Author/Ya-Ting Kuo, Postdoctoral Fellow, RSPRC; Yi-Meng Chao, Project Specialist, RSPRC

The origins of the investigation

The impact of climate change on the ecological environment and human society is now unavoidable. In addition to continuously impairing human health (Ahmad & Hossain, 2015), climate change has indefinable economic costs (Bolton et al., 2020). Moreover, owing to the increasingly stringent climate-related regulations at home and abroad, more frequent occurrence of extreme weather events, and the changes in consumer behavior, the various radical changes brought by climate change may potentially affect a company's revenue, product value, and even goodwill (Isabel et al., 2020). Therefore, the Financial Stability Board (FSB) established the Task Force on Climate-related Financial Disclosures (TCFD) in 2015. The TCFD published the Recommendations of the Task Force on Climate-Related Financial Disclosures in 2017, which provides consistent guidelines on voluntary disclosure, to help investors and decision-makers understand the climate-change-related risks and opportunities faced by companies.

Current status of TCFD-aligned disclosures in Taiwan and overseas

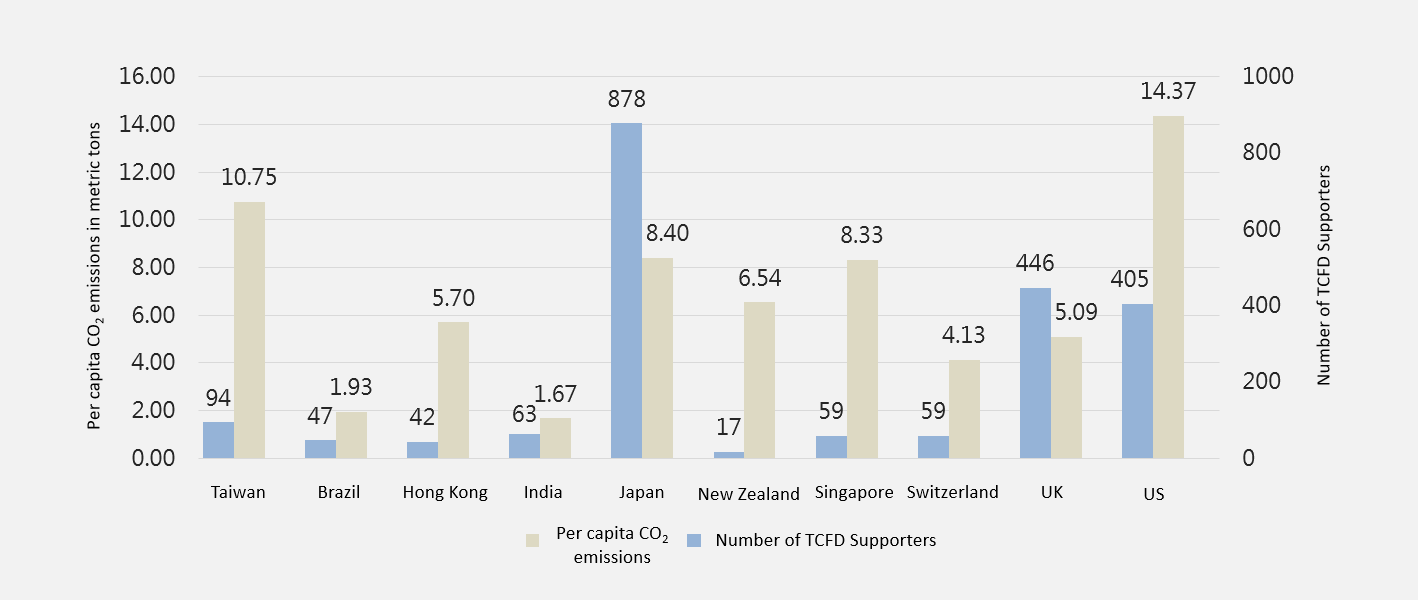

As of May 2022, in addition to more than 3,400 companies and organizations worldwide that have signed the TCFD, governments, responsible departments, financial regulators, and the central banks of different countries also support the act. In addition to Taiwan, 10 countries or regions, namely, Brazil, the European Union, Hong Kong, India, Japan, New Zealand, Singapore, Switzerland, the United Kingdom, and the United States have made it compulsory to disclose climate risks aligned to the TCFD framework (MSCI, 2022). Figure 1 shows the comparison between the abovementioned countries or regions (except the EU) and Taiwan, in terms of the number of entities that have signed the TCFD and the per capita carbon emissions. Among the Asian countries, the number of entities in Taiwan that have signed the TCFD is much lower than that of Japan. Only 94 companies and organizations have signed the TCFD, and the amount of per capita carbon emissions is higher than that of Japan. It indicates that in Taiwan, a place with high per capita carbon emissions, companies have to take more responsibility for climate action to mitigate the impact.

Figure 1 Number of entities that have signed the TCFD and the per capita carbon emissions.

Source: Compiled by the researchers of this study (TCFD, 2022; IEA, 2022)

Taiwan has also declared its determination to achieve net-zero emissions by 2050. In order to accelerate the carbon reduction process, support adaptation to climate change, and achieve the targets of climate actions, the Financial Supervisory Commission proposed the Green Finance Action Plan 2.0, which requires domestic banks and insurance institutions to make climate-risk-related financial disclosures for the previous year by the end of June each year, starting from 2023. Hence, TCFD-aligned disclosures are gradually turning from voluntary to mandatory in Taiwan. Although Taiwan has currently only made disclosures by banks and insurance institutions mandatory, as the international situation develops, companies in other industries may also be required to do so. The practices of the UK and Singapore illustrate this point. In November 2020, the UK issued A Roadmap towards Mandatory Climate-Related Disclosure, making it the first country to stipulate mandatory requirements for companies to make TCFD-aligned disclosures. Starting from 2021, premium listed companies have been required to make the disclosures, and the coverage will expand to more organizations each year. The Singapore Exchange Regulation announced in December 2021 that listed companies would be required to provide reports on climate-related issues from 2022. Related industries such as finance, agriculture, food, and forestry will have to make climate-related disclosures from 2023, while the materials and construction industry and the transportation industry will have to do so from 2024.

A major review of the TCFD investigation

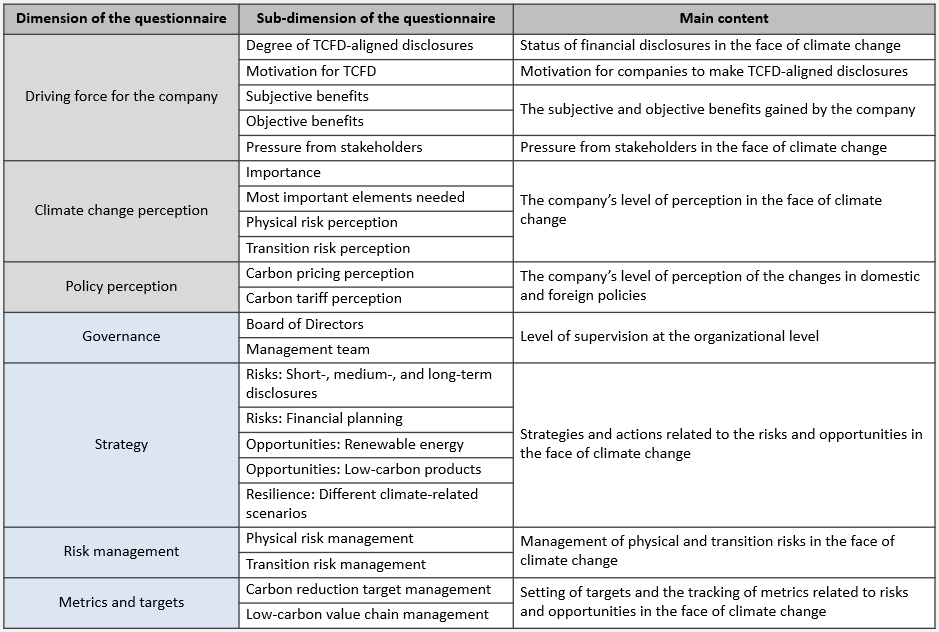

To investigate the willingness and practices of Taiwanese companies to make financial disclosures relating to the impact of climate change, the Risk Society and Policy Research Center, National Taiwan University, surveyed the TCFD-aligned disclosures by domestic companies (hereinafter referred to as "this survey") for the first time. The structure of this survey consists of seven major dimensions, namely, the driving force for the company, climate change perception, policy perception, governance, strategy, risk management, and metrics and targets (as shown in Table 1), to help grasp the attitudes and actions displayed by Taiwanese companies in the face of climate change related risks.

Table 1 Structure of the TCFD-aligned disclosures questionnaire

This survey was commissioned by the Risk Society and Policy Research Center, National Taiwan University, for the China Credit Information Service, with the investigation period from March 23, 2022 to April 12, 2022, and the target population includes companies with an annual revenue of more than 100 million NTD in the corporate database of the China Credit Information Service. The revenue ratio of the survey sample and the revenue ratio of the population have been checked for consistency, and the results indicate no statistically significant difference between the survey sample and the population.

Analysis of the survey sample

In total, 404 valid samples were collected, and the descriptive statistics are shown in Table 2. According to the survey results, the majority of the surveyed companies are those with less than 200 employees (accounting for 75.7%), not belonging to a corporate group (accounting for 78.0%), and that are non-listed and non-over-the-counter (OTC)-listed (accounting for 68.3%). The majority of the surveyed companies have a paid-in capital of over 100 million NTD (accounting for 71.0%), and a registered capital of less than 2 billion NTD (accounting for 85.1%). In addition, the majority of the surveyed companies are B2B companies (accounting for 82.9%). The persons who filled in the questionnaire on behalf of the surveyed companies mostly work in management departments (accounting for 59.7%), followed by accounting-related departments (accounting for 13.9%) and environmental safety and labor safety departments (accounting for 7.9%). The persons who filled in the questionnaire on behalf of the surveyed companies mostly held a supervisory position, such as vice president, chief financial officer, and factory director (accounting for 87.1%); while those who held a non-supervisory position, such as secretary, chief accountant, and corporate social responsibility specialist, accounted for 12.9% of the total.

Table 2 Descriptive statistics

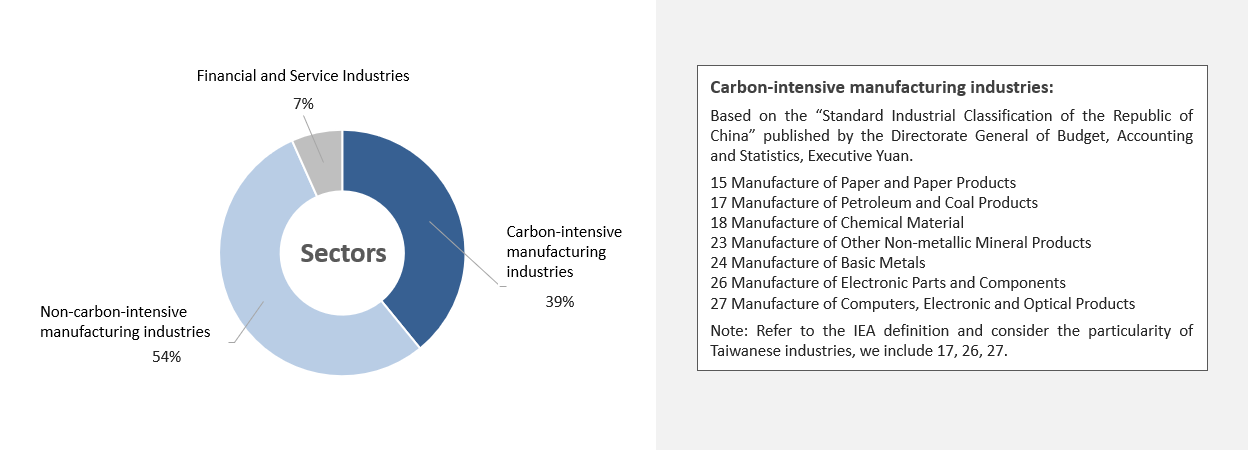

In terms of industries, manufacturing companies comprised the majority of the sample, followed by finance and service companies. However, compared with the service industry, companies in the manufacturing industry have more urgency to make TCFD-aligned disclosures, so this survey focuses on samples from the manufacturing industry. The manufacturing companies are divided into high carbon emitting manufacturing companies and low carbon emitting manufacturing companies. Currently, there is no clear definition of "high carbon emitting industries"; only "energy-intensive industries" are clearly defined. Energy-intensive industries include the manufacture of paper and paper products, manufacture of chemical materials, manufacture of other non-metallic mineral products, and manufacture of basic metals (according to the Standard Industrial Classification issued by the Directorate General of Budget, Accounting and Statistics, Executive Yuan, and their industry division codes are 15, 18, 23, and 24 respectively). However, considering the particularity of Taiwan's industries, major carbon emitters such as the Formosa Plastic Group belong to the 17 Manufacture of Petroleum and Coal Products, while electronics companies such as Taiwan Semiconductor Manufacturing Co. belong to the 26 Manufacture of Electronic Parts and Components and 27 Manufacture of Computers, Electronic and Optical Products. This survey defines "high carbon emitting manufacturing industries" to include seven manufacturing categories, according to the Standard Industrial Classification issued by the Directorate General of Budget, Accounting and Statistics. The seven categories include "15 Manufacture of Paper and Paper Products," "17 Manufacture of Petroleum and Coal Products," "18 Manufacture of Chemical Material, Fertilizers, Nitrogen Compounds, Raw Materials for Rubber and Plastics, and Man-made Fibers," "23 Manufacture of Other Non-metallic Mineral Products," "24 Manufacture of Basic Metals," "26 Manufacture of Electronic Parts and Components," and "27 Manufacture of Computers, Electronic and Optical Products," as shown in Figure 2.

Figure 2 Industry distribution of the survey samples

Key research result 1: Less than 10% of the companies make TCFD-aligned disclosures, and the driving force for companies is insufficient

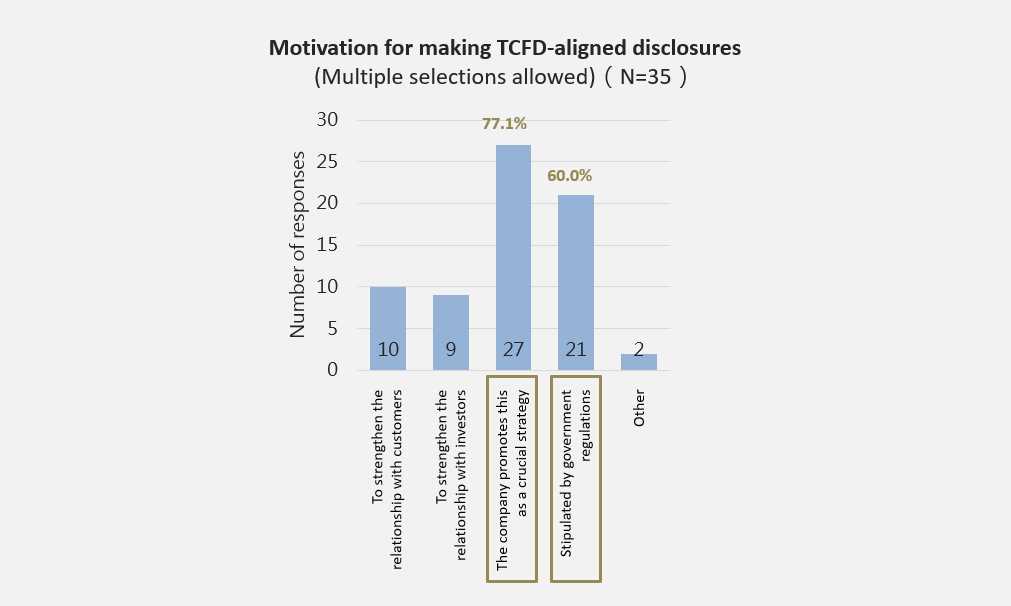

The survey revealed that less than 10% (8.7%) of the companies make TCFD-aligned disclosures. In other words, only 35 of the 404 surveyed companies responded that they make TCFD-aligned disclosures. The majority of the 35 companies that confirmed making TCFD-aligned disclosures have more than 200 employees, belong to a corporate group, and are listed companies and OTC-listed companies. First, we explain the results of the dimension "driving force for companies" from the perspectives of motivation, subjective benefits, and pressure from stakeholders. First, these results help with understanding the main motivation for companies to make TCFD-aligned disclosures. Nearly 80% (77.1%) of the companies that make TCFD-aligned disclosures stated that the main motivation for them to do so is that the company regards it as a crucial strategy, while 60.0% of the companies attributed the reason to government regulations (Figure 3). Therefore, we suggest that if the government were to impose mandatory requirements regarding TCFD-aligned disclosures on companies of various industries, it would be very important to strengthen communication with the senior managers of the companies.

Figure 3 The main motivations of enterprises to make TCFD-aligned disclosures

(Multiple selections allowed; N=35)

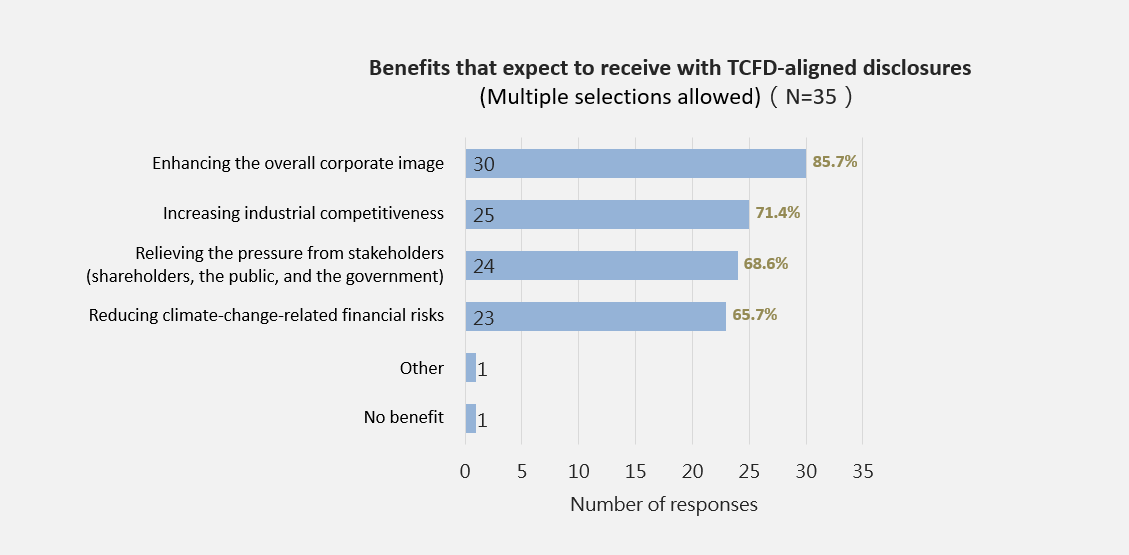

Second, Figure 4 reveals the subjective benefits of making TCFD-aligned disclosures. The results show that 85.7% of the companies believe that making TCFD-aligned disclosures can enhance their corporate image, 71.4% believe that industrial competitiveness can be increased, 68.6% believe that pressure from stakeholders can be relieved, and 65.7% believe that climate change related financial risks can be reduced. Through this survey, we learned that in addition to enhancing corporate image, TCFD-aligned disclosures by companies can also increase the companies' competitive advantage and reduce pressure from external stakeholders. By further revealing climate-related financial risks, companies can gain the benefit of sustainable business, and the abovementioned factors are the important driving forces for companies to make TCFD-aligned disclosures.

Figure 4 Subjective benefits gained by companies after making TCFD-aligned disclosures

(Multiple selections allowed; N=35)

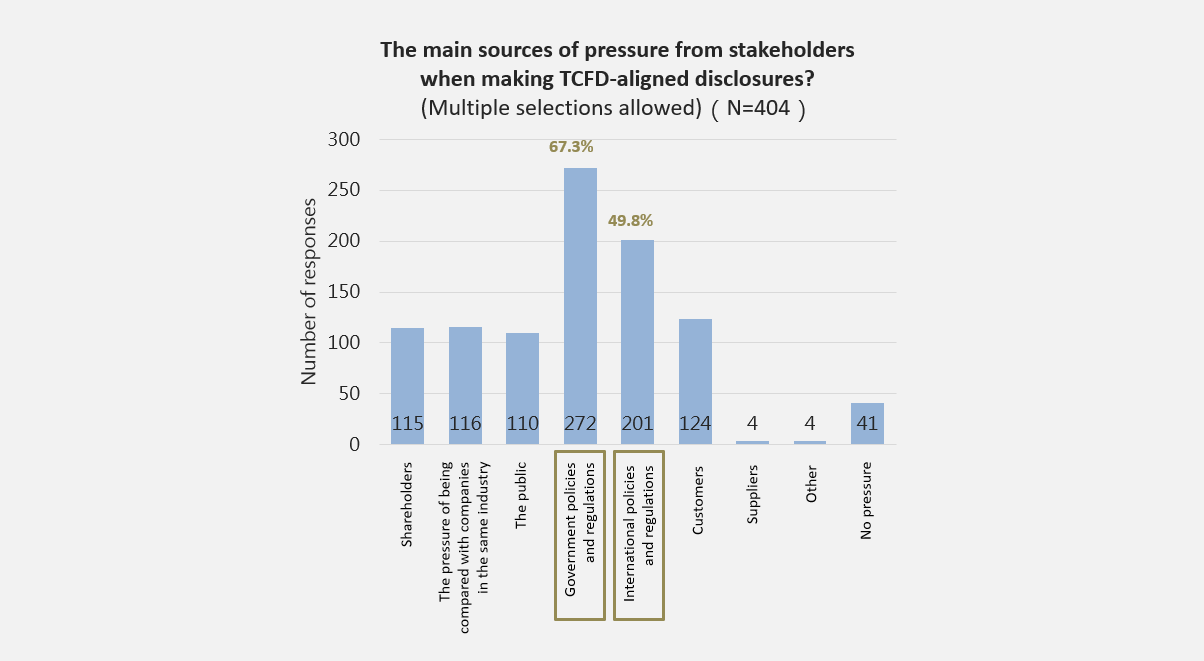

Lastly, by asking all the surveyed companies about the main sources of pressure from stakeholders, we found that 67.3% of the companies believe the main source of pressure to be the government's policies and regulations, while 49.8% believe the main source to be international policies and regulations (as shown in Figure 5). Hence, we can see that policies and regulations at home and aboard will drive companies to maintain the pace of moving toward net-zero emissions by 2050, so as to adjust their financial and strategic planning in response to climate change.

Figure 5 Pressure from stakeholders faced by companies when making TCFD-aligned disclosures

(Multiple selections allowed; N=404)

Key research result 2: High carbon emitting manufacturing industries devote greater attention and efforts to TCFD

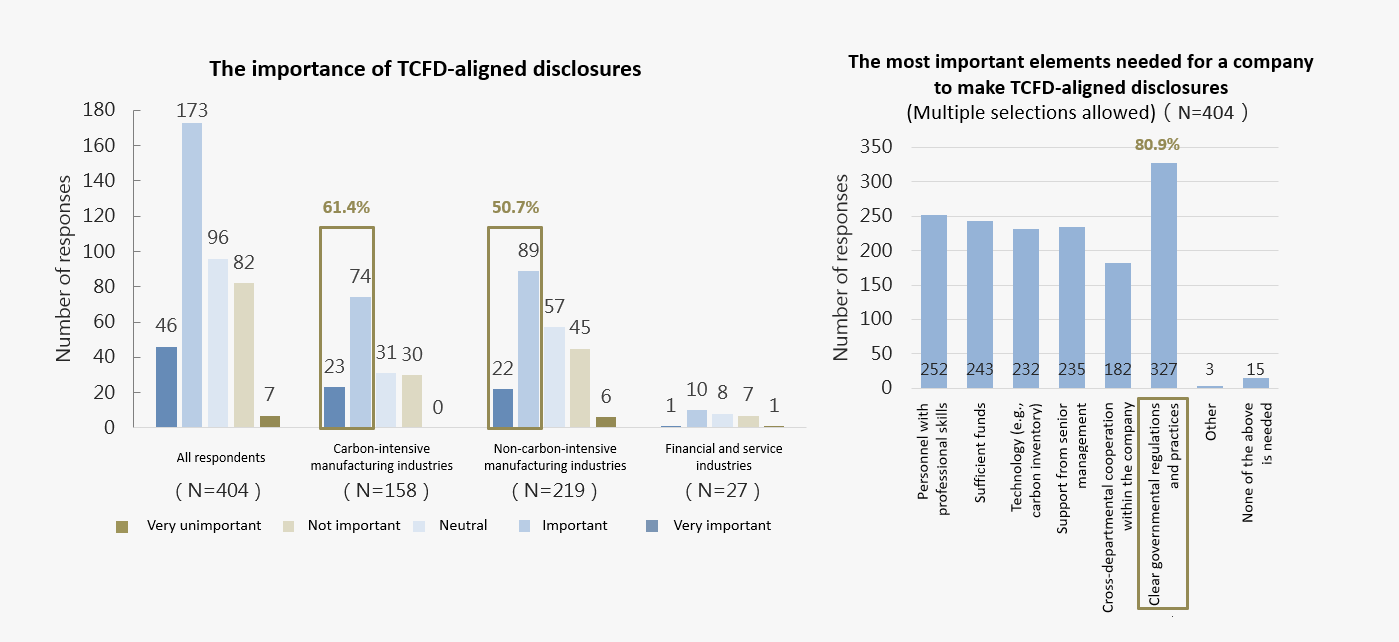

The dimension of climate change perception is explained from the perspectives of the importance of TCFD-aligned disclosures and the most important elements needed for TCFD-aligned disclosures. First, according to the survey, 54.2% of the companies believe that it is important or very important to make TCFD-aligned disclosures in the face of increasing climate change. Among the industries, more high carbon emitting manufacturing companies (61.4%) believe that TCFD-aligned disclosures are important or very important, compared with low carbon emitting manufacturing companies (50.7%). Second, regarding the most important elements needed for TCFD-aligned disclosures, apart from personnel with professional skills, sufficient funds, technology, and support from the senior management, 80.9% of the companies stated that clear governmental regulations and practices are necessary (as shown in Figure 6). Therefore, most of the companies surveyed generally recognized the importance of TCFD-aligned disclosures, and hoped the government would promote clearer regulations and practices. We suggest that the government strengthen communication with the corporate world, so that companies can also include net-zero emissions as one of their operational objectives and make changes to aim for the zero carbon emissions target, thereby promoting the sustainable development of the environment.

Figure 6 Importance of TCFD-aligned disclosures and the most important elements needed for TCFD-aligned disclosures

Key research result 3: Taiwanese companies are unaware of carbon prices and carbon tariffs in general

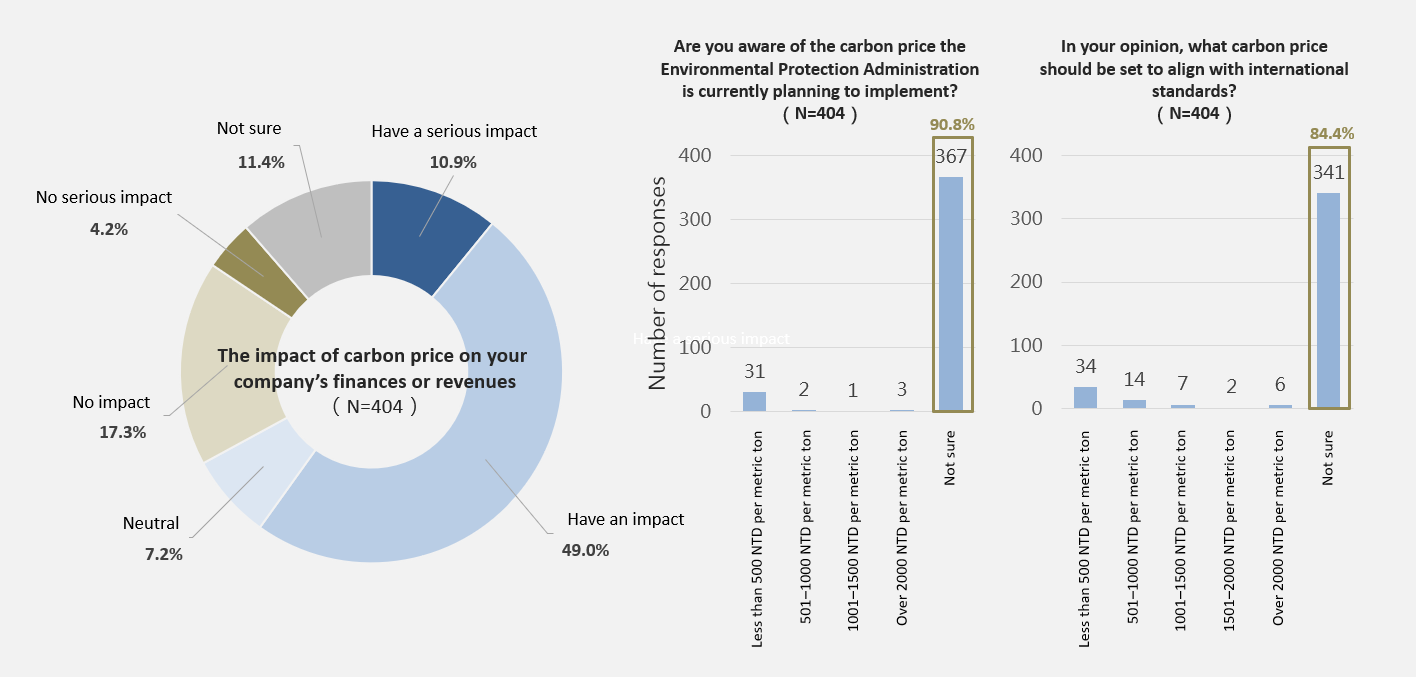

The "policy perception" dimension is designed to examine companies' perception of carbon pricing and carbon tariffs. First, in terms of carbon pricing, 49.0% of the companies believe that domestic carbon prices will affect their finances and revenues, and 10.9% believe that the impact will be serious. However, 90.8% of the companies admitted that they are unaware of the carbon price that the Environmental Protection Administration is planning to impose, while 84.4% admitted that they are unsure of what the carbon price should be set at to align with international standards (Figure 7).

Figure 7 Carbon pricing perception of the companies (N=404)

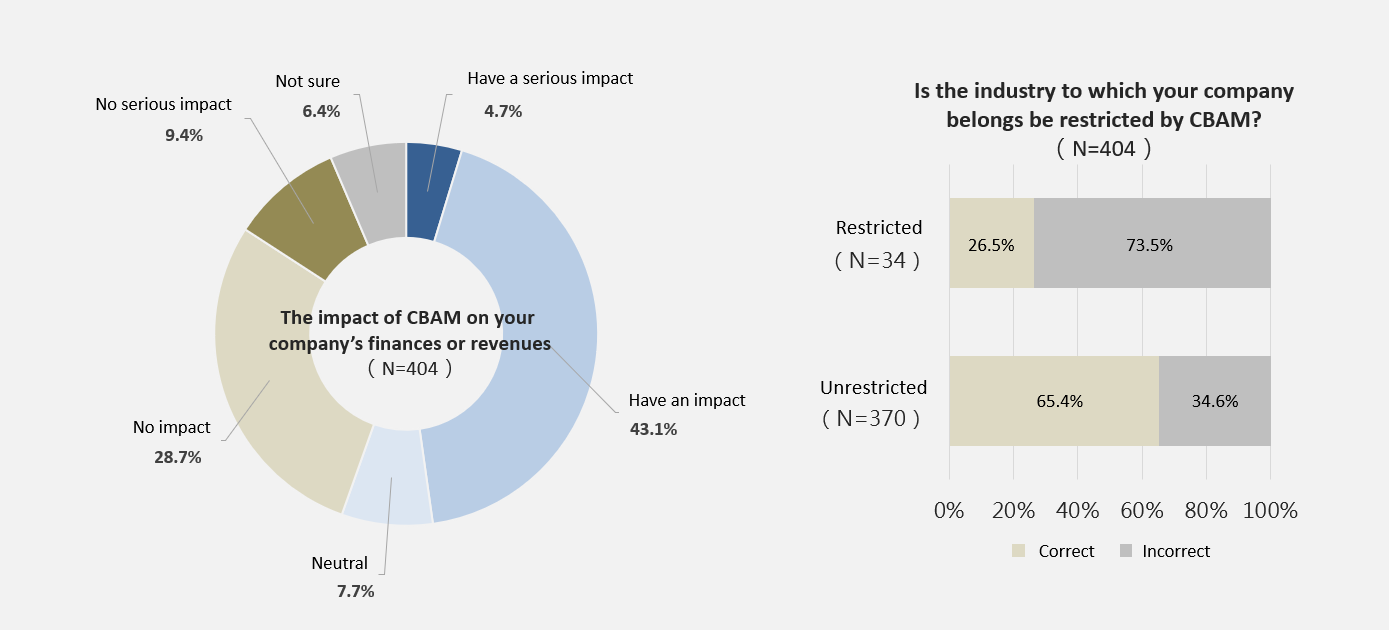

Second, in terms of carbon pricing, this survey aims to examine the companies' knowledge of the EU's Carbon Border Adjustment Mechanism (CBAM). The results show that 43.1% of the companies believe that it will affect their finances and revenues, while 4.7% believe that the impact will be serious. In addition, it is worth noting that 34 of the surveyed companies are subject to the regulation of the first phase of the CBAM, as they belong to the five major regulated industries, namely, cement, steel, aluminum, fertilizer, and electricity. However, only 26.5% of the surveyed companies are fully aware that they belong to an industry that is to be regulated, while 73.5% are unaware that their industries will be regulated by the CBAM (Figure 8).

Figure 8 Companies' carbon tariff perception (N=404)

Internal summary

In response to the expected changes in international policies and Taiwan's laws and regulations, Taiwanese companies will place greater emphasis on TCFD-aligned disclosures and more will join the practice. This investigation showed that the driving force for Taiwanese companies to make TCFD-aligned disclosures is inadequate, high carbon emitting manufacturing industries attach greater importance to TCFD than low carbon emitting manufacturing industries, and Taiwanese companies are generally unaware of the situation regarding carbon pricing and carbon tariffs. Therefore, we suggest that Taiwanese companies combine their management policies of corporate risks with the risks and opportunities of the TCFD framework and develop adaptation strategies beforehand in response to the policies, regulations, markets, immediate and long-term physical risks, and transition risks such as low-carbon product R&D, which are all impacted by future climate change.

The First Released Survey on Taiwanese Companies\' Actions on TCFD (Task Force on Climate-related Financial Disclosures)-aligned disclosures by the Risk Society and Policy Research Center, National Taiwan University (Part 2)

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

※The aforementioned may not be copied for commercial use without the center's consent, thank you.※