Author/Yi Ling Roy Ngerng, Assistant Research Fellow, RSPRC

The National Taiwan University (NTU) Risk Society and Policy Research Center (RSPRC) held its annual Fubon Globalization Taiwan Risk Society Forum on 25 June 2019, on the topic of, 'Using the Circular Economy to Overcome Global Warming'.

This article summarizes the main points covered during the late afternoon session (part 4).

Presentation by National Taiwan University (NTU) Risk Society and Policy Research Center (RSPRC) Postdoctoral Fellow Dr. Chia-Wei Chao: Policy Challenges and Promotion Strategies for the Internalization of External Costs

National Taiwan University (NTU) Risk Society and Policy Research Center (RSPRC) Postdoctoral Fellow Dr. Chia-Wei Chao explained that a high-carbon energy system is unsustainable and current mindsets about how high-carbon energy is cheaper needs to be overcome. He added that based on current estimates, high-carbon energy sources would actually become more expensive than other energy sources by 2025, when including for external costs in the internal costs of businesses. As such, Dr. Chao emphasized that with this knowledge, businesses should therefore take action to cut their usage today.

Dr. Chao also pointed out that investments in high-carbon industries and the provision of fossil fuel subsidies need to stopped, so that SDG goal 12, on responsible consumption and production, could be met. In addition, other Asian countries such as Japan, South Korea, Singapore and China have implemented carbon pricing and Taiwan should also follow suit, Dr. Chao said, albeit the carbon pricing of some countries such as Singapore being inadequate. Taiwan's Energy Transition White Paper also highlighted that an energy tax proposal would be introduced by 2020, so this is something to watch on Taiwan's horizon, he added, but even so, this would only be a proposal, and there is still no fixed deadline as to when energy tax will be implemented in Taiwan.

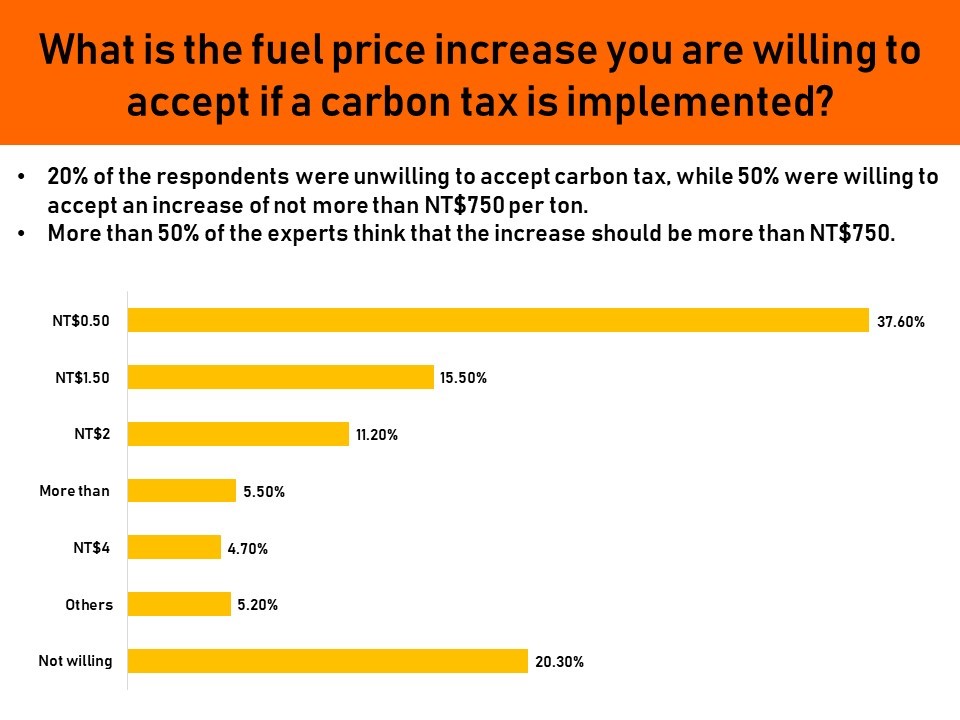

Dr. Chao also shared results from our center's survey that showed only 20% of Taiwanese respondents were not willing to accept carbon tax. On the other hand, the results also showed that 50% of the respondents said they were willing only to accept a carbon tax of not more than NT$750 per ton.

To facilitate the development of a low-carbon economy, Dr. Chao also proposed some solutions that Taiwan should adopt. He pointed out that Taiwan should develop a method to calculate the internalization of external costs, in order to define a new green financing concept. For example, President Obama's administration calculated the external costs of businesses' activities, with the aim of estimating the environmental and health impacts, to look at the benefits that could be obtained if the social costs are internalized. The government should also communicate with the public on the impact of fossil fuel subsidies, with the aim of eliminating these subsidies by 2025, he added. In addition, the government should also hold public consultations on the energy tax, and to educate the public about it. According to the Organization for Economic Co-operation and Development (OECD), an effective carbon floor price should be set to the level of US$34 per ton, and the government should therefore set a carbon price floor to this level accordingly, Dr. Chao said. To strengthen the corporate social responsibility of businesses, internal carbon pricing should also be included as part of the reporting that businesses are required to do. Dr. Chao also believed that in order for Taiwan to meet its international climate obligations, the carbon tax should optimally be implemented before the end of the next presidency, by 2024.

To enable carbon tax to be effectively implemented in Taiwan, Dr. Chao explained that there is a need to understand the contexts in which people are willing for carbon tax to be increased, and also their concerns as to why they would oppose carbon tax. In addition, the debates over the carbon tax needs to be taken in conjunction with other policy measures so that they act as a complement to support carbon tax measures. For example, any policy changes should not disproportionately impact on the low-income.

Presentation by Environmental Protection Administration (EPA) Deputy Director Wei-ming Huang: Internalization Strategies of External Costs

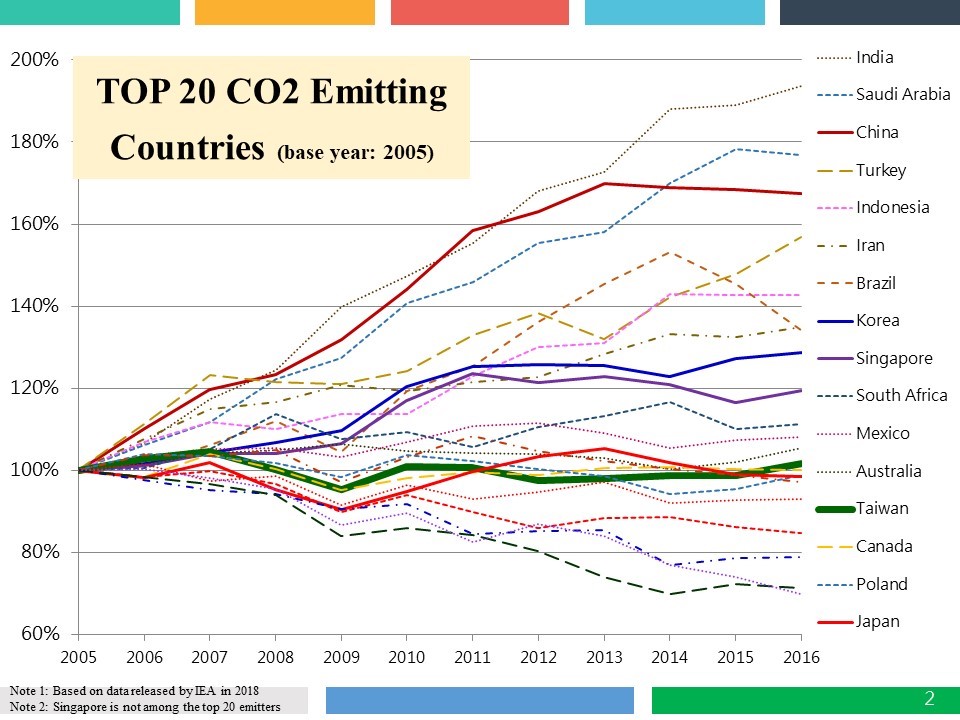

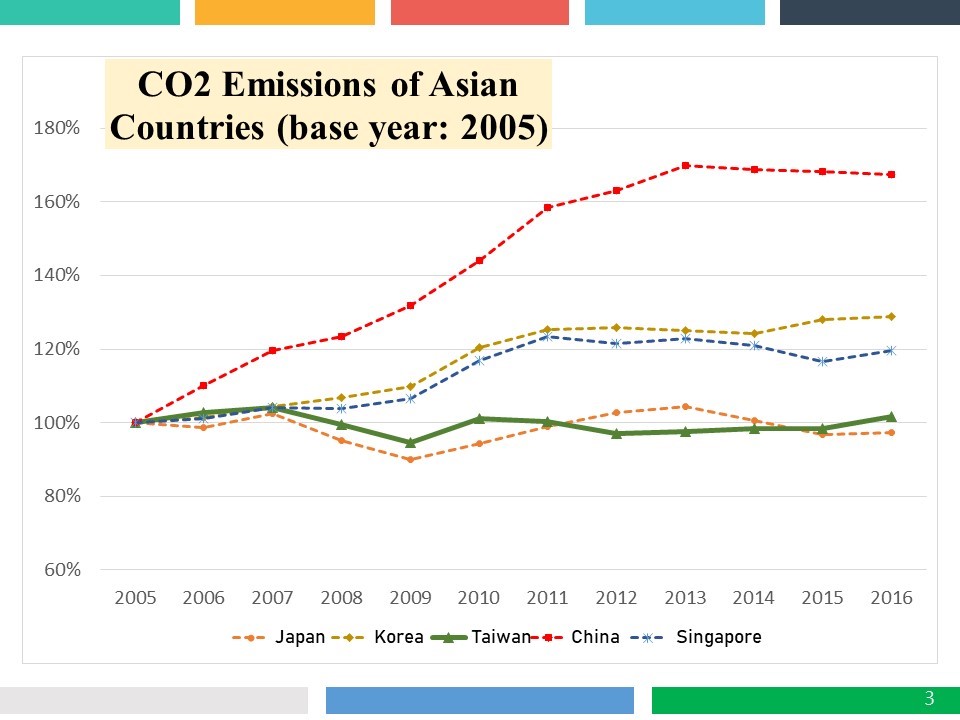

Environmental Protection Administration (EPA) Deputy Director Wei-ming Huang started his presentation by comparing Taiwan's CO2 emissions over the last decade with other countries, and said that in comparison Taiwan did not fare as poorly (bold dark green line).

He also pointed out that Taiwan's CO2 emissions has held steady as compared to the other major Asian economies.

Deputy Director Huang added that under the Greenhouse Gas Reduction and Management Act, the target to reduce greenhouse gases by 2050, by 50% of 2005's levels, has been set, and that at the current stage, the EPA is looking at how local government implementation of the act can be done.

Deputy Director Huang also admitted that the current environmental targets set by EPA are low because the EPA has yet to consider all possible environmental indicators in the setting of its environmental targets. One example he pointed out was the lack of the inclusion of the external costs of businesses' activities, which the EPA would need to compute, and another is on air pollution, where the EPA currently only includes the measurement of PM 2.5 in its targets, even though he conceded that other indicators of air pollution should also be included.

Accordingly, Deputy Director Huang said that the EPA is considering asking companies to furnish more information when they declare their finances, such as on carbon emissions, which could be used as a signal for carbon pricing. He also highlighted policy recommendations put forward by The Stern Review on the Economics of Climate Change concerning a global carbon tax of US$30 per tCO2 as the effective level calculated to enable carbon emissions to be reined in, though he did not follow up to say that the EPA would implement a tax to this level.

Sharing by Green Citizens' Action Alliance (GCAA) deputy secretary-general Shen-han Hong

In response to arguments respectively made by Dr. Chao and Deputy Director Huang, Green Citizens' Action Alliance (GCAA) deputy secretary-general Shen-han Hong immediately pointed out that the main issue Taiwan faces in its energy transition is the political sensitivity in Taiwan. In 2012, the backlash the Kuomintang government faced when increasing electricity prices has cast a shadow among politicians who have become fearful of proposing electricity prices increases, for fear that doing so would be political suicide. Mr. Hong was also of the opinion that the public would not be willing to accept electricity price increases, nor that carbon tax can be implemented by 2024. Nonetheless, if it was important for these measures to be put in place, then there is a need to map out individual strategies to look at how best to convince people on the need to do so, he said.

Mr. Hong highlighted that many labor unions are also aware of the external costs of businesses' activities, but that they believe that the onus lies on businesses to be the first to take responsibility and take action. However, for some occupations, like truck drivers who work in silo and with whom there are no company representatives to speak to, it is therefore a local challenge Taiwan needs to tackle in the conversation of the internalization of external costs, he added.

In addition, mindset shifts are required for energy transition to succeed, Mr. Hong pointed out. For example, there was the conception in the olden days where companies which used more electricity gave the perception that they were providing support to more families with their businesses. However, mindsets have evolved such that people are beginning to understand today that the burden of a company which uses too much electricity, falls on society's members who would have to pay for the external costs. Using another example, Mr. Hong explained how in the past, businesses tended to assume that using renewable energy would increase their costs, but the global mindset has shifted to being that not using renewable energy could in fact compromise on the competitiveness of businesses instead. However, even as the Taiwanese public is concerned about the effects of air pollution, the people he spoke to have been resistant to discussing policy changes, for fear of the impact it could bring. It is therefore not a given that just because there is concern over air pollution, that people would be willing to change policies to deal with the issue, he said, adding that a conversation would still need to be undertaken to convince people of the need to do so.

Sharing by Academia Sinica Institute of Economics Researcher Dr. Daigee Shaw

The final speaker, Academia Sinica Institute of Economics Researcher Daigee Shaw, pointed out that even though the conversation at the forum had been on the topic of the internalization of external 'costs', it is also necessary to talk about the internalization of external 'effects', which Taiwan had fared badly in. He also highlighted that while the discussion on external costs has generally pertained to the issue of pollution in Taiwan, external costs incurred from the overuse of natural resources, such as of coal and oil, should also be included in the conversation. However, the main difficulty in trying to internalize external costs has been the concern about cost increases, and due to the low public acceptance for this, the political risks of being involved are therefore seen as high. In the end, the concept of the internalization of external costs has widespread support but there is very little traction in actually implementing it because no one dares to do it, he said, thus leaving the issue with environmental groups to deal with.

However, it is possible to design policies that can gain wider acceptance, Dr. Shaw said. For example, the Greenhouse Gas Reduction and Management Act already provides guidance as to how this can be done. Under the act, the revenue from energy and carbon taxes cannot be used to increase the revenue of the government, and has to be returned to citizens instead, the rationale being that doing so would engender greater public acceptance. Dr. Shaw proposed that one way to allow citizens to benefit from this tax revenue is by evenly distributing it, to which Dr. Chao highlighted that each Taiwanese would receive an average of NT$8,000 a year. This method of distribution would be fair, Dr. Shaw explained, as the higher-income who can afford to drive cars more often should pay more taxes due to the higher emissions they produce, while the low-income who produce less emissions should receive more compensation in return. Dr. Shaw also pointed to the provinces of British Columbia and Alberta in Canada, as successful examples where carbon tax has been implemented to help increase the costs of fossil fuels while reducing carbon emissions. As such, if Taiwan wants to similarly implement carbon tax, all the government needs to do is to follow the guidelines as allowed for under the act, Dr. Shaw explained.

Implementing low carbon measures today would benefit future generations, some of whom are still very young and not even born yet, and as such some legislators should organize themselves as a group to represent the youths of the future and to speak up for them in the legislature, Dr. Shaw said, as has been done in countries such as Israel. Groups should also be brave and bold to push for a referendum on the implementation of a carbon tax or pollution tax. Instead of waiting for representative democracy to make change, people should use direct democracy to push for change, he said. In response to another speaker who said that Taiwan's referendum model has been twisted in its objectives for political motives, Dr. Shaw said that the key issue is in the framing of the referendum question, and how it can be clearly explained to enhance its buy-in and effectiveness.

Ultimately, IPCC's report emphasized that the increase in global temperatures should be kept below 1.5°C, which otherwise, Dr. Shaw said global warming could not be reversed and the human population could even be reduced to one-tenth of the current population, which would result in hunger and war. If it is not possible to cut emissions to zero by 2050, then we can forget about it, he said.

While past conversations have centered around the tug of war between economic growth and environmental protection, these two objectives do not necessarily exist in conflict if we are to take a long-term perspective, Dr. Shaw explained. Businesses which improve their business models by adopting greener practices, can become more competitive and regulations should be created to motivate them in that direction. While Taiwan's policies in the past had been protectionist to the businesses, it is time Taiwan takes seriously the risk to our planet and start implementing policies which would encourage businesses to innovate with the aim of protecting our environment, he added.

The event summaries of the other sessions can be found in the links below:

Part 1: Opening Address and Keynote Speech

Part 2: Morning Session – Circular Economy Strategies to Overcome Global Warming

Part 3: Early Afternoon Session – Taiwan's Progress in Greening Financial Flows and Energy Transition