies and strategies, these differences should be taken into consideration to ensure that Taiwanese companies take a leading role in the global net-zero transition by effectively supporting and advancing the sustainable transition across all industries and business types.

In conclusion, large corporations have demonstrated greater responsibility and commitment in promoting climate-related financial disclosures, whereas small and medium-sized enterprises face greater challenges due to their limited resources and capabilities. Government agencies and various industries will need to collaborate to close the gap between large enterprises and small and medium-sized enterprises in the sustainability transition as the gap between large enterprises and small and medium-sized enterprises becomes more evident. Ultimately, this will enable Taiwanese businesses to experience a comprehensive and sustainable transition.

Acknowledgments

The Third Corporate Climate-Related Financial Disclosure Survey was conducted by the NTU Risk Society and Policy Research Center, as part of the Industrial Climate Change Risk Assessment Research Project. The project was planned and executed by the research team, which included Kuo Ya-Ting, Chao Yi-Meng, Lin Fang-Ying, and Hsu Ling-Ru.

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

※The aforementioned may not be copied for commercial use without the center's consent, thank you.※

Are There Disparities in Sustainability Transitions? Analyzing the Extent of Climate-Related Financial Disclosures by Taiwanese Companies (Part 2)