Author /Ya-Ting Kuo, Assistant Professor, Department of Marketing & Distribution Management, Asia Eastern University of Science and Technology

Kuei-Tien Chou, Director of RSPRC

Yi-Meng Chao, Senior Assistant Researcher, RSPRC

Businesses have an increasing responsibility to address global climate change as risks intensify. Extreme weather events, such as droughts, floods, and hurricanes, pose serious threats to global economic and social stability. Companies, as key drivers of economic activity, are responsible for reducing their carbon footprints, improving energy efficiency, and advancing sustainable development. Moreover, investors and consumers are increasingly paying attention to how companies respond to climate change and provide detailed climate-related disclosures. Businesses must adapt their organizational structures, implement short-, medium-, and long-term strategic actions, identify and manage potential physical and transition risks, and establish clear objectives and metrics to effectively address climate change challenges. In the growing wave of global sustainability, these steps are essential to maintain international competitiveness. A fundamental change in the business environment must occur not only in terms of the transformation of strategies and the adoption of low-carbon technologies but also in terms of corporate governance, business strategies, and operational models. This will allow them to reduce their carbon footprint, contribute to sustainable development, and effectively manage the increasing climate risks, thereby achieving long-term sustainability.

The Third Corporate Climate-related Financial Disclosure (TCFD) Survey conducted by the NTU Risk Society and Policy Research Center can provide insight into how Taiwanese companies are responding to global decarbonization trends. Under government policies and market forces, companies have been disclosing climate-related information, implementing internal carbon pricing, and achieving tangible results in their low-carbon transition. The key points of the survey can be divided into three main aspects. First, the survey provides a comprehensive analysis of the current status of Taiwanese companies under the TCFD framework based on its four core elements: governance, strategy, risk management, and metrics and targets. Second, this study examines the state of internal carbon pricing among Taiwanese companies, examines the impact of carbon taxes on operating costs, and determines whether businesses are using internal carbon pricing to reflect their true carbon emission costs. Finally, the survey seeks to understand the practical actions of Taiwanese companies in their low-carbon transition strategies, including the adoption of renewable energy and the implementation of low-carbon innovation. These efforts benefit businesses by reducing operating costs and improving international competitiveness, particularly through meeting the consumer demand for sustainable products. The results of this study provide a clearer picture of the current state of climate-related disclosures, energy efficiency, and various forms of low-carbon innovation in Taiwan. The study provides valuable insight into Taiwan's transition to sustainable business models and provides recommendations and policy guidance to help Taiwanese companies achieve long-term sustainability.

Disclosure of the TCFD's Four Core Elements by Taiwanese Companies

1. Metrics and Targets Disclosure:

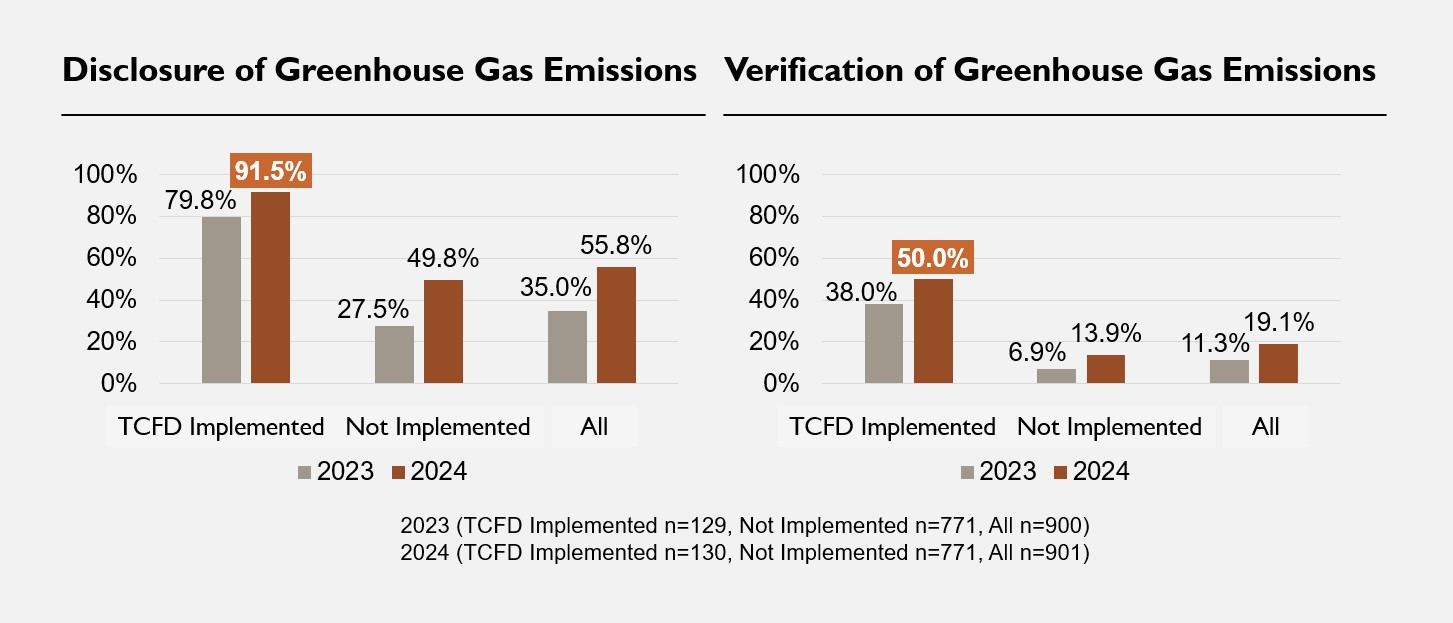

A growing number of companies are becoming aware of the importance of disclosing their greenhouse gas emissions due to the current global climate change crisis. Approximately 55.8% of the surveyed companies have publicly disclosed their greenhouse gas emissions data. A significant majority (91.5%) of those following the TCFD framework have completed greenhouse gas emissions inventories, with approximately half (50.0%) having had their data verified by a third party. This trend indicates that companies engaging in climate-related financial disclosures are more likely to emphasize climate responsibility and meet both domestic and international demands for transparency in climate-related information. In other words, the survey results demonstrated that the TCFD framework is playing a key role in promoting greater transparency in corporate climate-related disclosures.

Figure 1: Disclosure and Verification of Greenhouse Gas Emissions by Surveyed Companies

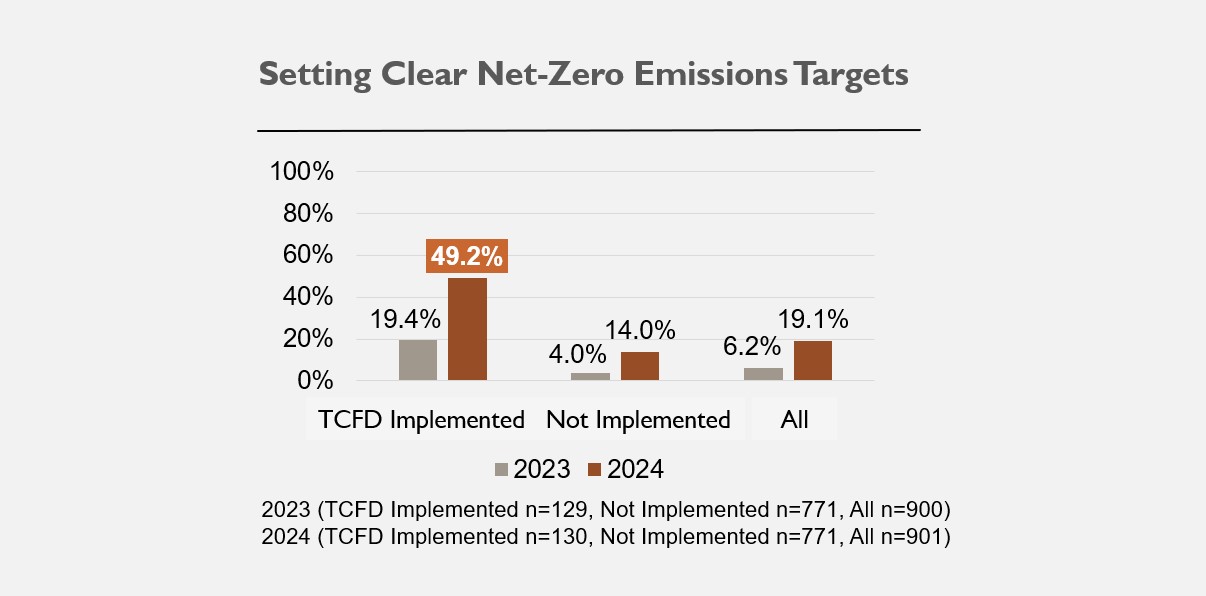

Considering the global push toward net-zero carbon emissions, setting clear net-zero emission targets is essential for companies to address climate change. It is also a key step toward tackling the climate crisis. However, the survey showed that only 19.1% of companies have established a timeline to achieve net-zero emissions. Many businesses still face significant challenges and gaps in their long-term plans to reduce greenhouse gas emissions. Companies that follow the TCFD framework are more likely to have established a net-zero target timeline than those that do not. Companies in this category are better positioned to demonstrate significant progress in reducing their carbon footprints, laying the groundwork for achieving long-term sustainability goals.

Figure 2: Status of Surveyed Companies in Setting Clear Net-Zero Emissions Targets

2. Governance Disclosure:

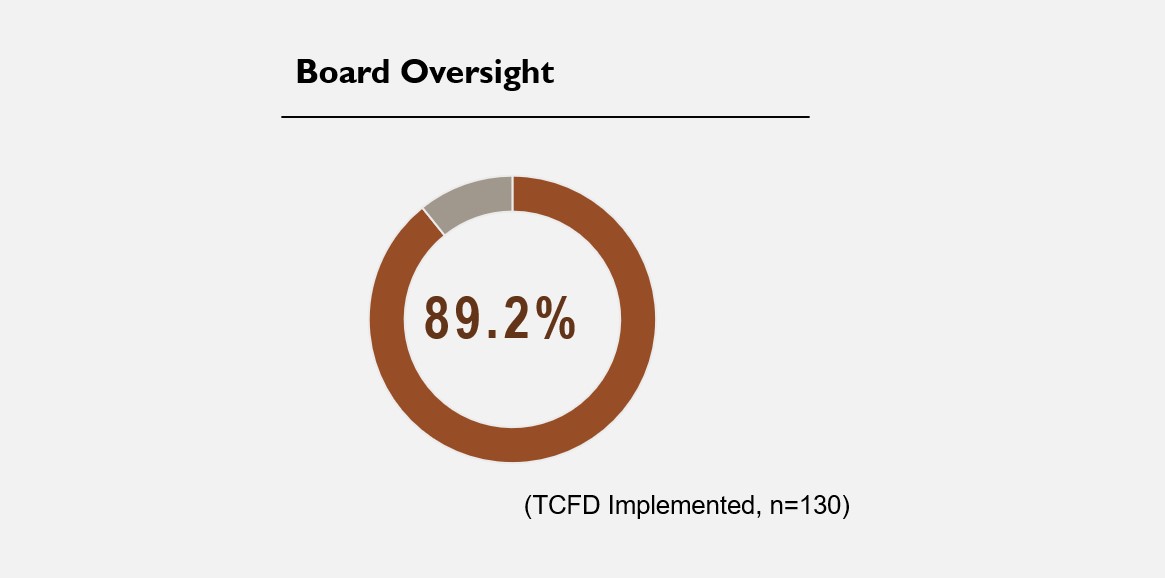

This survey examined the role of corporate boards in overseeing climate issues, climate-related training, and the connection between compensation and climate performance. The results indicated that nearly 90% (89.2%) of companies following the TCFD framework have boards that actively participate in and oversee climate-related issues. This indicates an increase in the importance these companies place on climate issues within their governance structures, contributing to a more efficient and effective response to climate-related risks.

Figure 3: Board Oversight of Climate-Related Issues in Companies Implementing the Task Force on Climate-related Financial Disclosure (TCFD)

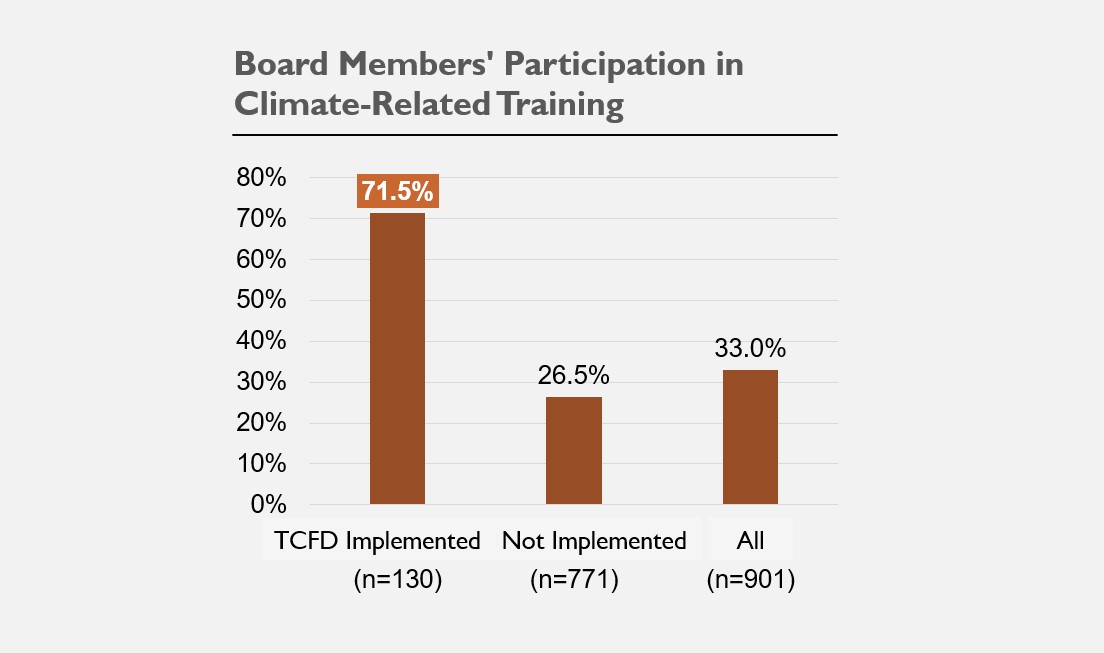

Compared to companies not implementing the TCFD, 71.5% of the board members of TCFD-compliant companies have undergone climate-related training. This highlights the importance companies place on climate knowledge and enhances the climate awareness of senior management. It is through this increased awareness that companies are able to formulate and execute more effective and forward-thinking climate strategies.

Figure 4: Status of Board Members' Participation in Climate-Related Training Among Surveyed Companies

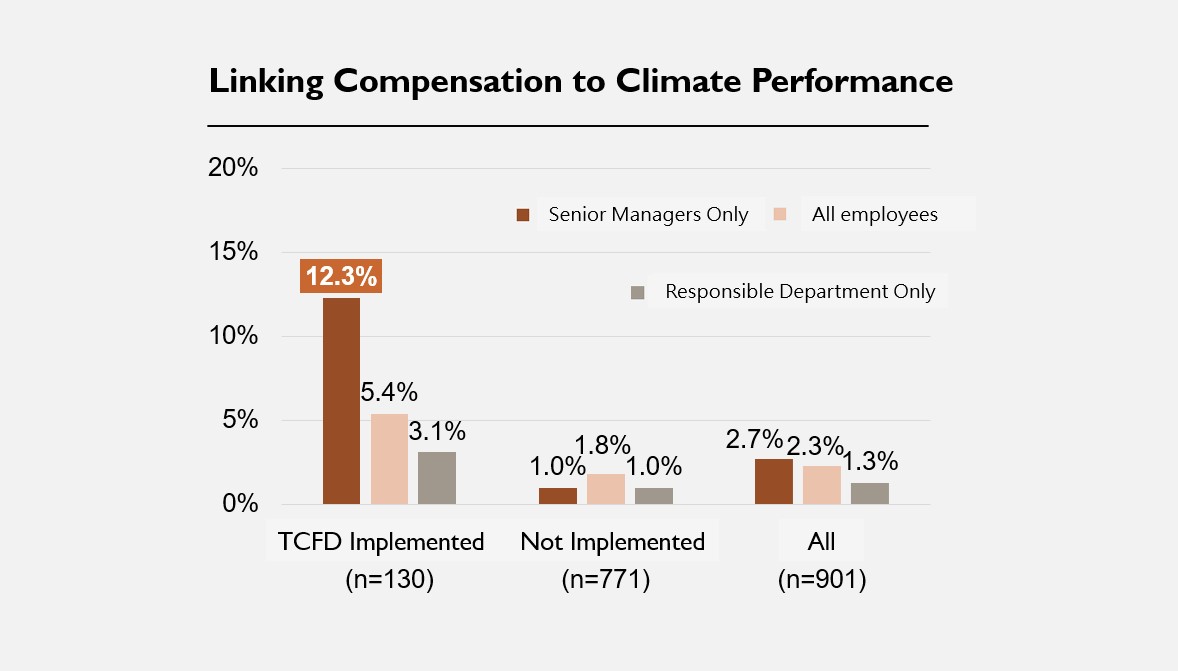

A compensation system that ties compensation to climate performance would motivate senior management to pursue and achieve climate goals, thus promoting compliance with corporate climate commitments. However, only 12.3% of the surveyed companies have linked executive compensation to climate performance. In most companies, climate performance has not been integrated into the incentive mechanisms for executive compensation, which may weaken their motivation to engage in climate governance.

Figure 5: Status of Linking Compensation to Climate Performance among Surveyed Companies

3. Strategy Disclosure:

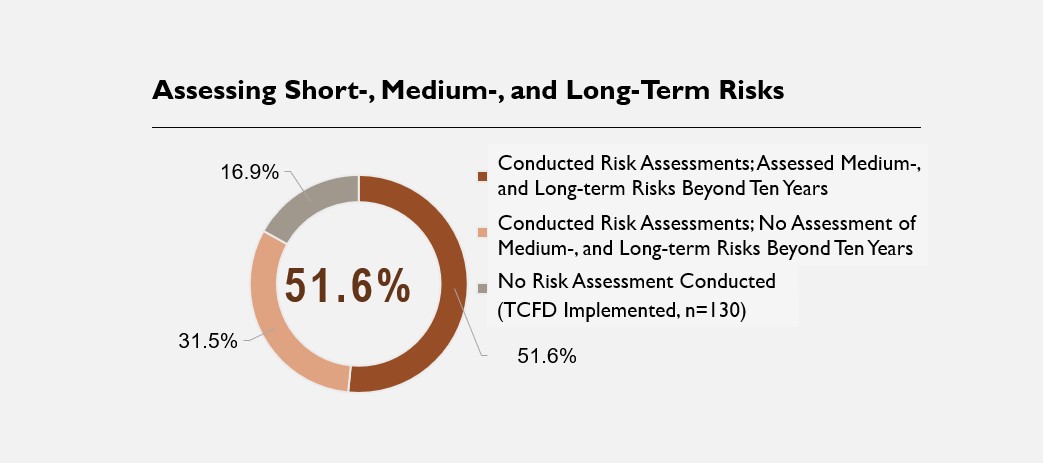

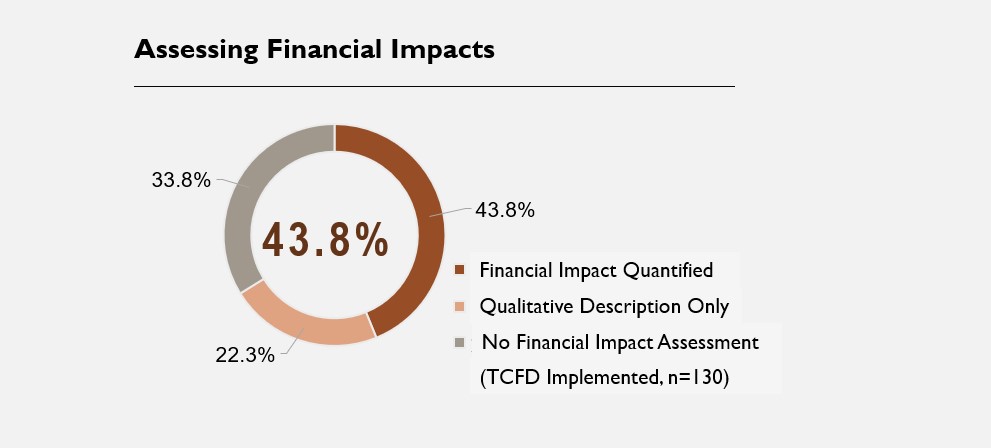

As climate change worsens, are companies adequately prepared for medium- and long-term climate risks? According to the survey, nearly half (48.4%) of the companies have not conducted risk assessments beyond ten years, and more than half (56.2%) have not quantified their financial impact. The lack of systematic strategies to address long-term climate change challenges could increase the risks to the sustainability of companies' operations in the future.

Figure 6: Status of the Task Force on Climate-related Financial Disclosure (TCFD)-implementing Companies in Assessing Short-, Medium-, and Long-Term Risks

Figure 6: Status of the Task Force on Climate-related Financial Disclosure (TCFD)-implementing Companies in Assessing Short-, Medium-, and Long-Term Risks

Figure 7: Status of the Task Force on Climate-related Financial Disclosure (TCFD)-Implementing Companies in Assessing Financial Impacts

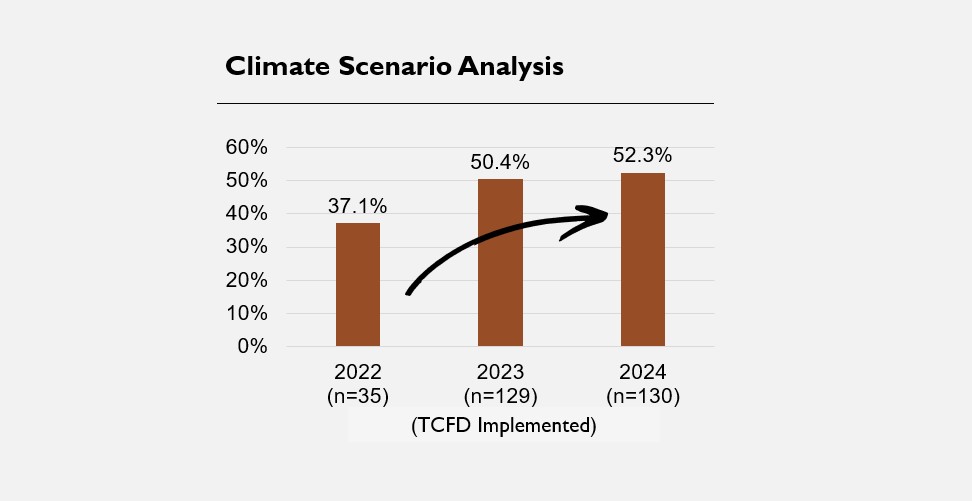

The number of companies using climate scenario analysis to assess future risks under different warming scenarios has steadily increased since 2022. Despite this, progress remains relatively slow. As of this year, just over half (52.3%) of the companies have incorporated climate scenario analysis tools into their strategic planning. The analysis of climate scenarios is an important tool that assists companies in understanding the potential risks they may encounter due to different global warming scenarios. However, this tool is still not widely adopted by Taiwanese companies.

Figure 8: Status of the Task Force on Climate-related Financial Disclosure (TCFD)-Implementing Companies Using Climate Scenario Analysis

4. Risk Management Disclosure:

Corporate risk management encompasses two core concepts: physical risks and transition risks. Physical risks, directly related to climate change, include extreme weather events and rising sea levels, which can significantly impact the assets and operations of a company. On the contrary, transition risks, involve challenges that companies may face during the transition to a low-carbon economy, such as policy changes, shifting market demands, and technological transformations.

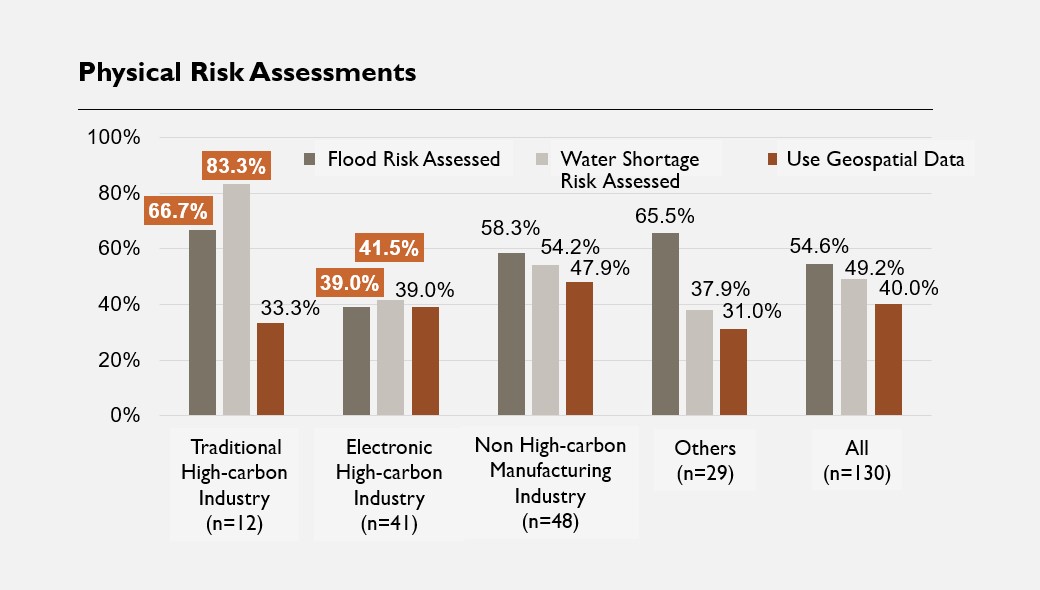

As for physical risks, the survey data indicated that traditional high-carbon industries have the highest rate of physical risk assessments. This is a reflection of their high degree of sensitivity and responsiveness to physical risks. In contrast, the electronic high-carbon manufacturing sector has a lower rate of physical risk assessments. Considering this gap, manufacturers of electronic high-carbon products need to enhance their risk management capabilities and strategies to better address physical climate risks.

Figure 9: Status of the Task Force on Climate-related Financial Disclosure (TCFD)-Implementing Companies in Conducting Physical Risk Assessments

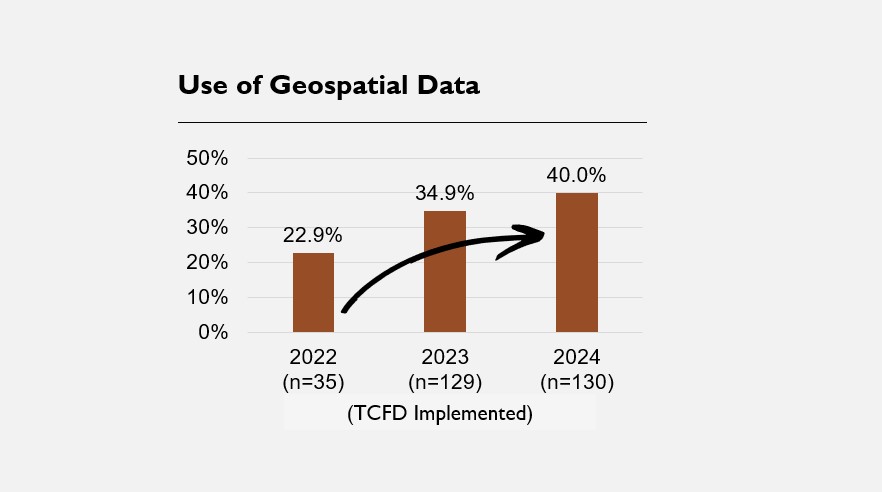

The use of geospatial data is a critical tool in risk management, which helps companies better understand and quantify the impact of physical risks on their operations. There has been a slight increase in the overall use of geospatial data by companies, but the growth rate remains limited. There is still considerable room for improvement in Taiwanese companies' adoption of advanced geospatial data technologies to identify and respond to physical risks.

Figure 10: Status of the Task Force on Climate-related Financial Disclosure (TCFD)-Implementing Companies Using Geospatial Data

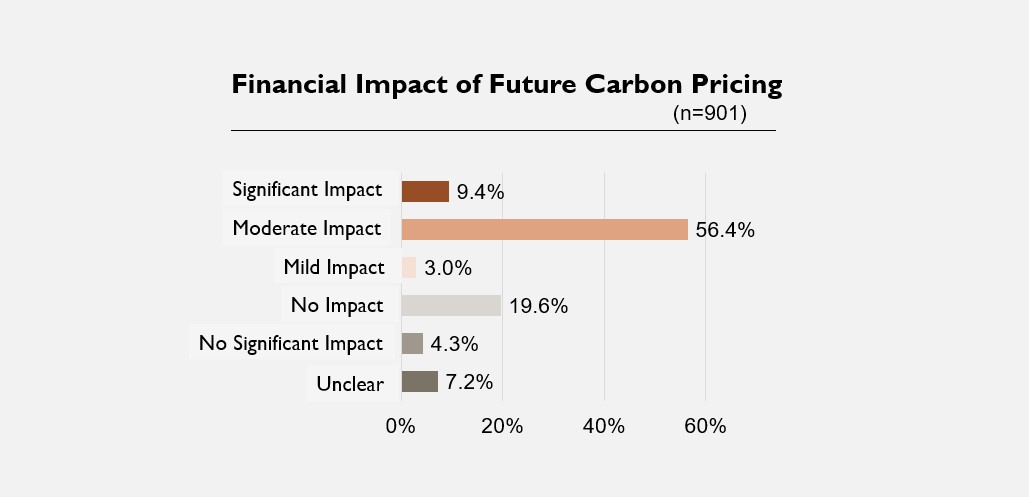

The most significant factors affecting companies' financial performance in terms of transition risks are domestic and international policies on carbon pricing regulations. Carbon pricing is a policy tool for internalizing the cost of carbon emissions, which directly impacts operational costs and competitiveness, especially in high-emission industries, where this impact is particularly pronounced. Consequently, companies are highly attentive and cautious about the financial implications of carbon pricing. The survey results indicated that approximately 65.8% of the surveyed companies believe that carbon pricing will have an impact or a significant impact on their financial situation.

Figure 11: Perceived Financial Impact of Future Carbon Pricing Among the Surveyed Companies

Challenges and Recommendations for Taiwanese Companies in Climate-Related Financial Disclosures

1. Strengthening Climate Governance and Linking Corporate Carbon Reduction Performance

Companies have a responsibility to enhance their board's oversight of climate issues to meet the increasingly severe challenges posed by climate change. Businesses should provide climate-related training for their board members and ensure that they participate actively in climate-related decision-making processes. This enables management to consider climate-related risks and opportunities appropriately and address them promptly. In addition to regular discussing and evaluating climate issues, the board should also play a key role in developing and monitoring corporate climate strategies and action plans. In the face of increasingly stringent global climate policies, such practices will enable Taiwanese firms to remain competitive and promote long-term sustainability.

Companies should incorporate climate performance into their compensation evaluation mechanisms to effectively respond to climate change and drive internal corporate climate action. By implementing this measure, management can be directly motivated to commit to climate strategies and work toward achieving them, thus setting a positive example that will encourage all employees to actively participate in climate action. A top–down climate governance culture can be established by linking climate performance to compensation, ensuring that all employees contribute to the achievement of corporate sustainability objectives. This approach can boost the company's long-term competitiveness and climate resilience and enhance its reputation in the marketplace.

2. Enhancing Medium- and Long-Term Risk Assessments and Increasing the Use of Climate Scenario Analysis

Companies in Taiwan are advised to conduct comprehensive evaluations and quantifications of climate risks over the next decade or more to strengthen their assessments of medium- and long-term climate risks. In particular, companies should analyze the potential effects of climate change on their financial health, including long-term effects on assets, supply chains, revenues, and costs. Developing such assessments will assist businesses in identifying and managing risks in advance, as well as in developing more resilient and forward-looking responses.

Thus, Taiwanese companies are recommended to adopt climate scenario analysis tools for different global warming scenarios. Using climate scenario analysis, companies can forecast and adapt to various possible climate change conditions. Businesses can use it to simulate operational environments under a variety of global warming scenarios, which will help them anticipate future challenges, probabilities, and impacts. The use of multiple scenario analyses allows companies to gain a better understanding of their risk exposure under various scenarios of global warming. By doing so, they will not only be able to handle extreme climate events with greater flexibility and resilience but also be better positioned to maintain their competitive edge and seize new opportunities for sustainable development as global climate policies tighten.

3. Promoting Cross-Industry Risk Management Knowledge Sharing and Establishing Clear Carbon Reduction Targets

In light of the growing impact of climate change on business operations, it has become increasingly important to facilitate the sharing of risk management experiences across industries. The traditional high-carbon industries, such as the steel and chemical sectors, have developed significant experience and best practices for managing climate-related physical risks. The majority of these industries possess strong risk awareness and response capabilities, which allow them to effectively identify, assess, and manage physical risks related to climate change, such as supply chain disruptions caused by extreme weather events.

Comparatively, the high-carbon electronic manufacturing sector has less experience in addressing physical risks related to climate change. A key approach to enhancing the risk assessment capabilities of the electronic manufacturing sector is to encourage these industries to learn from traditional high-carbon sectors and draw from their successful risk management strategies. Cross-industry knowledge sharing and learning can help electronic high-carbon manufacturers better identify and respond to climate risks.

The government should organize cross-industry professional forums and host workshops and seminars on climate change to foster dialogue and cooperation among various industries. Industries can also collaborate on joint training programs to explore the latest risk management technologies and share insights on interpreting geospatial data for various operational scenarios. Taiwanese companies can enhance their risk management and climate resilience capabilities by participating in these knowledge-sharing initiatives, which will make them more competitive and resilient in the face of the increasing complexity of climate change challenges. This can not only support the sustainable development of individual companies but can also strengthen the adaptability and resilience of entire industry systems in responding to climate change.

A long-term transition to a low-carbon economy requires Taiwanese companies to set specific and measurable targets for reducing their carbon emissions. Businesses should set scientifically based carbon reduction goals that encompass short-, medium-, and long-term reduction plans, with clear scientific benchmarks and indicators to measure progress. Providing regular assessments and reports on carbon reduction progress will not only improve internal management and strategy adjustments but also enhance transparency and accountability, thereby increasing stakeholders' trust and support.

Conclusion

Taiwanese companies must adapt to the challenges of climate change by making adjustments and improving management in the four key areas of the TCFD framework: governance, strategy, risk management, and metrics and targets. By strengthening climate governance, refining strategic planning, enhancing risk management capabilities, and setting clear carbon reduction targets, businesses will be better equipped to respond to the risks and opportunities presented by climate change. This will enhance the competitiveness of the international climate change industry and promote sustainable corporate transitions.

Acknowledgments

The Third Corporate Climate-Related Financial Disclosure Survey was conducted by the NTU Risk Society and Policy Research Center, as part of the Industrial Climate Change Risk Assessment Research Project. The project was planned and executed by the research team, which included Kuo Ya-Ting, Chao Yi-Meng, Lin Fang-Ying, and Hsu Ling-Ju.

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

※The aforementioned may not be copied for commercial use without the center's consent, thank you.※

Are There Disparities in Sustainability Transitions? Analyzing the Extent of Climate-Related Financial Disclosures by Taiwanese Companies (Part 1)