Author / Yi-Meng Chao, Project Specialist; Ya-Ting Kuo, Postdoctoral Fellow

The first part of the article analyzed the driving force for companies to make TCFD-aligned disclosures, and their climate change perception and policy perception in face of climate change. The second part will first explain the status of disclosures and the degree of implementation of the companies that make TCFD-aligned disclosures in terms of governance, strategies, risk management, and metrics and targets, and then present the design of TCFD assessment criteria. The companies that have never made TCFD-aligned disclosures were surveyed on their willingness to make TCFD-aligned disclosures in the future. Thus, the researchers of this study hope to obtain a clear picture of Taiwanese companies' TCFD-aligned disclosures and their attitude toward making TCFD-aligned disclosures in the future.

The degree of TCFD implementation varies between companies

According to the survey results, only 35 of the 404 surveyed companies make TCFD-aligned disclosures (accounting for 8.7%), indicating that the Taiwanese companies that make TCFD-aligned disclosures are still a minority. This indicates that although people are generally familiar with the impact of extreme climate on the environment and human beings, most Taiwanese companies are still hesitant about analyzing and taking action against climate-related financial impacts.

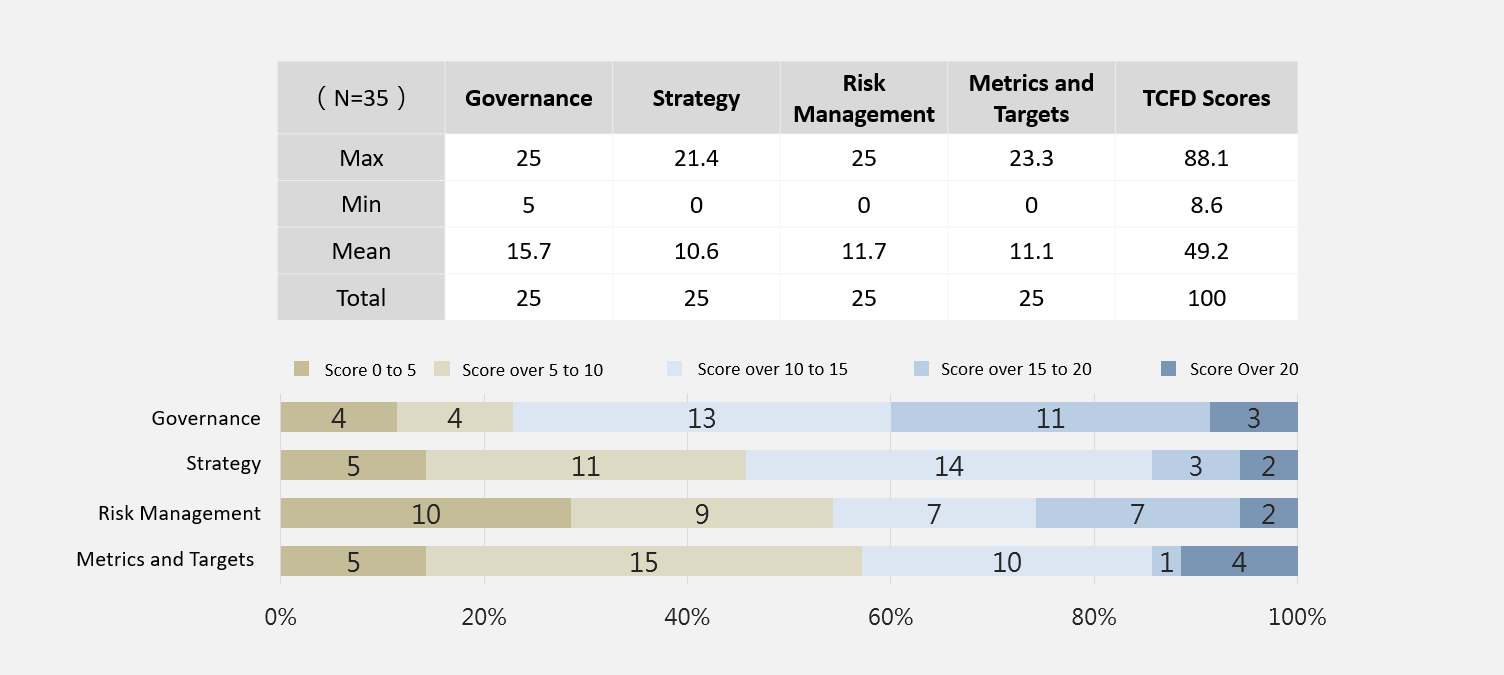

Therefore, this study further investigated the status of disclosures and the degree of implementation of the companies that make TCFD-aligned disclosures in terms of governance, strategies, risk management, and metrics and targets. A TCFD assessment based on the survey results was conducted, and the assessment criteria of each item are shown in Table 1. The TCFD assessment criteria are divided into four dimensions. First, the governance dimension has 3 items, which are mainly used to reveal the roles of the board of directors and management team in supervision and implementation, as well as their frequency of holding a meeting when dealing with TCFD-related issues. Thus, we can learn about the management strategies and actions of companies in the supervision of climate-related issues. Second, the strategy dimension has 9 items, which are mainly used to reveal whether the companies have disclosed their definitions of short-, medium-, and long-terms, evaluated financial impacts, used scenario analysis, used renewable energy, and been engaged in low-carbon innovation when evaluating the impact of climate change. These items help with understanding the climate resilience of a business or organization in the face of future impact caused by climate risks. Third, there are 3 items in the risk management dimension, which mainly involves asking companies about the types of physical and transition risks disclosed by them and the kinds of quantitative assessment methods they use. This dimension helps with assessing if the companies have established a system for the evaluation and management of climate risks to strengthen operational resilience.

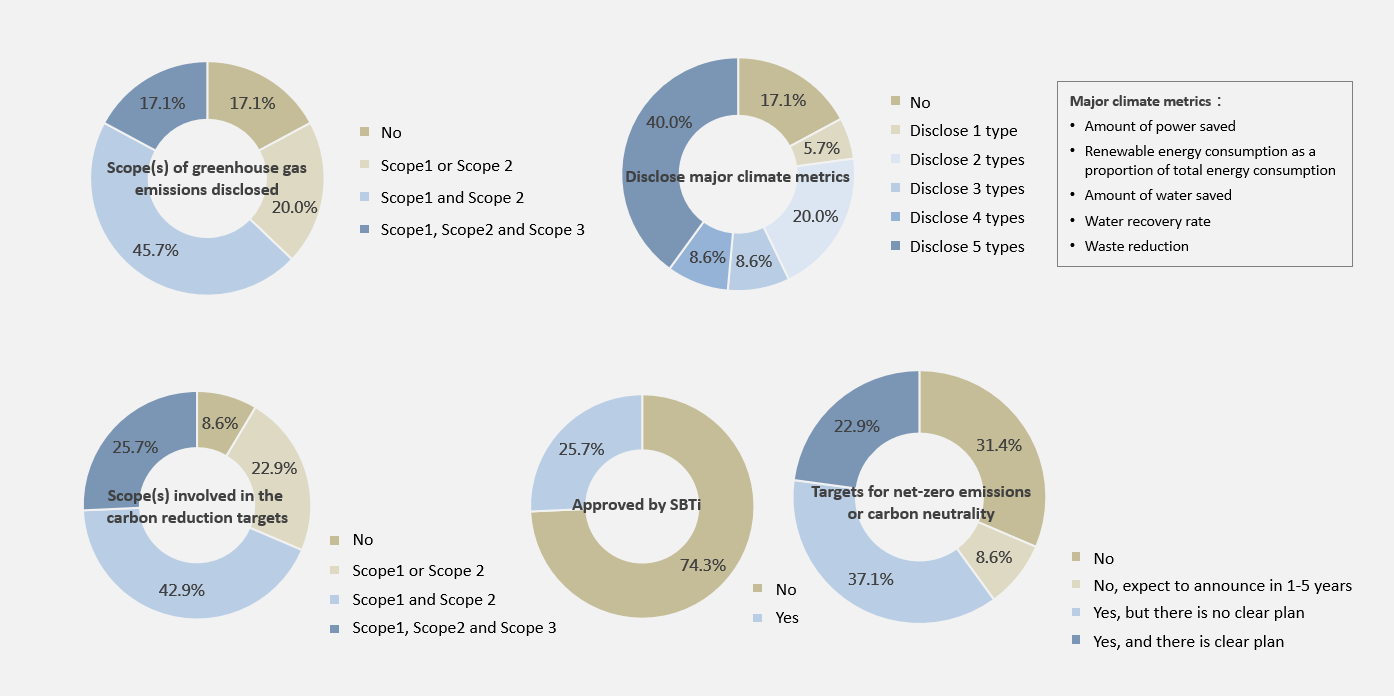

Lastly, the metrics and targets dimension has 9 items, which are mainly used to understand the management of carbon reduction targets by the companies themselves and their supply chains. This part reveals the companies' goals and their determination to reduce various types of greenhouse gas emissions in the face of climate change by investigating the scopes of greenhouse gas emissions that the companies and their supply chains disclosed, whether they disclosed other major climate metrics (such as power consumption, water consumption, renewable energy consumption as a proportion of total energy consumption, and waste reduction), whether they have a carbon reduction target, whether the carbon reduction targets have been reviewed and approved by SBTi, and whether they have promised a net-zero emissions or carbon neutrality target.

As the four major TCFD dimensions have different numbers of items, to prevent a single dimension from affecting the total score disproportionately, a weighted score design has been used to calculate the scores of the dimensions, so that the highest score of each dimension is 25, and the total score is 100.

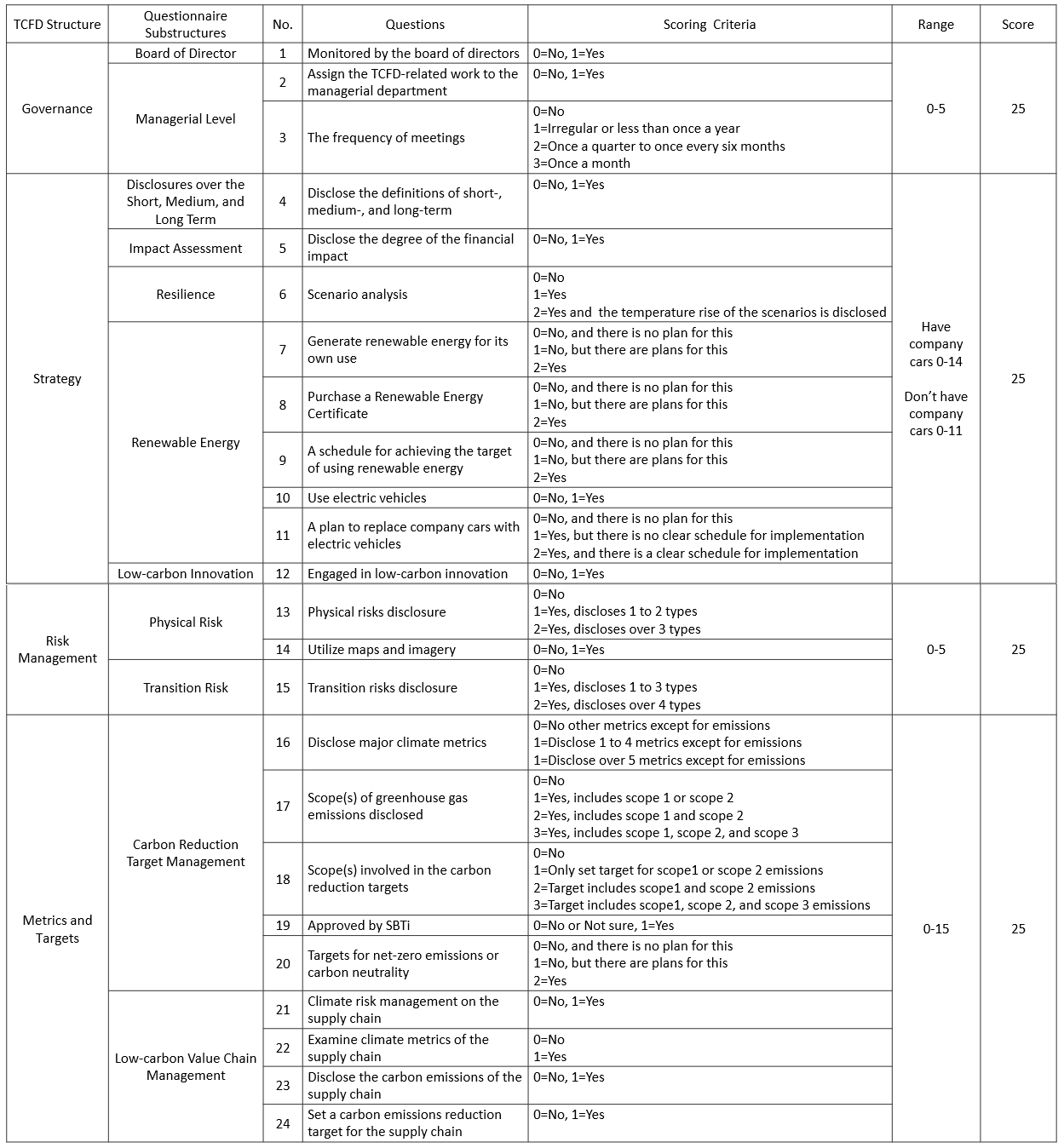

Table 1 TCFD assessment criteria

The assessment of the governance dimension shows that supervision by the board of directors is most common

The survey results of the governance dimension show that 68.6% of the companies monitor their TCFD-related issues through their board of directors, and 80.0% assign TCFD-related issues to a specific management unit(s) or project personnel. Moreover, 60.0% of the companies hold meetings regularly, while 14.3% hold meetings more than once a month (as shown in Figure 1). This indicates that the vast majority of the companies have their TCFD-related issues monitored by the board of directors, and assign the issues of climate-related risks to a specific management unit(s), while 60.0% of the companies hold relevant meetings regularly as climate-related issues are taken seriously.

Figure 1 Survey results of the governance dimension

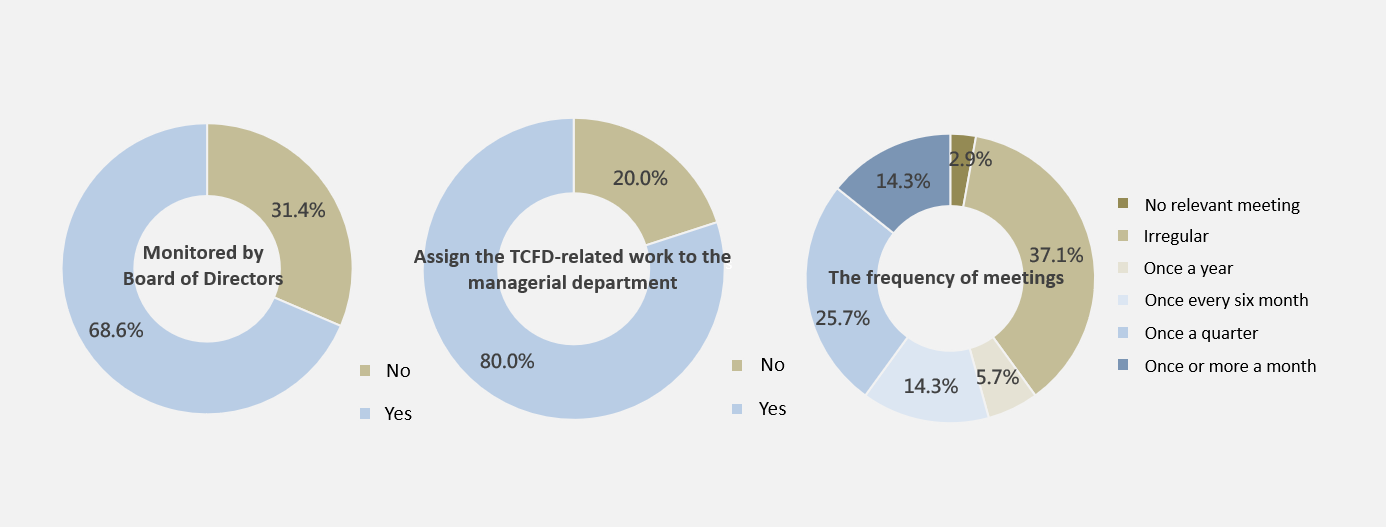

The strategy dimension reveals that most companies lack a target for renewable energy use

Regarding the strategy dimension, first, the survey reveals that 34.3% of the companies do not disclose the definitions of short-, medium-, and long-terms; 51.4% do not disclose the degree of financial impact; and 62.9% do not utilize scenario analysis (Figure 2). Additionally, this survey asked the reason for the companies not disclosing the details regarding the abovementioned three aspects. There are two major reasons. The first is that they had "just started to make TCFD-aligned disclosures" and the company was still in the period of introduction, so they are yet to deal with the details; some stated that they had just enlisted the help of a consultancy to assess the related issues. The second reason is that they lacked a clear understanding of the assessment methods, mainly owing to the lack of professionals and the inability to deal with the issue independently. In addition, some of the companies believed that the relationship between the physical and transition risks brought about by climate change and the financial impacts was not close or significant, or believed that such financial impacts were small, so they had never disclosed the degree of climate-related financial impact. Regarding not using scenario analysis, the companies cited the reasons of insufficient information, lack of tools, and difficulty in data collection.

Furthermore, the survey on the "energy transition" of companies includes examining their use of renewable energy and electric vehicles, as well as their targets and plans for relevant issues. The survey results on renewable energy show that 40% of the companies generate renewable energy for their own use, but only 14.3% have purchased a Renewable Energy Certificate. In addition, 28.6% of the companies have set a renewable energy target, while in contrast, 71.4% of the enterprises have not yet set a target for renewable energy. Regarding the use of electric vehicles, if the company did not own company cars, they were not included in the scoring. Among the companies with company cars, 78.1% have not yet used electric vehicles, while 84.4% are yet to set a schedule for the target of using electric vehicles in the future.

Lastly, regarding low-carbon innovation, the survey found that 65.7% of the companies are engaged in low-carbon innovation in terms of products, processes, organization, and marketing. As most of the respondents of this survey are B2B manufacturing companies, fewer companies are engaged in marketing innovation (34.8%) than in innovations in products (60.9%), processes (78.3%), and organization (73.9%) (Figure 2).

Overall, the strategy dimension of the survey shows that in the face of the impact of future climate risks, the surveyed companies have not planned for short-, medium- and long-term climate resilience and lack corresponding plans for renewable energy and electric vehicles, as they lack a clear understanding of the risk assessment methods and personnel with relevant skills, or because they are in the early stage of making disclosures. However, as most of the companies have awareness about building a low-carbon environment in the future, they are actively engaged in low-carbon innovation.

Figure 2 Survey results of the strategy dimension

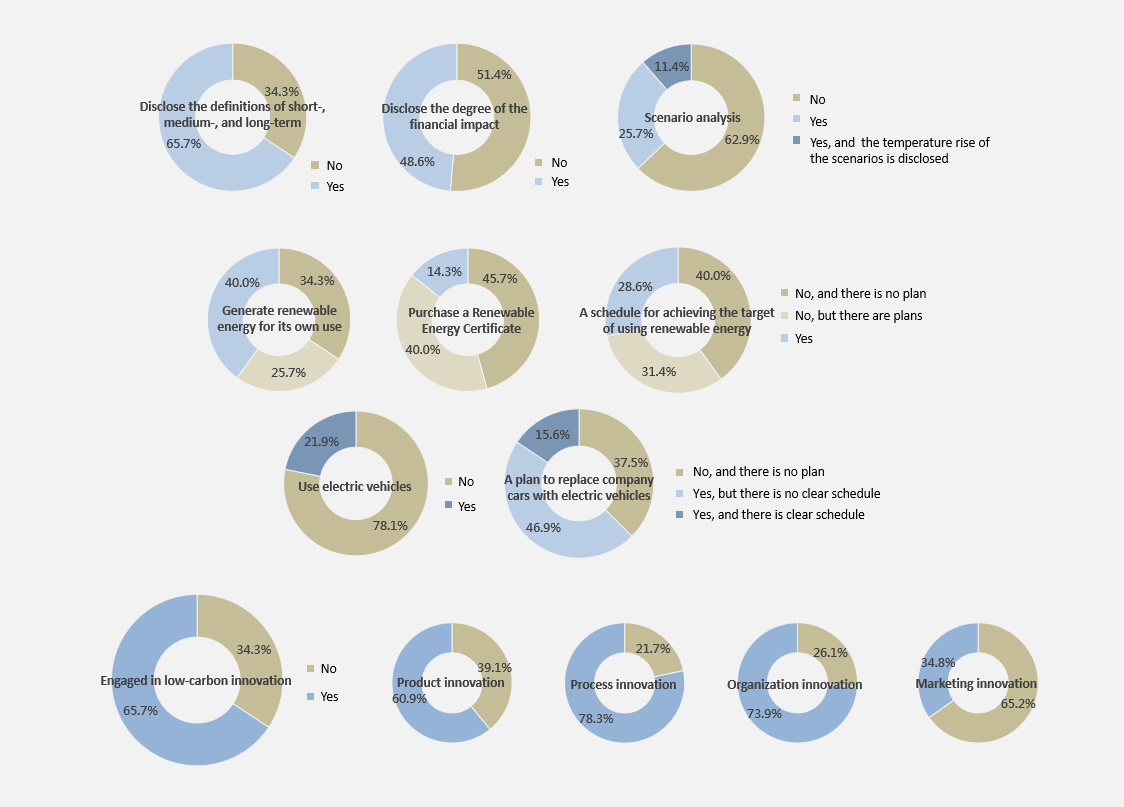

Quantitative assessment of the risk management dimension needs to be strengthened

The risk management dimension of this survey aims to understand the disclosure status of the companies in terms of transition risks and physical risks, and the use of maps and imagery during the physical risk assessments. The results show that the four types of transition risks, namely, (1) policies and regulations, (2) technology, (3) market, and (4) reputation are disclosed by 34.3% of the companies, while 37.1% do not disclose any transition risks. Physical risks such as flooding, scarcity of water, temperature rise, and strong wind are not disclosed by 22.9% of the companies. Although 77.1% of the companies disclose physical risks, only 22.9% of them use maps and imagery, showing that companies' quantitative assessment of climate risks is below par (Figure 3). Challenges and Opportunities faced by the Climate Change Risk Assessment for Business, an article published in the latest issue of the RSPRC newsletter, introduces the study on Climate Change Risk Assessment for Business (CCRAB) led by Academia Sinica, in which our center participated. The project will establish the tools and a platform for climate change risk assessment for businesses, hoping to help companies quantify their own climate change risks.

Figure 3 Survey results of the risk management dimension

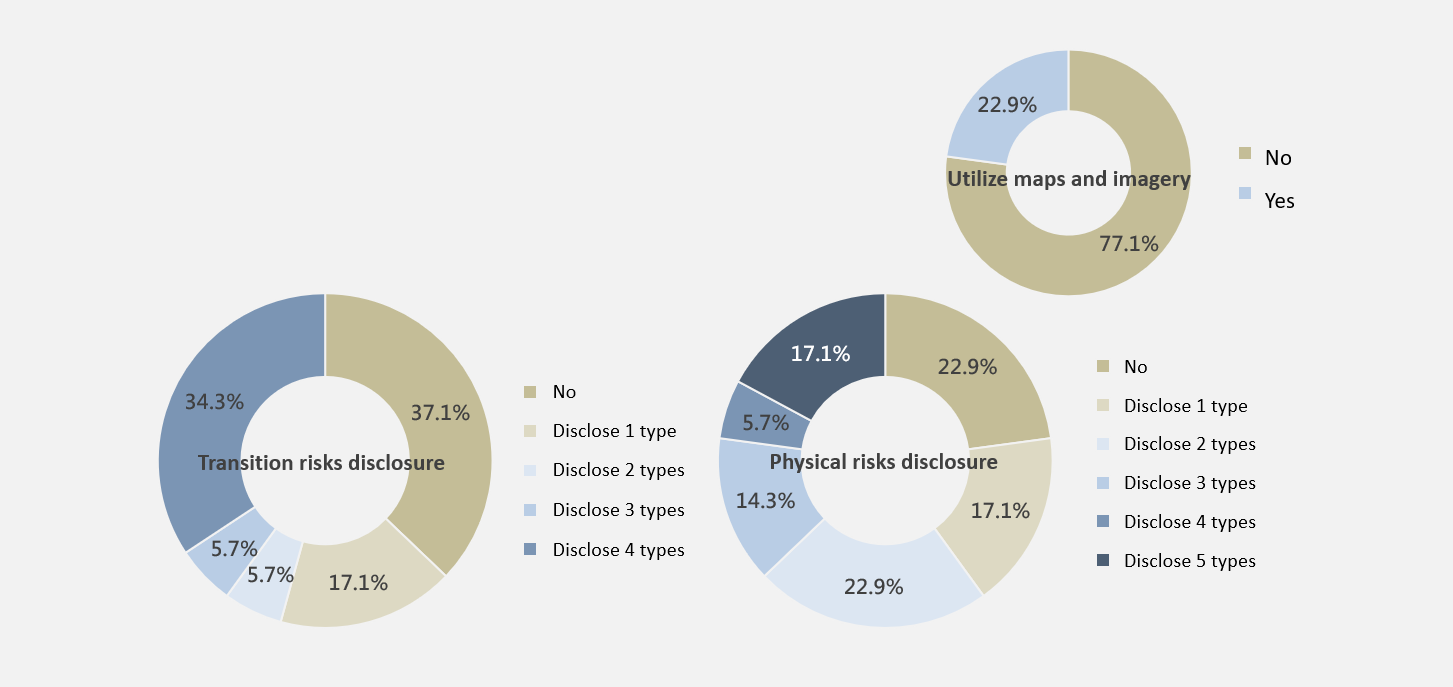

The metrics and targets dimension shows that companies mainly focus on their own inventory

The metrics and targets dimension, specifically, the "metrics" part, shows that 17.1% of the companies do not disclose their greenhouse gas emissions, 20.0% only disclose the emissions of Scope 1 or 2, nearly half (45.7%) of the companies disclose the emissions of Scopes 1 and 2, accounting for the largest number, and only 17.1% disclose the emissions of Scope 3. Apart from disclosing greenhouse gas emissions, 82.9% of the companies disclose the amount of power saved, renewable energy consumption as a proportion of total energy consumption, amount of water saved, water recovery rate, waste reduction, and other major climate metrics.

In addition, the results of the "target" part show that only 8.6% of the companies have not set a target for greenhouse gas reduction, while 42.9% have set a target for the reduction of Scopes 1 and 2 greenhouse gases, accounting for the largest number. Apart from this, 25.7% of the companies declared that their carbon reduction targets had been reviewed and approved by SBTi, while 22.9% stated that they had set a clear schedule for achieving the target of net-zero emissions or carbon neutrality (Figure 4).

Figure 4 Survey results of the metrics and targets dimension (companies' own operation)

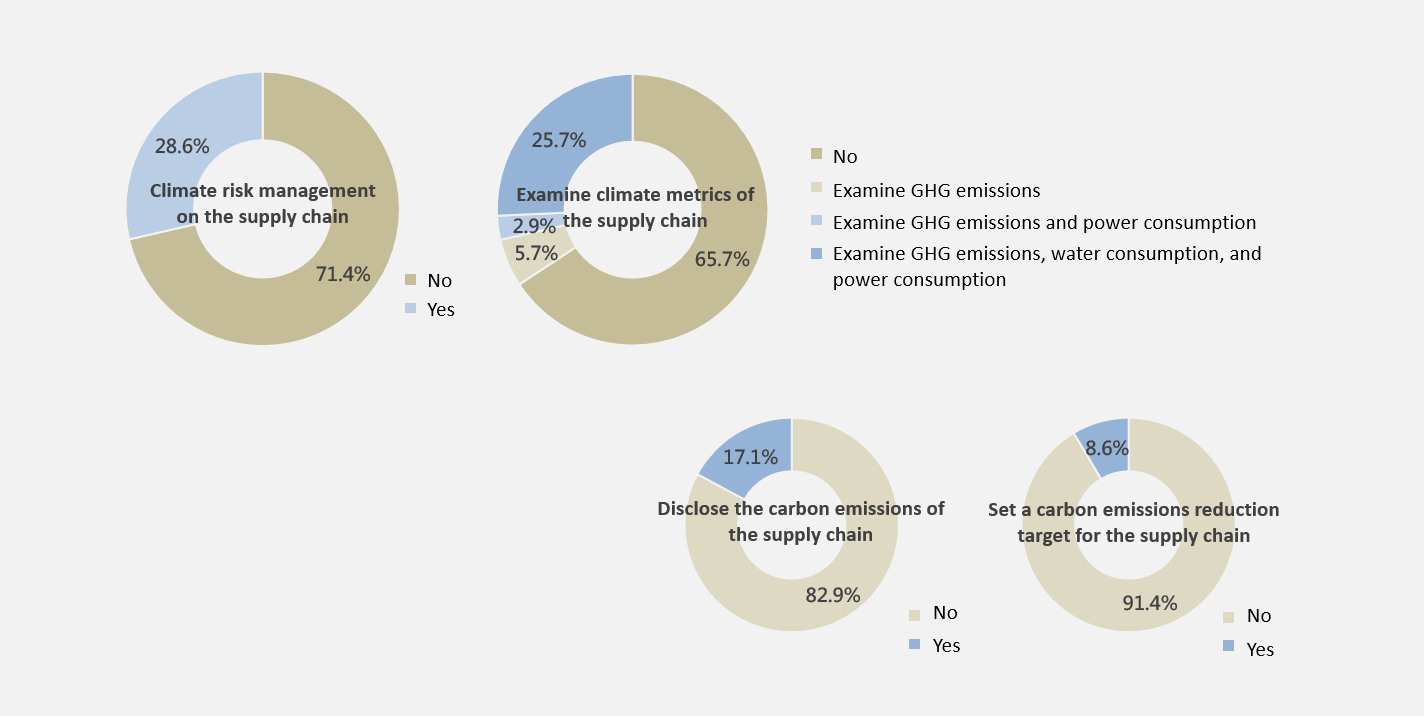

In addition to the companies' own operation, the metrics and targets dimension also investigates whether these companies have conducted climate-related metric inventories of their supply chains, or set targets for the supply chains (as shown in Figure 5). The results show that 71.4% of the companies do not include their upstream and downstream supply chain partners in their climate risk management, 65.7% have not conducted inventories of their supply chains on climate-related metrics such as greenhouse gas emissions, and only 25.7% conduct inventories of their supply chains on metrics such as greenhouse gas emissions, power consumption, and water consumption. In addition, 17.1% of the companies disclose the emissions of their supply chains; 8.6% of the companies stated that they had set a greenhouse gas emissions reduction target for their supply chains.

In conclusion, the metrics and targets dimension shows that less than 10% of the companies have not set a greenhouse gas emissions reduction target, and among the companies that have set a target, less than 30% have had their targets approved by the Science Based Target (SBT) standard. Moreover, nearly 80% of the companies have not set a clear schedule for achieving the target of net-zero emissions or carbon neutrality. This shows that most companies mainly focus on their own inventory on climate-related metrics, and it is rare for them to conduct inventories of their upstream and downstream supply chain partners on emissions and emissions reduction metrics. Therefore, the prospects of the actual emission reduction actions of the survey companies are worrisome. Apart from their own efforts toward emissions reduction, they should also take the initiative to cooperate with their upstream and downstream supply chain partners to work on their emissions reduction.

Figure 5 Survey results of the metrics and targets dimension (low-carbon supply chain management)

The average score of the governance dimension is the highest among the four major TCFD dimensions

Following the description of the survey results of all TCFD dimensions, the assessment and weighted calculation of the scores are conducted according to the aforementioned TCFD assessment criteria in Table 1 to obtain the companies' individual scores and total scores in the four TCFD dimensions. The results show that while the governance dimension has an average score of 15, the other dimensions, namely, the strategy, risk management, and metrics and targets dimension, only have an average score of about 10 (as shown in Figure 6).

Figure 6 The assessment results of the companies for the four TCFD dimensions

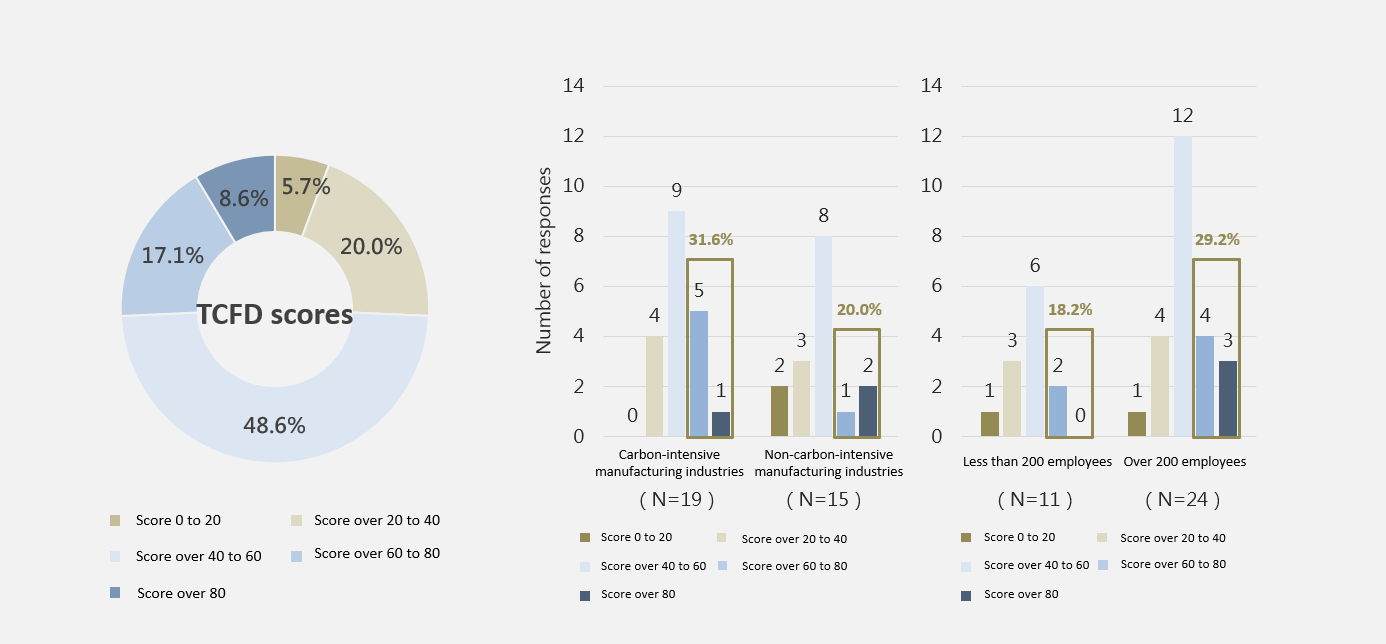

The assessment results show that the degree of making TCFD-aligned disclosures varies significantly between companies. About half (48.6%) of the companies achieved a score between 40 and 60. Only 8.6% of the companies scored above 80, and these companies disclose more information and perform better in quantitative assessment, low-carbon supply chain management, and climate action and planning. In terms of industries, the proportion of companies with a TCFD score above 60 is higher in the high-carbon manufacturing industries (31.6%) than in the non-high-carbon manufacturing industry (20.0%). In terms of different company sizes, a higher proportion of companies with more than 200 employees obtained a TCFD score above 60 (29.2%) than companies with less than 200 employees (18.2%) (as shown in Figure 7).

Figure 7 TCFD scores of the companies

Listed companies and over-the-counter (OTC) listed companies are more willing to make disclosures according to the four major elements of TCFD, compared with non-listed companies and non-OTC-listed companies

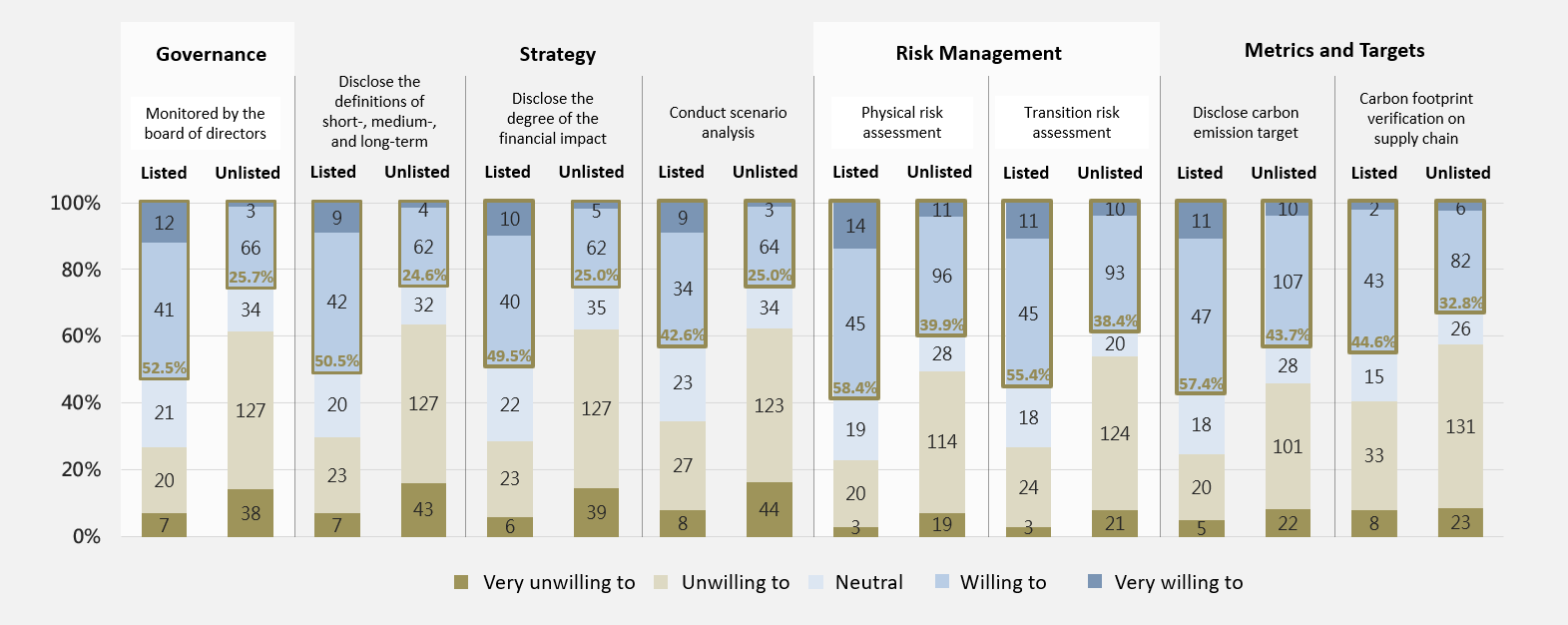

Among the 404 surveyed companies, 369 companies have never made TCFD-aligned disclosures, and this survey aimed to determine whether they are willing to make TCFD-aligned disclosures in the future, although they have not started any climate-related financial disclosures. The survey found that in the four major dimensions of governance, strategy, risk management, and metrics and targets, a higher proportion of listed companies and OTC-listed companies answered that they were willing to and very willing to make disclosures than non-listed companies and non-OTC-listed companies (as shown in Figure 8).

In the governance dimension, 52.5% of the listed companies and OTC-listed companies stated that they were willing to and very willing to report TCFD-related issues to their board of directors in the future, while 25.7% of the non-listed companies and non-OTC-listed companies showed the same levels of willingness. The situation is similar with the strategy dimension. Compared with non-listed companies and non-OTC-listed companies, a greater number of listed companies and OTC-listed companies are willing to or very willing to make short-, medium-, and long-term disclosures (50.5%), disclose the degree of financial impact (49.5%), and utilize scenario analysis (42.6%). In the risk management dimension, more than 50% of the listed companies and OTC-listed companies are willing to or very willing to conduct physical risk assessments (58.4%) and transition risk assessments (55.4%) in the future, while less than 40% of the non-listed companies and non-OTC-listed companies are willing to do so (39.9% and 38.4%, respectively). In the metrics and targets dimension, 57.4% of the listed companies and OTC-listed companies are willing to or very willing to disclose their carbon reduction targets in the future, and 44.6% are willing to or very willing to conduct carbon inventory on their supply chains, and both proportions are higher than that of non-listed companies and non-OTC-listed companies (43.7% and 32.8%, respectively). The survey results show that listed companies and OTC-listed companies are more willing to control the risks and opportunities brought to business operation by climate change, especially in the dimensions of governance and risk management, in which more than 50% of them expressed their willingness to take these actions.

Figure 8 Willingness to make TCFD-aligned disclosures in the future (N=101 for listed companies and OTC-listed companies; N=268 for non-listed companies and non-OTC-listed companies)

Therefore, the following conclusions are drawn in this survey:

- Since the TCFD Recommendations were issued in 2017, less than 10% of Taiwanese companies have made TCFD-aligned disclosures.

- The assessment of the governance dimension shows that supervision by the board of directors is the most common method of supervision.

- Regarding the strategy dimension, more than 70% of the companies have not set a target for renewable energy use, but more than 60% have engaged in low-carbon innovation.

- The quantitative assessment of the risk management dimension needs to be strengthened.

- Regarding the metrics and targets dimension, companies mainly focus on their own inventory on climate metrics.

- Listed companies and OTC-listed companies are more willing to make TCFD-aligned disclosures in the future, compared with non-listed companies and non-OTC-listed companies.

This survey conducted by the Risk Society and Policy Research Center, National Taiwan University, can help us obtain a clear picture of Taiwanese companies' TCFD-aligned disclosures and their attitudes toward making TCFD-aligned disclosures in the future. Apart from this, this study hopes that the analysis and the TCFD assessment criteria set up in this survey provide companies with several key findings and perspectives and stakeholders with a reference, to encourage Taiwanese companies to be more active in planning climate-related risk exposures. By establishing clearer strategies and targets for carbon reduction, and strengthening cooperation with upstream and downstream of supply chain, companies will be able to work with stakeholders as they face climate-related challenges, grow together in terms of sustainability, and gain key competitive advantages.

The First Released Survey on Taiwanese Companies\' Actions on TCFD (Task Force on Climate-related Financial Disclosures)-aligned Disclosures by the Risk Society and Policy Research Center, National Taiwan University (Part 1)

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

※The aforementioned may not be copied for commercial use without the center's consent, thank you.※